TD Cowen analyst Michael Elias has explained to clients through multiple notes over the last month that Microsoft has scaled back on data center projects in the U.S. and Europe. This development is unsurprising, as readers have been aware of the emerging risks posed by the cheaper and more efficient Chinese DeepSeek (as noted on Jan. 27), prompting us to question whether AI data capacity will be achieved sooner than initially anticipated.

Another worrying sign for the AI bubble—or rather, a continuation of Elias' reporting on Microsoft scaling back data center projects—comes from Bloomberg, which provides additional color on MSFT supposedly halting data center construction sites in Indonesia, the UK, Australia, Illinois, North Dakota, and Wisconsin.

Here's more from the report, citing people familiar with talks (list courtesy of Bloomberg):

Elias first raised concerns about Microsoft scaling back on AI computing capacity in a note on Feb. 24, in which he stated that Microsoft was terminating AI data center leases. This was followed by a separate note last week, in which the analyst reported that Microsoft had walked away from data center projects in the U.S. and Europe, amounting to a capacity of approximately 2 gigawatts of electricity.

"We continue to believe the lease cancellations and deferrals of capacity points to data center oversupply relative to its current demand forecast," Elias said last week.

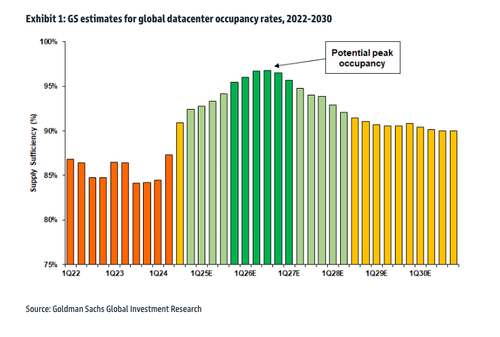

News of the cheaper Chinese DeepSeek—a response to OpenAI's ChatGPT—in late January, which is allegedly 40–50 times more efficient than other large language models, had Goldman's Rich Privorotsky at the time proposing a new theme that spelled bad news for the AI bubble: "If you can do more with less, it naturally raises the question of whether so much capacity is necessary."

The whole "do more with less" theme produced by DeepSeek sparked a debate that AI peak demand capacity could be reached much sooner than Goldman's forecast of late 2026.

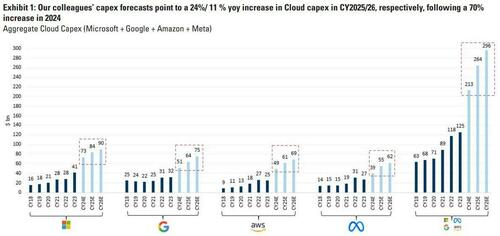

Capex revisions next?

Year to date, Goldman's AI and power baskets have gotten the memo...

Goldman's China AI basket leads US AI baskets.

. . .