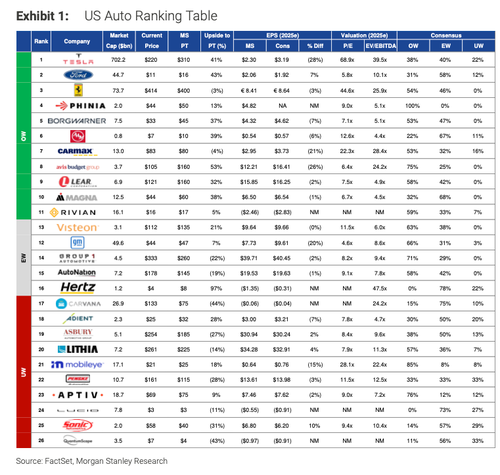

Morgan Stanley's autos guru, Adam Jonas, has just crowned Tesla as the 'Top Pick' for the US auto market, dethroning legacy OEM automaker Ford Motor Company.

Here are the several factors that drove Jonas' decision:

A more in-depth understanding of why Jonas upgraded Tesla to number one on 'Top Pick' in US autos and maintained his overweight stance on the company with a price target of $310 that commands a 40% upside from here:

Given Jonas' bull case, he explained some of the risks that could derail upside price action in Tesla:

In markets, shares of Tesla were up nearly 6% to $232.5 in the early cash session, while Ford shares were down about 2%.

Last month, Jonas suggested that Tesla could be poised for the powering up America theme ("The Next AI Trade") with its solar energy and storage business

Cathie Wood, head of Ark Investment Management, has been pounding the table about Tesla's technical analysis and explained recently on CNBC: "Longer the base, the bigger the breakout."

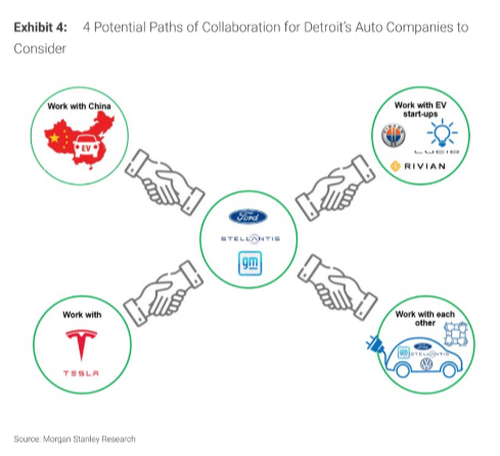

Jonas noted earlier this year that the EV sales slowdown could trigger a consolidation wave across the industry.

The entire industry (excluding Tesla) might face a reckoning next year if Trump wins in November. That's because the former president has stated that EV subsidies will be eliminated. Even Musk supports this move.

Why? Well, as Musk said: "Take away the subsidies. It will only help Tesla. Also, remove subsidies from all industries!"

So, back to what Jonas noted: "...Tesla may achieve an even more dominant position in the market ..."