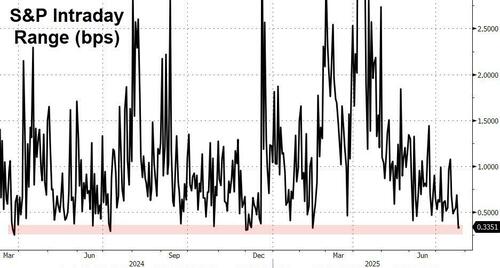

Yesterday and today were among the lowest range days for the S&P 500 over the past four years, but, as Goldman Sachs trading floor noted, on the flip side, market volumes remain quite active tracking to the third 20B share session of the week (and highest weekly average volume since April’s record-setting volume sessions)...

Source: Bloomberg

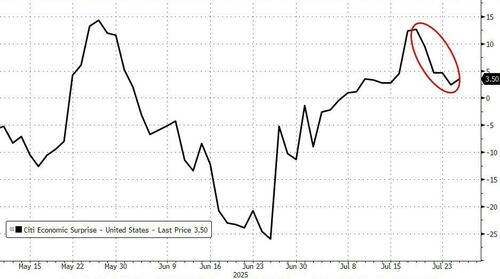

It was also quiet on the macro front (outside of tariff talk), with a slight lean to disappointment in the data...

Source: Bloomberg

'Micro' dominated most of the narratives:

EPS recap after week two: 33% of S&P market cap has now reported and so far, 62% have reported EPS beats of >1stdev (vs 48% historic avg), while 12% have reported EPS misses >1stdev (vs 13% historic avg).

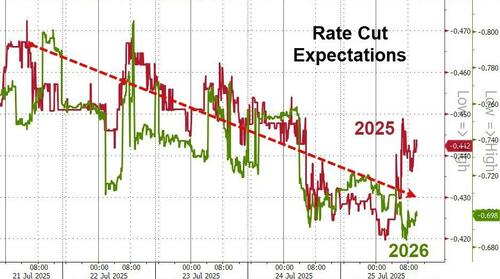

Rate-cut expectations drifted lower this week...

Source: Bloomberg

It was a headline heavy day early on as Trump addressed the press pool before boarding Air Force One for Scotland, but market reactions were muted amid the summer doldrums.

More tariffs are coming and rates seem to be in line with what the president has already pre-announced.

On Europe, Trump cast some doubt over the deal, but the overall tone was positive. The trade framework with China remains on track, too.

And on Jerome Powell, the president has backed off from this threats to fire the Fed chair:

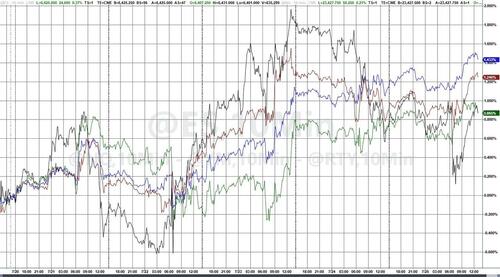

While all the majors ended the week in the green with the S&P leading (and Small Caps and Nasdaq lagging)...

...the big picture hid the ugly reality under the hood - as meme stocks soared and momentum was clubbed like a baby seal...

Source: Bloomberg

Who could have seen that coming?

Hedge funds had another tough week, with Goldman's proxy falling to its lowest level in two years...

Source: Bloomberg

And before we leave equity-land, we note that this afternoon saw the more 'ominous' "Spot Up Vol Up" trade start to evolve, suggesting blowoff top is imminent...

Source: Bloomberg

Treasuries were mixed this week with short-end yields higher while the long-end was the biggest (price) gainer with yields down 6bps...

Source: Bloomberg

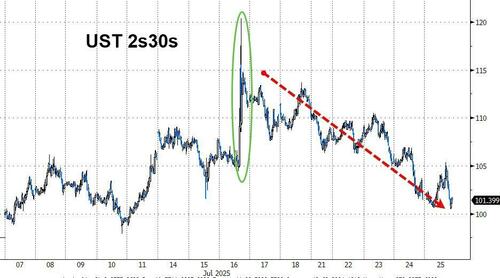

The yield curve (2s30s) flattened significantly this week...

Source: Bloomberg

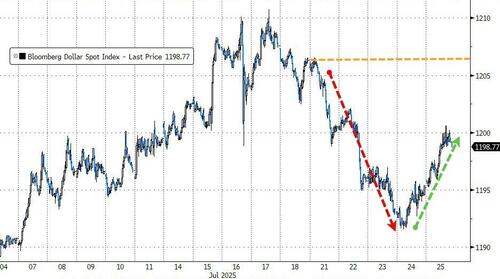

The dollar ended the week lower, despite a strong comeback the last two days...

Source: Bloomberg

Gold fell for the 3rd day in a row testing its 50DMA (marginally lower for the second week in a row)

Source: Bloomberg

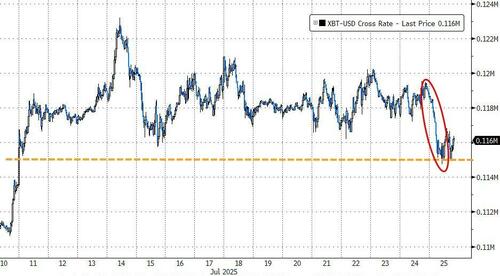

Bitcoin also fell for the second week in a row, testing $115k at two week lows...

Source: Bloomberg

Ethereum outperformed significantly on the week, extending its bounce off the 2019 lows...

Source: Bloomberg

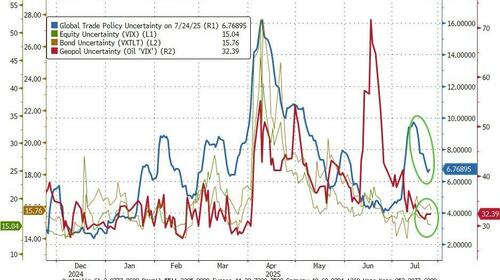

Finally, next week is a big one...

Source: Bloomberg

...with 37% of the SPX reports earnings including META + MSFT (Wed night) and AAPL + AMZN (Thurs night). We also get a healthy dose of macro with the FOMC on Wed and Payrolls on Friday. Additionally the 8/1 trade deal deadline also looms on Friday with Trump planning to send 200 letters to various countries between now and then...

Source: Bloomberg

...for now, global trade policy uncertainty is falling fast.