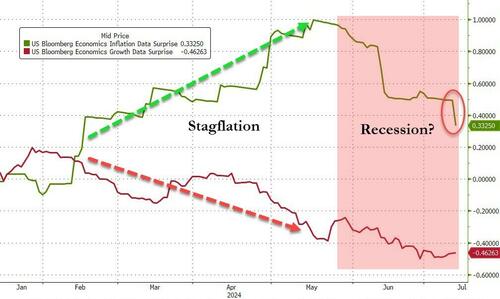

Misses across the board today in CPI left US macro surprise data languishing in 'not so soft landing' territory...

Source: Bloomberg

...as inflation and growth factors have are now tumbling in a 'recession-y' kinda way...

Source: Bloomberg

...all of which prompted a surge in rate-cut hopes, with 2024 expectations at their highest since April (61bps) as 2025 is now pricing in four full rate-cuts...

Source: Bloomberg

Which sent gold higher, the dollar lower and Treasury yields plunging (led by the short-end)...

Source: Bloomberg

... BUT the picture was very different in equity market land...

Source: Bloomberg

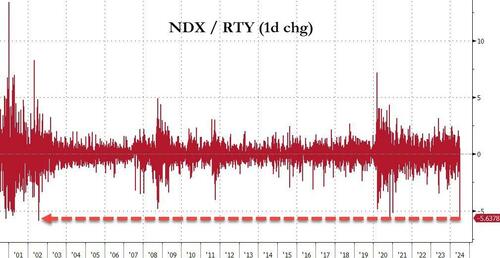

...where Nasdaq was monkeyhammered while Small Caps surged. The Dow clung to unchanged as the S&P ended off around 1% weighed down by Tech obviously...

That RTY/NDX spread was over 600bps at its peak today. By the close it was the biggest relative outperformance of the Russell 2000 over Nasdaq 100 since 2002...

Source: Bloomberg

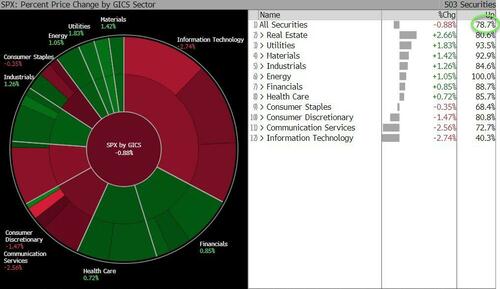

...and oddly, breadth was crazy positive despite the ugliness as the reverse MAG7 trade struck hard...

388 members of the S&P currently trading up on the day vs 111 in the red (top 5 breadth day of the year).

TSLA tumbled on robotaxi-delays talk...

NVDA stalled at its previous record close and dropped over 5%...

However, as Goldman's traders noted, as big as today's moves are, they hardly register on long-term charts...

Source: Bloomberg

But, the NDX/RTY pair does remain at a key support level for now...

Source: Bloomberg

Finally, before we leave stocks, volumes on Goldman's trading desk were tracking higher +27% vs the 20dma and index trading leading the way w/ ETF’s capturing 31% of the overall tape.

Both LOs and HFs much better for sale.

There was plenty of activity in other asset classes too...

The dollar was clubbed like a baby seal on the dovishness back to pre-June Payrolls lows...

Source: Bloomberg

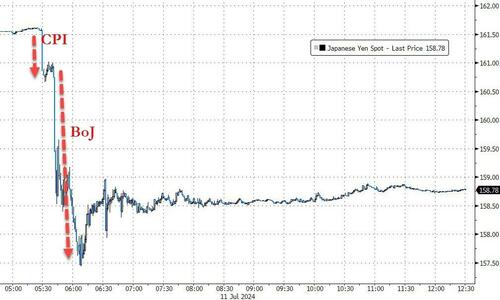

..helped lower by alleged BOJ intervention to strengthen the yen...

Source: Bloomberg

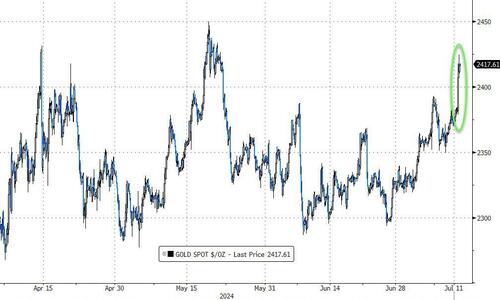

Gold soared back near record highs with spot prices topping $2400 once again...

Source: Bloomberg

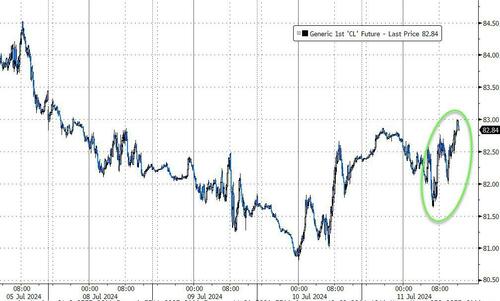

Crude prices managed gains too with WTI back up to $83...

Source: Bloomberg

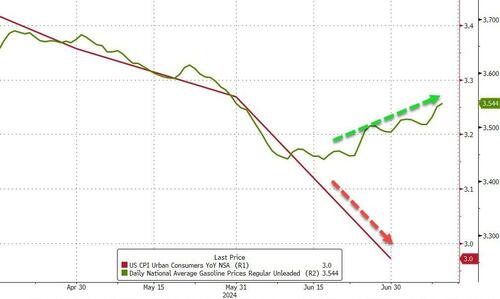

And Powell and Biden better hope that oil prices (and thus gas prices) start coming down soon or today's CPI may be overwhelmed...

Source: Bloomberg

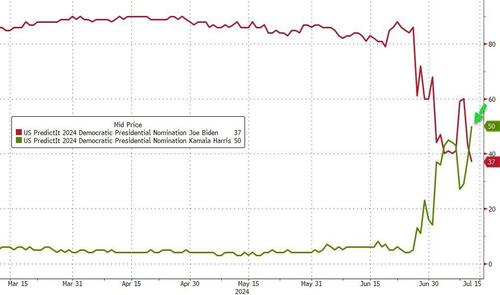

Still if you think you had a turbulent day, give a thought for President Biden who is now behind none other than Kamala Harris in the betting for who will get the Democratic Party nod...

Source: Bloomberg

Time to get back on your knees, Joe!