Morgan Stanley US equity strategist Michelle Weaver joins a growing number of Wall Street analysts warning about deteriorating conditions for consumers. Weaver wrote in a recent note to clients that travel companies exposed to "lower-income consumers" are beginning to experience "demand weakness."

Weaver's note, published on Sept. 21, follows JPMorgan consumer trader Brian Heavey's truth bomb on Sept. 20 when he turned extraordinarily negative on the US consumer. Since then, Mike Wilson, Morgan Stanley's chief investment officer, penned a note about the 'consumer falling off a cliff.'

"A significant proportion of US Consumers have drawn down their Covid era excess savings and our US Economics team estimates that lower-income households have fully exhausted their excess savings, while middle- and higher-income households are less willing to spend their excess savings on consumption," Weaver told clients.

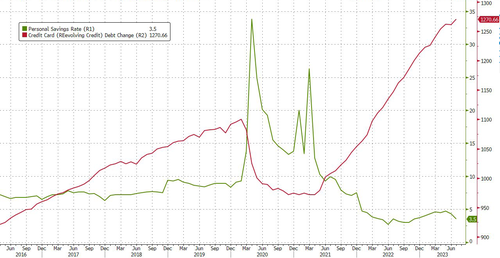

Her note was published after the Fed's latest beige book that warned: "Some Districts highlighted reports suggesting consumers may have exhausted their savings and are relying more on borrowing to support spending." And a period when credit card growth wanes, and the consumer has never been in worse shape.

Also, the three-year pause in student loan payments has expired, as some 28 million borrowers are imminently facing a restart in payments. This will add a $15.8 billion monthly headwind - or $190 billion per year - to US consumer spending.

Understanding all of this, Weaver's view is that some of the first impacts of a slowdown will be "travel companies exposed to the lower-income consumer showing indications of demand weakness."

Here's more from the note:

She added:

Travel has shown signs of cooling, led by areas exposed to low-income consumers. This problem could broaden out crimping company margins and earnings. We believe there could be more downside ahead and are underweight the Consumer Discretionary sector.

None of this is a surprise, as we've already reported in July, "Airline Stocks Hit Turbulence After Alaska Air Signals Slowing Demand," and last month, "American Airlines Cuts Earnings Forecast As Headwinds Hit Airline Industry." In mid-July, we said, "Cash-Strapped Consumers Travel By Bus To Destination Hotspots."

Still no recovery in airline stocks.

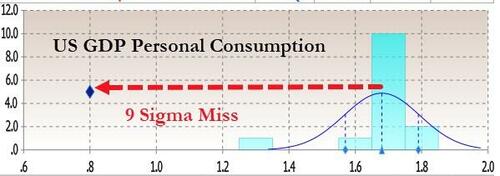

Meanwhile, last week, Personal Consumption data in the latest GDP revision collapsed in a stunning 9-sigma miss to expectations.

... and there goes the "strong" Bidenomics economy as "strong" data points only last about a month and then are downgraded.

Beware of a faltering consumer.