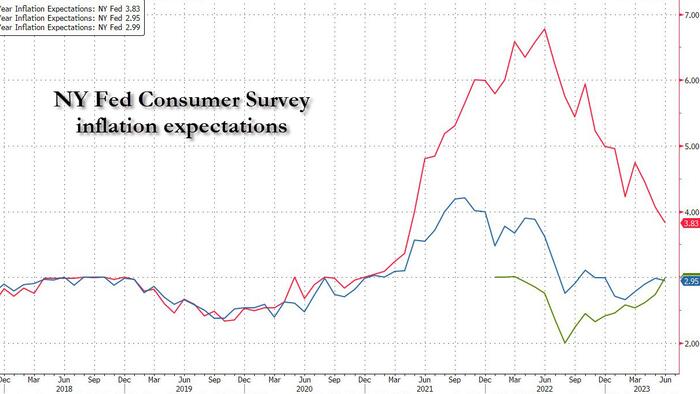

If Powell was on the fence about whether to hike rates in two weeks after the June "hawkish skip" or whatever the said pause is now called, the latest monthly data just released by the NY Fed Consumer Survey should help allay his fears.

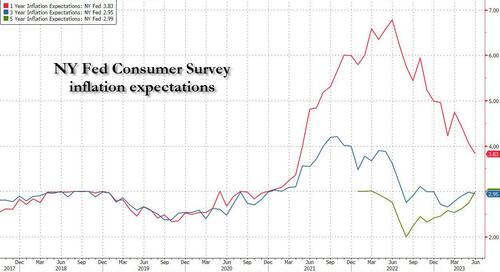

According to the NY Fed, near-term inflation expectations - those for the one-year horizon and which traditionally just follow the latest move in the price of gasoline - dropped again to 3.83% in June from May's 4.07%, the third straight decline - one which was broad-based across all demographic groups - and the lowest reading since April 2021. The measure has now fallen by 3 percentage points from its series high in June 2022. This drop, however, was offset by a virtually flat inflation expectation in the three-year-ahead horizon (which dipped to 2.95% from 2.98%) and a surprise increase in the five year inflation expectations, which rose to 2.95% from 2.72% in May, the highest print since March 2022.

At the same time, median inflation uncertainty—or the uncertainty expressed regarding future inflation outcomes—declined across all three horizons.

Some other observations:

Median home price growth expectations increased for the fifth consecutive month from 2.6% in May to 2.9% in June, the highest reading since July 2022. The increase was driven by respondents with a college degree and those who live in the South and West Census regions, which is surprising because those educated folks should realize what "higher for longer" rates mean for home prices. Unless, of course, we don't have higher for longer and ordinary Americans once again prove to be smarter than the Fed.

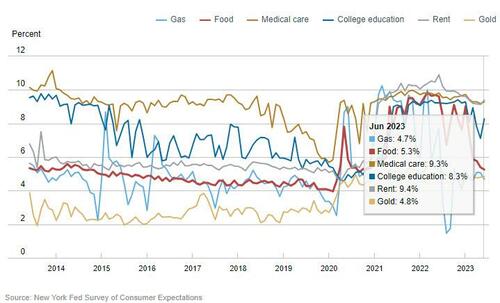

Median year-ahead expected price changes declined by 0.4 percentage point for gas (to 4.7%) and 0.1 percentage point for food (to 5.3%). In contrast, median year-ahead expected price changes increased by 1.2 percentage points for the cost of college education (to 8.3%), 0.1 percentage point for medical care (to 9.3%), and 0.3 percentage point for rent (to 9.4%).

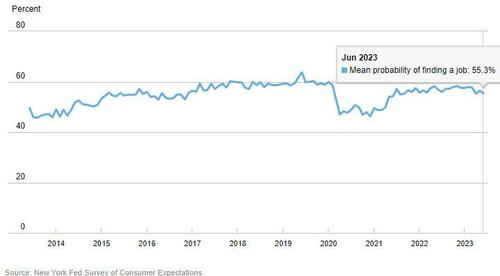

Labor Market

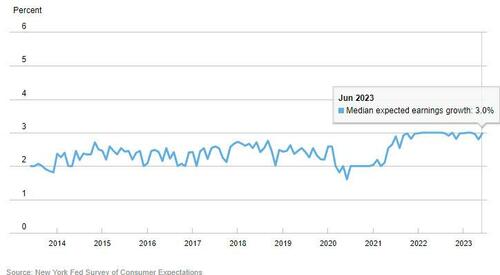

And here are the survey respondents' expectations on topics of household finance

More in the full survey available here.