Microsoft "Strongly Refutes" Cowen Report It Is Canceling Data Center Orders... But Questions Remain

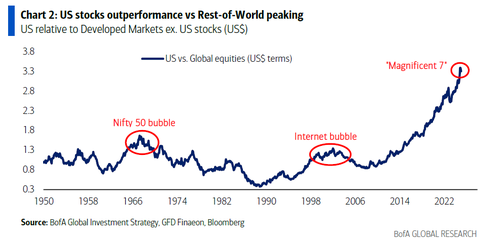

After the TD Cowen report on Microsoft data center order cancellations - which we first profiled yesterday for our subscribers, well before Bloomberg - spooked European energy and US AI infrastructure stocks sending them sharply lower, and with the market on the verge of a brutal selloff (as Goldman cautioned last night) it was incumbent on the biggest Mag 7 member to step in... or otherwise the following hockeysticking Mag7 chart would have a very painful reacquaintance with gravity.

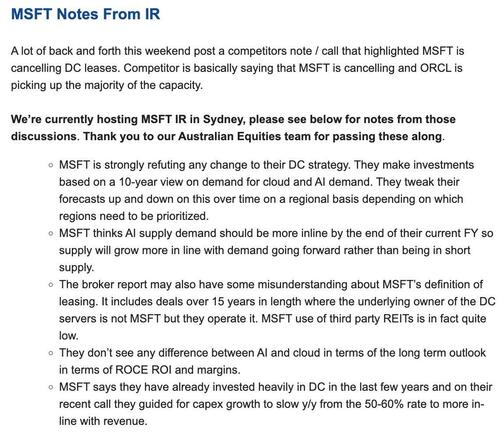

Sure enough, while Microsoft was unable to come out and directly refute what TD Cowen said - because it is accurate - Microsoft did damage control using everyone's favorite mouthpiece-for-hire, Jefferies, which in the back of a salesnote, so as to avoid giving it too much prominence even though everyone knew the entire market would read it immediately, the bank said that there has been "a lot of back and forth this weekend post a competitors note / call that highlighted MSFT is cancelling DC leases. Competitor is basically saying that MSFT is cancelling and ORCL is picking up the majority of the capacity."

And so, to give MSFT a chance to respond, but not really respond so it is not in violation of Reg FD or some other materially misleading comment, Jefferies was used as a broken telephone by the 2nd largest company in the world to convey the following message: We’re currently hosting MSFT IR in Sydney, please see below for notes from those discussions. Thank you to our Australian Equities team for passing these along.

MSFT is strongly refuting any change to their DC strategy. They make investments based on a 10-year view on demand for cloud and AI demand. They tweak their forecasts up and down on this over time on a regional basis depending on which regions need to be prioritized.

MSFT thinks AI supply demand should be more inline by the end of their current FYI supply will grow more in line with demand going forward rather than being in short supply.

The broker report may also have some misunderstanding about MSFT’s definition of leasing. It includes deals over 15 years in length where the underlying owner of the DC servers is not MSFT but they operate it. MSFT use of third party REITs is in fact quite low.

They don’t see any difference between AI and cloud in terms of the long term outlook in terms of ROCE ROI and margins.

MSFT says they have already invested heavily in DC in the last few years and on the recent call they guided for capex growth to slow y/y from the 50-60% rate to more inline with revenue.

And the note in question:

Which is all great... but why did MSFT not immediately publish as Press release this morning, or at least send an agent to CNBC to discuss the report? Simple: because what TD Cowen said is 100% true and accurate, and now the spin begins.... and just like one month ago the narrative was goalseeked away from DeepSeek to Javan's law, or some other bullshit, this time MSFT was forced to admit that it is in fact cutting leases but, you see, it's perfectly normal and the company "tweaks" their forecasts depending on which "regions need to be prioritized."

We wonder how much time this buys MSFT and the Mag7 bubble, but it is becoming obvious that the half life of these self-serving mental acrobatics is getting short and shorter... and one of these days MSFT will be forced to throw in the towel and slash its capex forecast by 20%, 30% or more, starting the next market crash.

Earlier:

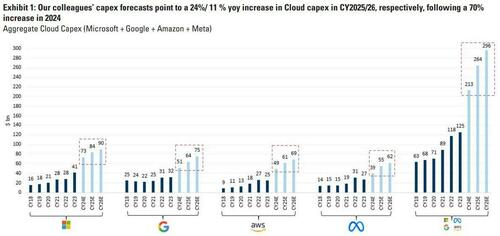

Just about a month ago, when Wall Street first realized the existential threat that China's (far cheaper and much more efficient) DeepSeek technology posed to the grand AI narrative - which has almost singlehandedly pushed stocks higher for much of the past two years - we speculated (so to speak) that Wall Street's forecasts for Mag7 capex may be just a... tad excessive.

