Mercedes shares declined in Germany on Thursday after the struggling automaker reported a nearly one-third drop in 2024 profits, pressured by softening demand in China and sluggish electric vehicle sales. Analysts at Bernstein characterized the 2025 outlook for passenger cars as "predictably weak."

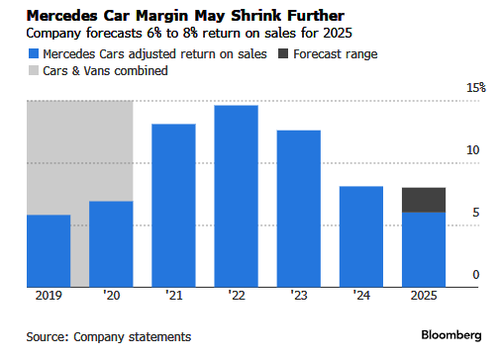

Here's a snapshot of the 2024 fiscal year financial results. The focus is on deteriorating EBIT margin (courtesy of Bloomberg):

Mercedes announced plans to slash 10% of production costs through 2027 and provided a dismal outlook for this year. It expects lower sales and guided profit margins lower than Wall Street's expectations...

2025 Forecast:

"To ensure the company's future competitiveness in an increasingly uncertain world, we are taking steps to make the company leaner, faster and stronger," CEO Ola Kallenius wrote in a statement.

With CEO Kallenius at the helm, Mercedes has prioritized producing higher-end vehicles while shifting away from entry-level models. There was a time—many years ago—when the automaker focused on building cars for executives. However, weak demand for Maybachs and G-Wagons in China and other markets has pressured this strategy.

Kallenius expects margins margins upwards of 10% by 2027. Like many others in Europe, automakers have been pressured by weakening global demand, a dismal economic environment in Germany, and Chinese competitors such as BYD. At the same time, trade tensions with the US are another headwind for EU automakers.

On Thursday, Mercedes shares in Germany fell as much as 3.8% in trading. Shares have been locked in a four-year lateral between 50 euros as the base and 75 euros as the ceiling.

Analyst commentary from Goldman's George Galliers and others noted that 4Q24 "beat" but profit margin forecasts for this year are problematic:

More analyst commentary (courtesy of Bloomberg):

RBC (outperform)

- Analyst Tom Narayan writes that the buyside's expectations were heightened into today's investor event and some may have expected more on capital return, for example relating to the Daimler Truck stake

- Notes the miss in the van margin guidance for 2025

- Still, says the 4Q Ebit came in ahead of consensus and the company is calling for 2025 cars Ebit margins to be 7%, at the midpoint where consensus is

Bernstein (market-perform)

- Analysts led by Stephen Reitman say 2025 passenger cars guidance is "predictably weak" and in-line with their expectations, while vans guidance is a miss

- Say it's a slight beat on the full-year results and the guidance, and notes the new buyback details

Citi (neutral)

- Analysts Harald Hendrikse and Soumava Banerjee say Mercedes is "at least fighting" its deteriorating Ebit margin trend and the share buyback program should shore up the firm's earnings per share until 2027, when new products are meant to boost profitability

Separately, Europe's largest automaker, Volkswagen, has also come under pressure, moving forward with cost-cutting measures to reduce 35,000 jobs in Germany by the end of the decade. Europe is a mess.