US natural gas futures are up 2.5% in late afternoon trading, reaching $2.98 per mmBtu, driven by new forecasts showing a shift in cold weather from the West Coast to the East next week. This suggests households may crank up their thermostats for the first time this season as a proper chill sets in.

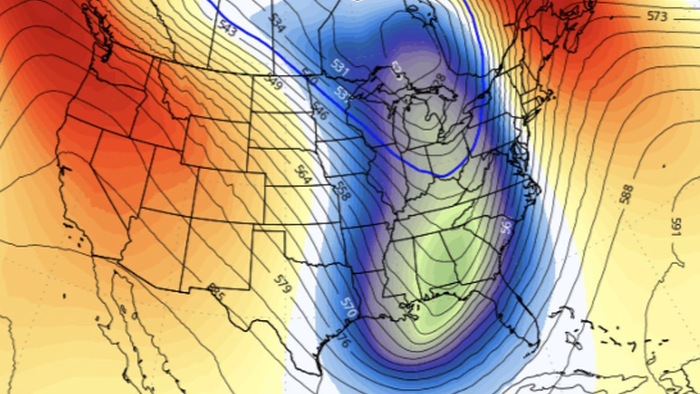

Private weather forecaster BAMWX published a new mid-day GEFS run for late November that shows "massive cold trends" for the eastern half of the US.

"The pattern supports the cold stretch and we have a better tap to cold air ahead," BAMWX wrote on X, adding, "Could get pretty interesting for a time late month for wintry potential."

Meteorologist Ryan Kane wrote on X, "It's safe to say next weeks ULL will be the big pattern changing system (Nov 20-23rd). Nice -EPO, +PNA & -NAO will all work to drive cold into the eastern half of CONUS."

"Snow potential should come Thanksgiving week as the -NAO attempts to break down as the cold air is established," Kane noted.

BAMWX said the pattern shift to much cooler temps in the interior Northeast could produce ripe conditions for snow next week.

Here's what other meteorologists are saying...

Back to NatGas fundamentals, here's the latest data (courtesy of Bloomberg):

Weather:

Forecasts shifted cooler for parts of the West Coast with colder temperatures moving eastward later in the Nov. 18-22 period: Maxar

See WHUT for a map of latest 6-10 day weather forecast: NOAA * Click here for two-week temperature forecasts for the US

Storage:

Gas inventories probably rose 39 bcf last week, based on median of analyst estimates compiled by Bloomberg

Five-year average gas inventory change for week ended Nov. 8 is +29 bcf

Stockpiles totaled 3.932 tcf as of Nov. 1, 5.8% above the five-year average

EIA to report weekly storage data at 10:30am New York time on Thursday

Daily BNEF Gas Data:

Lower-48 dry gas production on Wednesday ~100.4 bcf/day, or -5.2% y/y

Lower-48 total gas demand ~81.7 bcf/day, or -3.1% y/y

Dry gas exports to Mexico ~6.5 bcf/day, or -2% w/w

Estimated gas flows to LNG export terminals ~13.7 bcf/day, or +1.5% w/w

Maybe a cold blast in the Northeast and other parts of the US will be the catalyst to push NatGas futures past the $3 mark, which has served as strong resistance for nearly two years.

In mid-August, the 208th edition of the Farmers' Almanac published the "Wet Winter Whirlwind." It noted, "There will be a lot of precipitation and storms"—all dependent on location."

And this: NatGas Bulls Rejoice: Colder Winter Lower 48 Forecasts May "Place Upward Pressure" On Prices