And for a few hours, Wall Street did the same, sending tech names plunging, and NVDA crashing the most on record, wiping out nearly a trillion dollars in market cap in a single session. But it didn't last, and the very next day Wall Street held a masterclass in mass delusion, whereby the narrative of collapsing capex was promptly goalseeked away with some 19th century deus ex machina called Jevon's paradox, which simply states that if the price of a technology tumbles its widespread adoption will more than make up for sunk capital costs (try explaining that to Global Crossing). Or something along those lines... and while HFT algos had no idea what any of this meant, the fact that momentum shifted from sell to buy was enough - and in the ensuing 4 weeks everything ripped straight up, as if the entire embarrassing DeepSeek episode had never happened and everyone forgot all about it.

That was - until this weekend, because as a report from TD Cowen strongly suggests, the first kneejerk reaction to the DeepSeek news may have been the correct one.

It turns out that while everyone was patting themselves on the back for not reading too much into the DeepSeek shocker, the companies responsible for the very Capex binge that is supposed to propel markets ever higher and justify the S&P's ludicrous 22x PE multiple, were quietly cutting their losses, because - in the immortal words of John Tuld, "it sure is a hell of a lot easier to just be first" to get out of a losing position.

According to TD Cowen's Michael Elias, "channel checks indicate that MSFT has 1) canceled leases in the US, totaling 'a couple of hundred MWs' with at least two private data center operators, 2) has pulled back on the conversion of SOQs to leases, and 3) has re-allocated a considerable portion of its international spend to the US."

"When coupled with our prior channel checks,"Eilas concludes, "it points to a potential oversupply position for MSFT."

And if Microsoft is first in canceling leases and generally blowing up the "Capex to the Sky" narrative (on which the "market to the sky" narrative is built), which it would have to be since it has the biggest projected capex hockeystick of all its Mag7 peers...

... then everyone else will promptly follow.

Below we excerpt from the full note because, well, it may be more market moving than even the DeepSeek news:

Our Channel Checks Indicate Microsoft Has Cancelled Select US Data Center Leases and Has Pulled Back on SOQ To Lease Conversion; Pulls Back on International Market Expansion.

Our recent channel checks indicate that Microsoft has terminated select leases with at least two private data center operators across multiple U.S. markets, totaling a couple of hundred MW. Our checks indicate that in some situations, Microsoft is using facility/power delays as a justification for the termination. Recall, as we highlighted in our 2022 Takeaways from PTC, this is the same tactic that Meta used to cancel multiple data center leases in the U.S. after we learned in our checks that Meta had then canceled a $48B capex program related to the metaverse (Meta subsequently cut its capex guidance by $5.4B two weeks later).

Separately, our channel checks suggest that Microsoft has also pulled back on converting negotiated and signed Statement of Qualifications (SOQ’s) (the precursor to a data center lease) into signed leases. To this point, it is currently unclear to us if this is simply a delay in SOQ-to-lease conversion or if it is an outright termination of the SOQ with no conversion to leasing expected. For context, based on our checks, a SOQ sets forth the terms and conditions for the lease and does not constitute a lease agreement. However, the conversion rate of SOQ’s into a signed lease is close to 100%, with data center operators using this as the signal to start data center construction. In addition, our channel checks indicate that Microsoft is also re-allocating a considerable portion of its projected international spend to the U.S., which suggests to us a material slowdown in international leasing.

So why is this happening?

While Cowen has yet to get the level of color via its channel checks as to why this is occurring, the bank's initial reaction is that "this is tied to Microsoft potentially being in an oversupply position." As Cowen highlighted in its recent takeaways from PTC, the bank learned via its channel checks that Microsoft:

- Walked away from multiple 100MW deals in multiple markets that were in early/mid-stages of negotiations.

- Let +1GW of LOI's on larger footprint sites expire.

- Walked away from at least five land parcels that it had under contract in multiple Tier I markets.

At the time, the bank also highlighted that the magnitude of both potential data center capacity it walked away from and the decision to pull back on land acquisition (which supports core long-term capacity growth) indicates the loss of a major demand signal that Microsoft was originally responding to and that it believed the shift in Microsoft's appetite for capacity is tied to OpenAI, which recent press reports appear to confirm.

To that point, report author Elias asks to consider this: Microsoft was the most active lessee of capacity in 2023 and 1H24, at which time it was procuring capacity relative to a capacity forecast that contemplated incremental OpenAI workloads. However, as TD Cowen believes is indicated by its decision to pause construction on a data center in Wisconsin — which prior channel checks indicated was to support OpenAI — there is capacity that it has likely procured, particularly in areas where capacity is not fungible to cloud, where the company may have excess data center capacity relative to its new forecast.

This is the bank's (polite) interpretation of the current situation. The less polite interpretation is that the CapEx bubble - which was supposed to inject up to half a trillion dollars in new growth capital in just a few years to keep up with an exponential AI demand curve - just went pop.

And for those who need a refresher on why it "sure is a hell of a lot easier to just be first", here you go...

More in the full note available to pro subs in the usual place.