So much for the "broadening out of the rally" bullshit!

Semis were slammed - their biggest drop since the COVID lockdowns - as the market had trouble with weaker than expected 3Q guidance from European semi bellwether, ASML (and headline chatter of further crackdowns on chip exports to China)

Source: Bloomberg

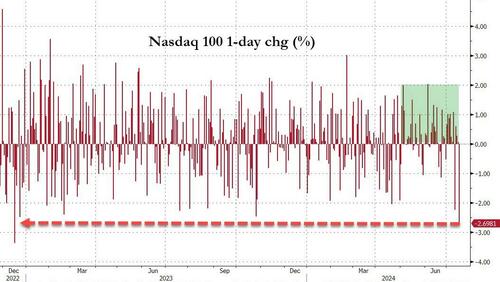

The Nasdaq damn broke today as it suffered its biggest single-day drop since Dec 2022...

Source: Bloomberg

Small Caps actually had a down day today (though outperformed Nasdaq) as The Dow hit a new record high...

The last five days have seen Small Caps (Russell 2000) outperform Large Caps (Russell 1000) by the largest amount in history (going back to 1979)...

Source: Bloomberg

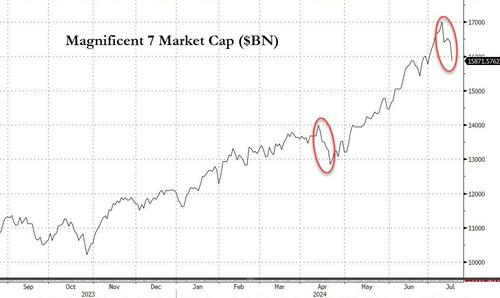

The Magnificent 7 stocks have lost a staggering $1.1 Trillion in market cap in the last five days...

Source: Bloomberg

But that's still a drop in ocean in context of how far they have come...

Source: Bloomberg

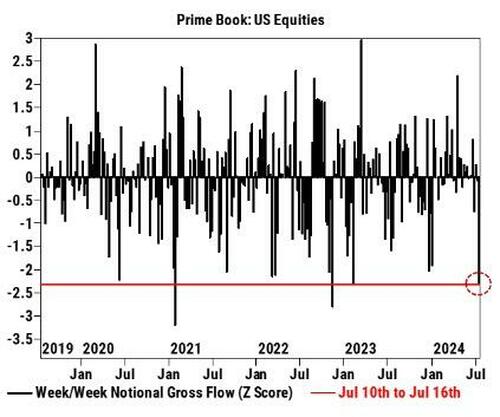

Under the hood, Goldman's trading desk noted that volumes +17% vs the trailing 20 days and can feel it flow-wise on the desk. S&P top of book tracking much higher as well +11%. Our floor is skewed much better for sale (-8%) with most moving their feet in TMT. Across Semis, we have seen significant supply most concentrated in AI winners. We have also seen supply across rideshare names (UBER, LYFT) + ADRs.

For context, in cumulative notional terms, the de-grossing activity over the past 5 sessions is the largest since Nov '22 and ranks in the 99th percentile on a 5-year lookback...

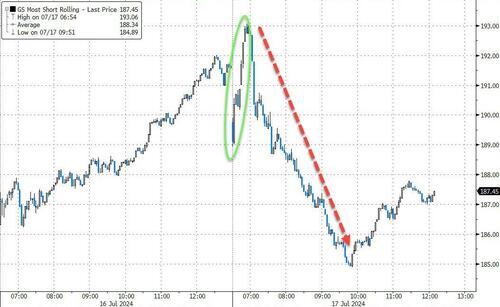

Dovish comments from Fed's Waller were largely ignored - though did provide some juice for the initial short squeeze on Small Caps at the cash open...

Source: Bloomberg

Treasuries were mixed today with the long-end very modestly outperforming overall (2Y +1bps, 30Y -1bps). Weakness overnight gave way to a strong bid during the US session as equities sold off...

Source: Bloomberg

Rate-cut expectations remained dovish with 2025 expectations rising today...

Source: Bloomberg

The dollar tumbled further below June Payrolls lows today, back near two-month lows...

Source: Bloomberg

Much of the dollar weakness was the further implosion of the yen carry trade (which strengthens the yen vs the dollar)...

Source: Bloomberg

Crude prices soared today, helped by a big inventory decline...

Source: Bloomberg

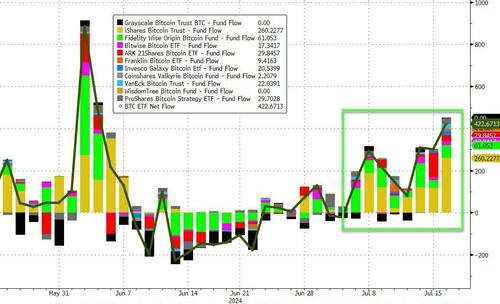

Bitcoin ETFs continued to see stronger inflows...

Source: Bloomberg

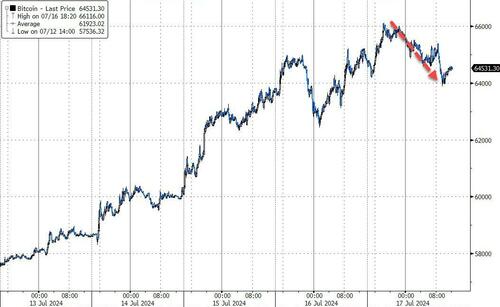

But bitcoin was weighed down modestly today by the overall tech turbulence (notably strong relative performance though)...

Source: Bloomberg

Gold dipped back from record highs but spot found support at $2450...

Source: Bloomberg

Finally, if you thought you had a bad day in the markets, President Biden's odds of getting the nomination collapsed... again...

Source: Bloomberg

Kamala's awful quiet, eh?