By Molly Schwartz, cross-asset macro strategist at Rabobank

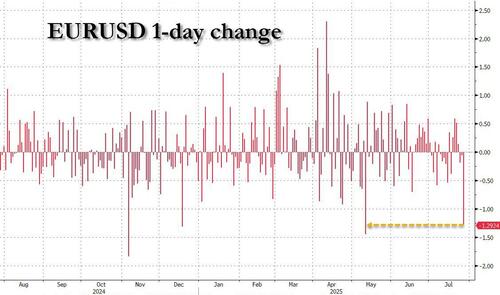

The euro took a hit yesterday, depreciating around 1.3% against USD for the worst intraday performance in two months. Meanwhile, USD had its best day since early May as the DXY Index climbed by more than 1.0%. These moves come as an extension of the trade deal announcements Trump made over the weekend.

The main headline was the “deal” between the US and the EU which established a 15% baseline tariff in addition to various carveouts and sectoral tariffs, as well as a commitment by the EU to buy $750 billion worth of US energy products and commit $600 billion of investment into the US by 2028. However, our energy strategist, Florence Schmit, has called into question the plausibility of this promise, citing that “the EU would need to import roughly 67% of its energy needs from the US,” and this is without even taking to account European competition with Asian and Middle Eastern buyers.

However, not all are thrilled with this trade deal. Some German industry leaders have expressed concerns. When headlines and tariff rates are constantly changing, so does sentiment. Prior to Trump’s inauguration, economists were talking about “worst case scenarios” that included horrific outcomes like a 5% universal tariff, and 15% on Chinese goods. After witnessing 145% tariffs on China and Liberation Day “reciprocal tariffs,” it’s easy to shrug off the current developments. But the actual tariff levels still matter. According to Bloomberg, Wolfgang Niedermark of the BDI industry federation has wailed that “the EU is accepting painful tariffs. Even a 15% tariff will have immense negative consequences for Germany’s export-oriented industry.”

President Trump has said “no more Mr. Nice Guy” and is putting his foot down with Putin. On July 14, Trump announced that Putin would have 50 days to come to a ceasefire agreement with Ukraine. If Putin failed to comply, Trump would enforce sanctions on buyers of Russian energy. The original 50-day deadline would have expired on September 2. However, in a conversation with Prime Minister Starmer, Trump said that he was “going to make a new deadline of about 10, 10 or 12 days from today,” which suggests that we could see the new deadline sometime during the tail-end of next week. The change in timeline, however, appears to be less of an effective push to get Putin to end the war, and rather a resignation, stating that he “already knows the answer.” Given our perceived inefficacy of the sanctions threats, coupled with a lack of progress from Putin on coming to a ceasefire agreement, it’s likely that the answer is “no.”

While Trump is playing the tough guy, we still question the efficacy of sanctions on buyers at all. The last time we spoke of this deal, we quoted our other energy strategist, Joe DeLaura, who said that “sanctions are only as good as the enforcement and mechanisms employed.” At the end of the day, these sanctions are unlikely to impact the flow of oil and energy markets were resistant, closing near Friday’s highs.

In tariff talk: Trump was asked about “when US tariffs on UK steel imports would come down to zero from 25%,” to which Trump replied “[w]e’re going to know pretty soon.” Yesterday, China and the US also sent trade representatives to Stockholm to discuss extending the present tariff truce. While neither Scott Bessent of the US nor He Lifeng of China spoke to reporters after yesterday’s chat, conversations are expected to resume this morning. Bessent has said that “trade is in a very good place with China.”