How well are Americans managing their money, and how does it vary between the states?

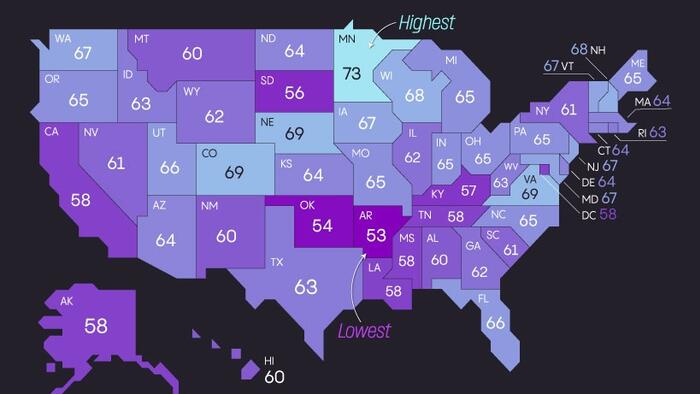

This financial literacy map, via Visual Capitalist's Pallavi Rao, attempts to answer both questions using 2025 data from WalletHub, a personal finance services company.

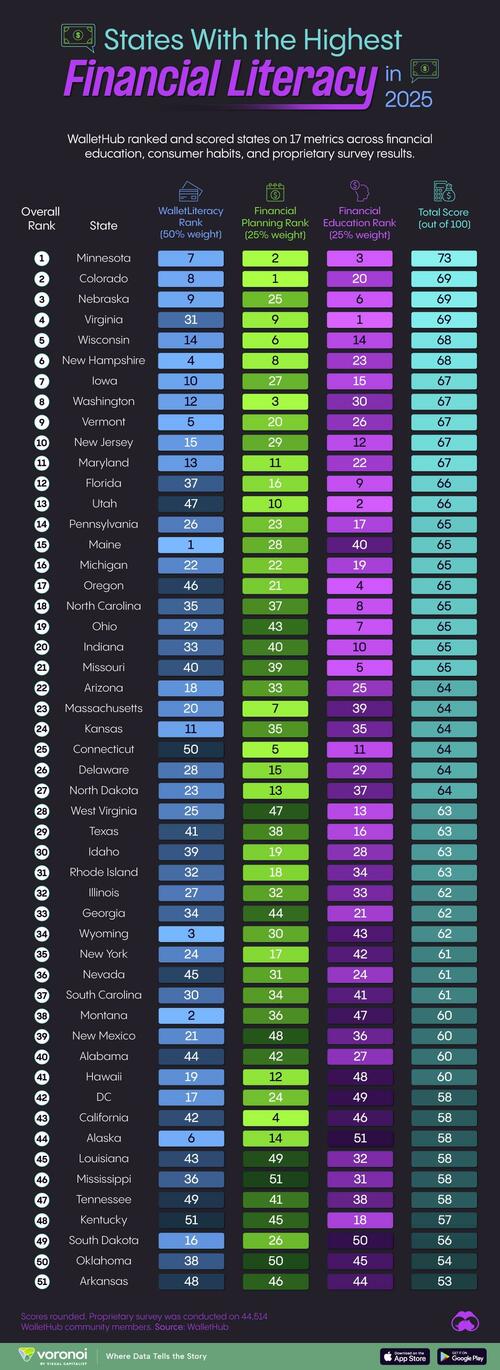

They ranked and scored states on three main benchmarks: financial education, financial planning (or consumer habits), and how Wallethub’s own users performed on their financial literacy survey.

ℹ️ These benchmarks are further subdivided into 17 metrics (credit score, savings, personal finance courses, etc.) and are weighted differently. Please read the source’s methodology section for a full breakdown.

Minnesota is the most financially literate U.S. state with 73 points, according to WalletHub’s latest analysis.

Here’s some sub indicators where Minnesota outperformed the rest of the country.

And here’s how each state scores out of 100. Figures are rounded.

(Out of 100)

Meanwhile, Arkansas tested the worst, with 53 points. Its score is impacted by having the second-worst performance on WalletHub’s financial literacy survey.

And here’s each state’s rank within the three main benchmarks.

(50% Weight)

Rank (25% Weight)

Rank (25% Weight)

There’s some further insights to explain some noticeable geographic trends.

While investing in the markets is all the rage—particularly with the rise of no-fee platforms—WalletHub’s benchmarks prioritize an often overlooked part of money management: debt.

America’s credit card debt collectively crossed $1 trillion in 2023, and it’s only been growing since.

On average, American households have about $5,000 in outstanding credit card balances, which can take anywhere between one to two years to pay off depending on monthly incomes.

Of course, managing expenditures to avoid or reduce debt has been particularly difficult in the multiple years of post-pandemic inflation.

Need more money management insights about the United States? Check out: America’s Average Bank Account Balance, by State for a quick overview.