By Michael Every of Rabobank

Ahead of the Fed meeting, our US strategist Philip Marey has just put out an FOMC preview titled ‘Casino’ that acts as reminder that his ahead-of-the-market call of three Fed 25bps cuts this year starting in September still holds - but there is now a substantial risk of a 50bp move this week. The market has been pricing the Fed as close to a 50-50 red-black roulette wheel spin. Yet his title is even better: because those who use analysis to predict the game’s outcome get their hands broken with a hammer.

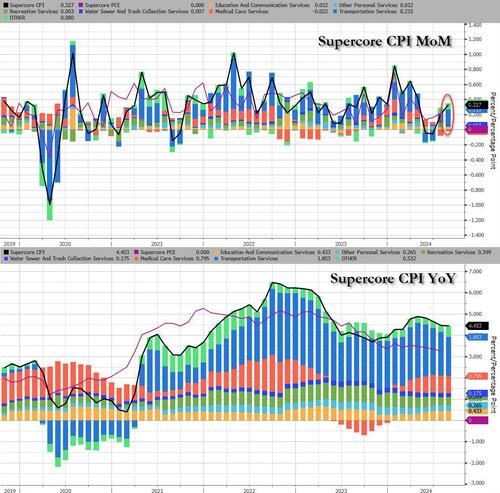

The Fed want inflation back at 2%. On a headline basis, it’s heading there. However, this is led by deflation in and from China, which the Fed has nothing to do with, and which is prompting tariffs globally. It’s also due to a collapse in global commodities pricing in a global downturn the Fed say isn’t coming. Core inflation is 3.2% y-o-y and not heading lower. On an ultra-core basis, it’s also over target, edging higher, held up by housing. There, rate cuts mean lower mortgage rates, so more housing demand, but not more supply. That means inflation, not deflation, regardless of what White House economic advisor and former Fed Deputy Chair Brainard just said.

The Fed want to see unemployment stay low - if it’s meaningful given recent demographic changes they apparently knew nothing about. Yes, the last payrolls revision shifted the dynamic there significantly: but again, did the Fed not know this was coming when some had been mentioning it for months in advance? Literally weeks ago, the Fed were unconcerned, now they worry: yet weekly initial jobless claims data are unchanged.

Nor are the Fed using their endless speaking opportunities to underline that financial conditions are not tight, but loose. Mortgage rates are moving lower before the Fed does. Stocks are at record highs. Credit and junk bond spreads are near lows. The two-year yield is so far below the Fed Funds rate that we almost don’t need to bother having a Fed Funds rate, which is a discussion that gets your hand broken by different people.

You count all those cards, and it suggests a near 50-50 call between 25 and 50bps as the first Fed cut. Even so, logic and consistency say the larger move, only seen at the start of past economic shocks, would suggest the Fed fears something they aren’t telling us. As Philip puts it, “if the economy has become fragile, a 50bps cut could even undermine confidence and make it even more fragile.” Indeed, I put it to you that to go 50bps one must contend either the Fed didn’t know what they were doing recently; or don’t know what they are doing now; or both.

Regardless, large men in suits and sunglasses are politely inviting us for a chat about the Fed in a room with no windows. Fed whisperers used as channels for unofficial communication when their constant prattling, dots, and plots still don’t get the market to ‘efficiently price’ what they want, have one message: 50bps. Nick Timiraos; Greg Ip; John Hilsenrath; former Fed members; oddly, even the Financial Times editorial board are all saying it. How have the verbose Fed gotten to the point where this full court press is required, or is this all just coincidental?

Worse, three Democratic senators, led by Elizabeth Warren, are openly calling for the Fed to go 75bps: these are the same people outraged at the idea that Trump should have a say in setting interest rates. Is that a framing device to make a 50bp move look measured, or is that just a conspiratorial thinking? It’s not like there isn’t a swirl of such thinking around right now, and for very good reasons, even if, again, it risks getting one’s hand broken even typing it.

Were we to get 50bp --which I repeat Philip sees as a tail risk, not a given-- would the market see it as nifty (catching up to the curve), shifty (what am I missing?), grifty (who’s on the take?), or Swift-y (political)?

Yet, believe it or not, there are other high-stakes tables being played at elsewhere that matter:

“That’s the truth about Las Vegas. We’re the only winners. The players don’t stand a chance.” – Sam ‘Ace’ Rothstein, Casino