Under Armour CEO Kevin Plank has relisted his 400-acre equestrian farm in northern Baltimore County—formerly owned by the Vanderbilt family—for $22 million, marking its second appearance on the market in less than a year. The listing comes as Under Armour grapples with years of financial troubles and recent restructuring, with shares down 87% from their 2015 peak.

The Wall Street Journal reported that Plank's Sagamore Farm—think of it as the billionaire's playground—was listed by real estate agent Denie Dulin of Compass. The 16,000-square-foot main house features six bedrooms and overlooks a private dirt flat track for horse racing in the Worthington Valley area.

Plank purchased the property around 2007 but declined to tell WSJ how much he paid for the farm. He noted that more than $22 million was spent on the land and renovations over the years.

In the early days of ownership, and while UA shares were much higher, Plank ran a racehorse operation out of the farm. However, due to time commitments, he closed the farm's racehorse operations in 2021.

"That's a business you don't want to be in unless you're in it all the time," he said.

Time commitment? Or spending at least a million a year or more to upkeep the farm was a money pit.

In recent years, Plank has been locked in a dispute with a local conservatory group after he made plans to expand his Sagamore Spirit Distillery on the property.

UA shares over the last decade have been a rollercoaster down.

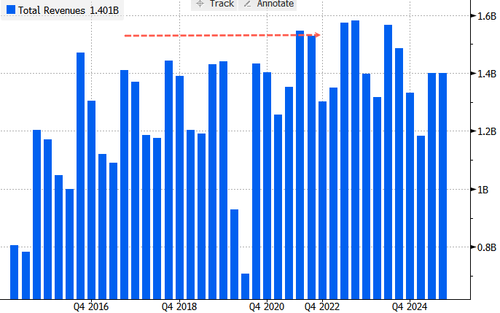

UA revenues stagnate.

Plank should pick his local politicians more wisely. The billionaire hosted far-left Democrats, including Gov. Wes Moore, at Sagamore's main house last spring in a closed-door fundraiser.

Moore (Soros-friendly) has accelerated Maryland's rapid demise into twin crises...

Back to the farm, WSJ noted:

Plank, who has been CEO of Under Armour off and on since he founded the company in 1996, started quietly shopping Sagamore Farm off-market last year.

One investor group in the Baltimore area that inquired about purchasing the farm last year told us that zoning issues on the property deterred them from buying it. Much of the property is restricted by conservation zoning, they said.

"Plank has sold two other high-profile homes in the past decade, a Georgetown mansion for $17.25 million in 2020 and his Park City, Utah condo for $18 million in 2023," WSJ noted.

With UA shares near record lows and Plank offloading multiple properties in recent years, the re-listing of Sagamore may signal the billionaire's growing need for liquidity.

The question now is, which Maryland billionaire will buy the property next? David Smith of Sinclair?