Goldman Sachs gaming analysts Minami Munakata and Haruki Kubota were spot on in forecasting the explosive popularity of Nintendo's newly released Switch 2, which shattered records with millions of units in sales in just four days.

Nintendo wrote on X late Tuesday night that it sold over 3.5 million Switch 2 consoles in just four days, surpassing the original Switch's first-month sales of 2.7 million back in 2017.

Switch 2 has become "the fastest-selling Nintendo hardware ever globally," the Japanese gaming company said. This strong sales momentum sets a strong pace toward the company's goal of 15 million units sold by March 2026.

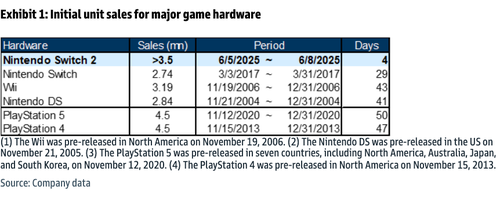

"We believe sales are tracking above our shipment assumption of 3.9 mn units in the April-June 2025 quarter, and also above the initial sales pace for the PlayStation 4 and PlayStation 5 (Exhibit 1, Exhibit 3)," Munakata wrote in a note to clients earlier.

Exhibit 1

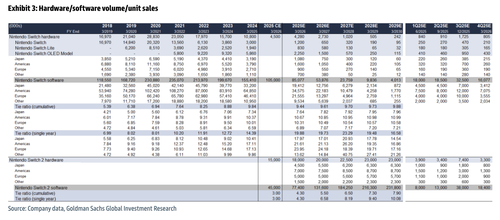

Exhibit 3

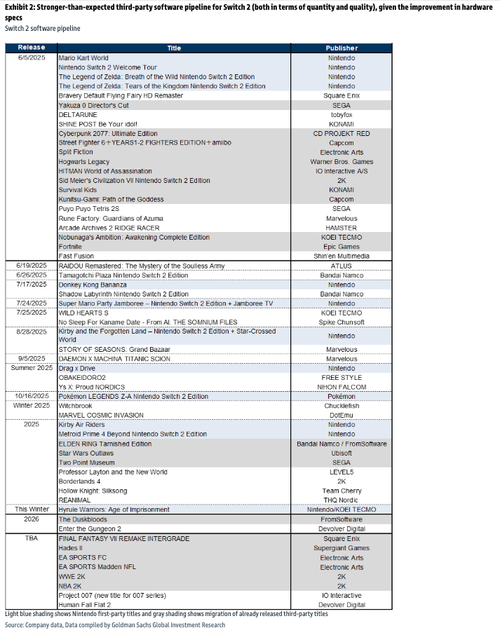

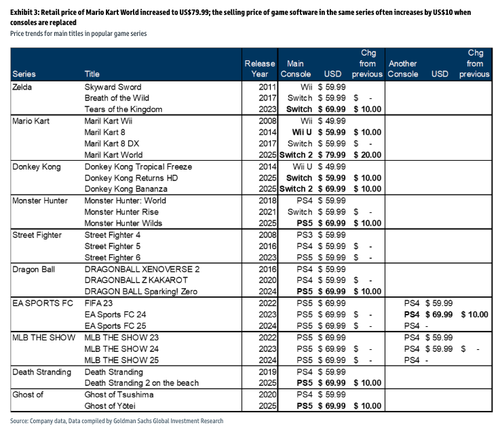

The analysts also highlight a robust third-party game pipeline and a premium price of $79.99 for Mario Kart World as key drivers of stronger revenue...

We focus in particular on the strong pipeline of third-party titles for the Nintendo Switch 2 (in terms of both quantity and quality), and the higher selling price for the new Mario Kart World title (US$79.99), which is above prices for previous titles in the series. We expect to see an increase in per-console revenues (from content, services, peripherals, etc.) in the transition from the Nintendo Switch to the Nintendo Switch 2, similar to that seen in the transition from the PS4 to the PS5. Our FY3/26 operating profit estimate is 15% above the Bloomberg consensus. As seen during the PS4/PS5 transition, we believe Nintendo can maintain and expand user engagement, allowing it to secure higher margins from the first year of the successor console launch compared with the previous console launch (see our report here). We make no changes to our earnings estimates or our 12-month target price of ¥14,500, and we maintain our Buy rating.

Here's the third-party game pipeline:

Nintendo shares in Tokyo have hovered near ¥12,000 over the past six weeks, with upward momentum showing signs of exhaustion.

Our reporting so far:

We've previously highlighted the gaming industry's long-running deflationary spiral—development costs have soared while retail prices stagnated. Now, however, an inflection point may be emerging as AAA games begin creeping toward the $100 mark.