In our preview of META's Q1 results this afternoon (ahead of which Goldman's desk had positioning as a 7 out of 10), we said that it feels like centuries ago that META had that 20-day winning streak in Jan/Feb with the name now nearly 30% below YTD highs, which put tactical positioning in cleaner spot into today's print relative to recent META prints (bear case focused on macro/tariff-related risks to Revenues vs elevated capex/expense burdens). Well, the bulls can exhale because the results which META just reported will give them another taste of what that meltup felt lik, because the stock is surging 5% on a big top and bottom line beat, coupled with an increase to the capex guidance.

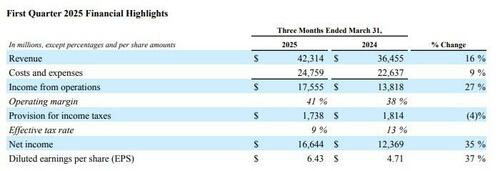

Here is are the blowout results which META reported for Q1:

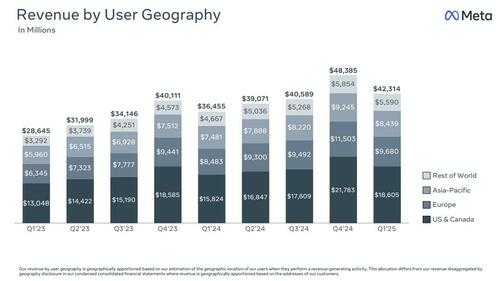

Here are some of the key charts from the quarter, starting with Revenue by geography:

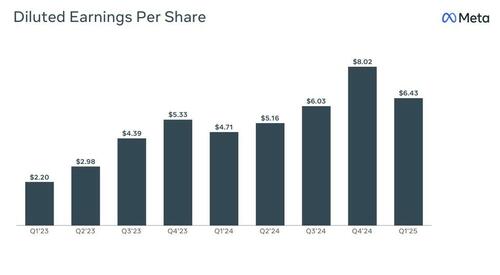

EPS:

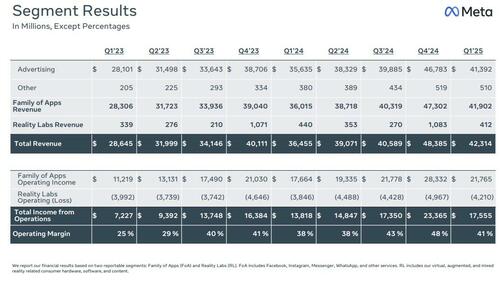

Segment results:

Expenses continued to shrink:

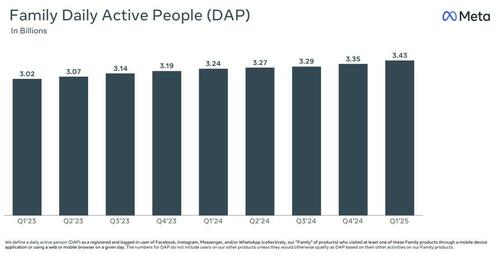

Users are growing...

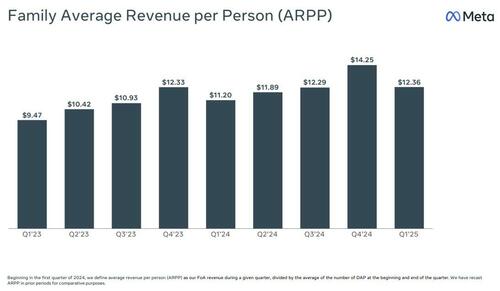

... as is revenue per user

Meta needs its advertising business to continue growing in order to fund an expensive expansion in artificial intelligence, which is driving the future of the business through improvements to ads, algorithms and personalization. Sure enough, the guidance was solid, if harldy stellar:

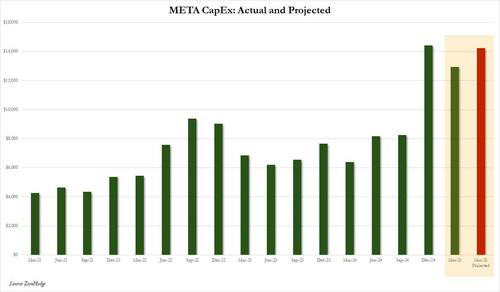

But perhaps most important, at a time when everyone was freaking out about sliding capex, Meta boosted its capex forecast, and now sees it be in the range of $64-72 billion, increased from our prior outlook of $60-65 billion.

This updated outlook "reflects additional data center investments to support our artificial intelligence efforts as well as an increase in the expected cost of infrastructure hardware. The majority of our capital expenditures in 2025 will continue to be directed to our core business."

This is important because while META once again missed on its actual capex, spending $12.94BN on property and equipment in Q1, well below the $14.239BN expected...

... the company is once again hockeysitcking its capex forecast, and is clearly backloading spending in the second half of the year, when at least according to most nevertrumper eceonomists, the US will be in a deep recession.

In response to the blowout earnings, shares rose as much as 5.6% in after-hours trading, after closing at $549. Meta stock was down more than 6% year-to-date before the company reported earnings, still performing better than most of America’s biggest technology companies amid the recent market selloff.

The full META presentation is below (pdf link).