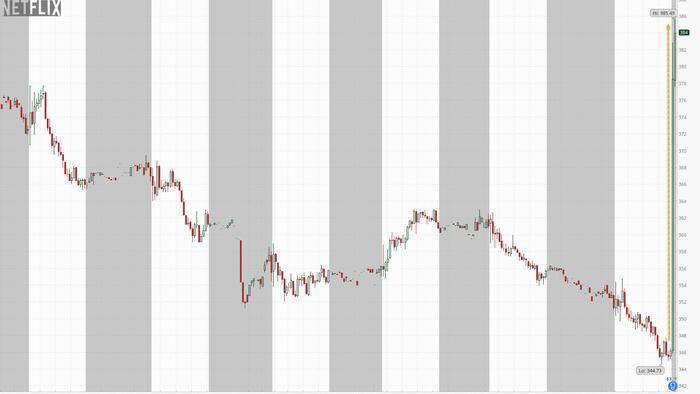

After suffering a historic collapse at the end of 2021, when in the span of five months Netflix lost 75% of its value, the company has enjoyed a solid recovery over the past year when it rose by nearly 200%, from a low of $166 to a recent 52 week high of price of $481, which was the highest since January of 2022, before it lost 28% of its value in the past three months.

Curiously, the solid performance over the past year - which saw the stock down 41% from its pandemic-era all-time closing high of $610.34 on June 30, 2021 but also up 21% YTD vs the 14% increase in the S&P - continued despite several earnings reports that were at best mixed (two quarters ago NFLX not only missed on subs but also slashed guidance, last quarter the company's guidance disappointed despite blowing away subscriber estimates) which brings us to today when the OG video streamer is again trading north of $150N in market cap despite an ongoing Hollywood strike that has mothballed the company's movie and production pipeline for months.

With that in mind, bulls are are hoping for stronger revenue and subscriber growth and guidance than one quarter ago, including more than 6 million new streaming subs at a time when NFLX has cracked down aggressively on password sharing and is navigating a transition from focusing on subscriber growth to maximizing earnings through price hikes and an ad-supported service. It has little choice amid a torrent of competition from some of the world's biggest media companies. Here's what else to expect

What else analysts are watching for:

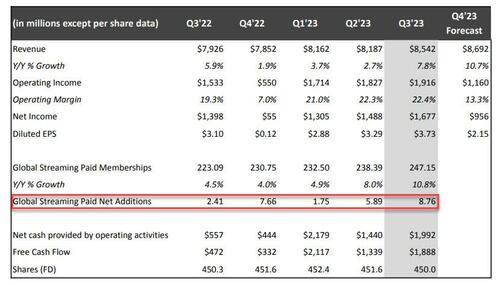

With that in mind, and considering that options were pricing in a 7.6% swing after hours today, here is what NFLX reported for its third quarter:

And visually:

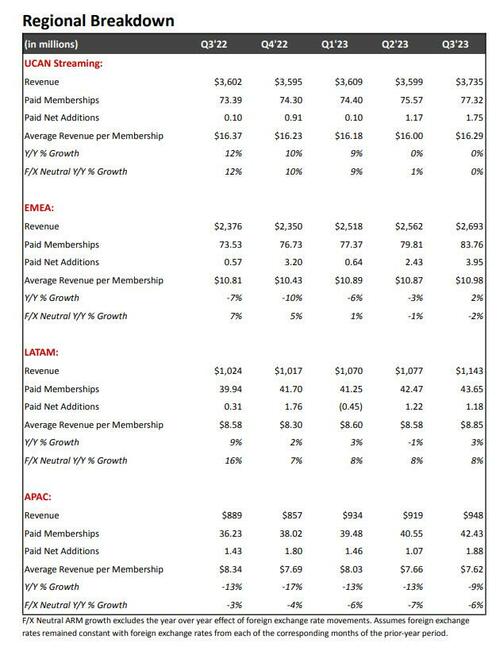

And here is the regional detail: curiously the bulk of new subs in Q3 was in the EMEA region.

While the current quarter was stellar, the company's Q4 guidance was curiously on the weak side, coming below consensus for both revenue, EPS and margins:

Some more details from the company:

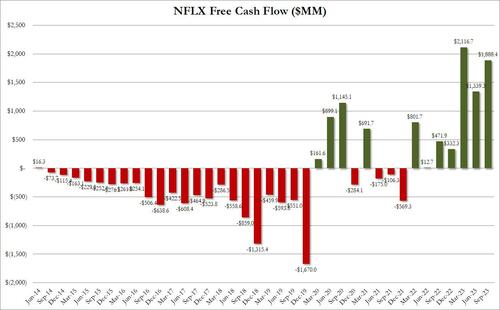

And here is full 2023: thank you striking workers:

Yet we find it odd for the 2nd consecutive quarter that while the Hollywood strike is boosting free cash flow, it has no adverse impact on revenue...

Going back to the company's results, free cash flow in Q3’23 amounted to a whopping $1.9B compared with $472MM in the year ago quarter; this was the second highest FCF quarter on record.

NFLX finished Q3 with gross debt of $14B (in-line with the company's $10B-$15B targeted range) and cash and short term investments of $8B, leaving net debt at $6.5BN. During the quarter, NFLX repurchased 6M shares for $2.5BN. Since the inception of this authorization, NFLX has bought back $4.1B. In September, the board increased an additional $10BN stock repurchase authorization on top of the $1B remaining under the prior authorization.

And while the company's Q4 guidance was just a touch on the light side, the market was more than happy with the surge in Q3 subs and the full year cash flow guidance, and sent the stock 11% higher; however when factoring the 2.7% drop during the regular session, it appears that most calls and puts will expire worthless: the market was pricing in a +/-8% change today and that may be precisely what it will get.