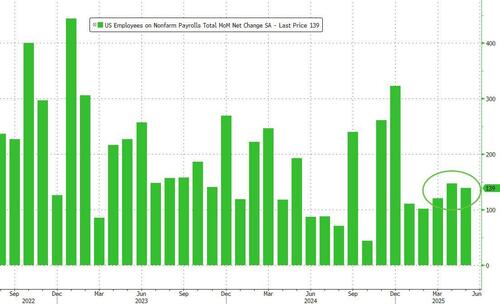

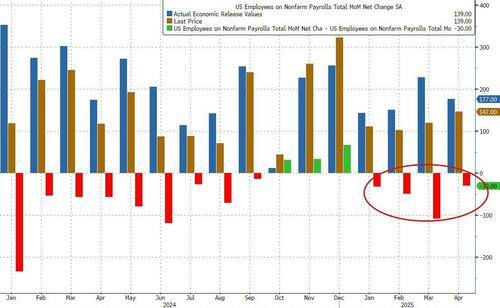

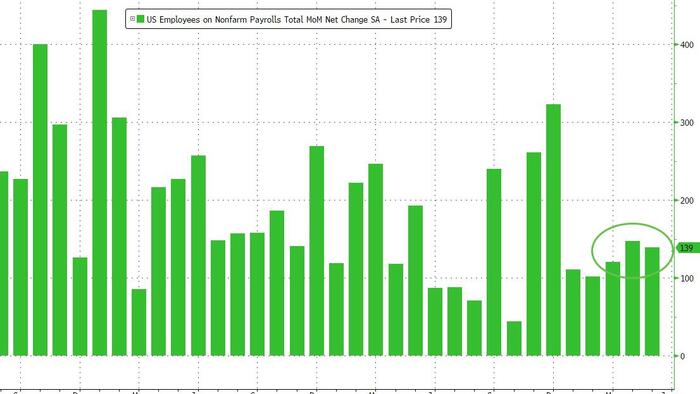

With the jobs whisper number of 110K flirting dangerously close with a sub 100K print, one which both JPM and Goldman said could spark a waterfall selloff in stocks, moments ago the BLS reported that in May the worst case scenario was averted, with the US adding a modest 139K, which while below last month's print, was above the median consensus of 126K, and well inside the estimated range of 75K to 190K.

That was the good news; the bad news is virtually all historical data points during the Trump admin were revised lower, with April revised 30K lower from 177K to 147K, and March revised 65K lower from 185K to 120K. Worse, every single month under the Trump admin has been revised lower.

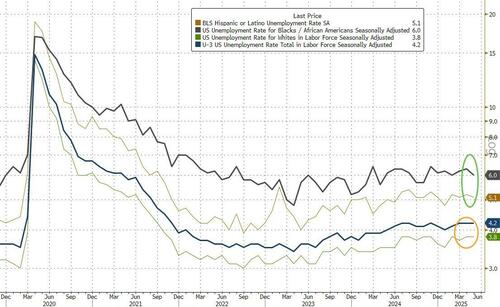

Turning to the unemployment rate, there were no surprises here: consensus expected an unchanged 4.2% print from April, and got just that. The unemployment rate has so far held at 4.2 percent in May and has remained in a narrow range of 4.0% to 4.2% since May 2024. The number of unemployed people, at 7.2 million, changed little over the month.

Among the major worker groups, the unemployment rates for adult men (3.9 percent), adult women (3.9 percent), teenagers (13.4 percent), Whites (3.8 percent), Blacks (6.0 percent), Asians (3.6 percent), and Hispanics (5.1 percent) showed little or no change over the month.

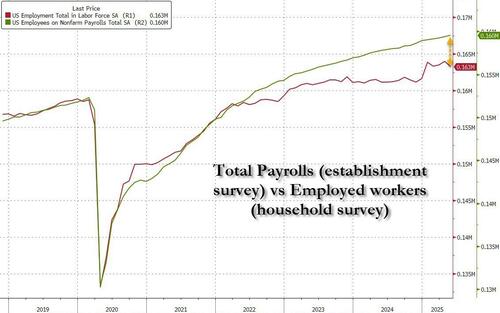

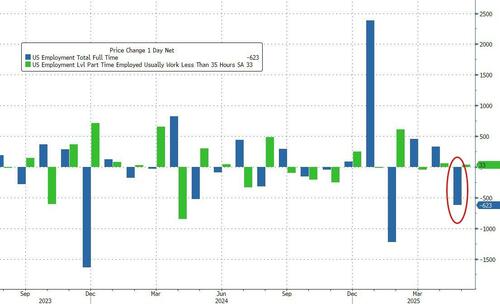

The unemployment rate was the result of a modest increase in the number of unemployed people (from 7.166 million to 7.237 million) while the labor force declined by ~600K, from 171.135 million to 170.510 million. More importantly, the disconnect between the Household survey and Establishment survey is back, as the number of employed workers plunged tumbled by 696K, even as payrolls reportedly rose.

Some more qualitative details from the report:

Next, turning to earnings, we find that May average hourly earnings actually printed stronger than expected, rising 0.4% MoM, double the 0.2% expected, and up from the 0.2% in April. On an annual basis, earnings rose 3.9%, also above the 3.7% consensus, and unchanged from the upward revised April print of 3.9%.

Average hourly earnings for all employees on private nonfarm payrolls rose by 15 cents, or 0.4 percent, to $36.24 in May. Over the past 12 months, average hourly earnings have increased by 3.9 percent. In May, average hourly earnings of private-sector production and nonsupervisory employees rose by 12 cents, or 0.4 percent, to $31.18.

There were also no surprises in the number of hours worked: In May, the average workweek for all employees on private nonfarm payrolls was 34.3 hours for the third month in a row. In manufacturing, the average workweek was little changed at 40.1 hours, and overtime was unchanged at 2.9 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls remained at 33.7 hours in May.

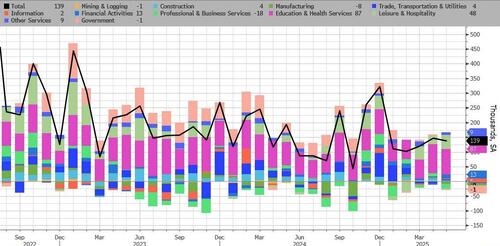

Here is the breakdown of jobs by industry:

Employment showed little change over the month in other major industries, including mining, quarrying, and oil and gas extraction; construction; manufacturing; wholesale trade; retail trade; transportation and warehousing; information; financial activities; professional and business services; and other services.

Last but not least, there was acute softness in both the breakdown between full and part-time workers, where the former tumbled by 623K and the latter increased by 33K

Finally, the number of native-born workers tumbled by 444K, while foreign-born workers also dropped by 224K, and easing back from the record set two months ago.

Overall, this was a poor jobs report if one ignores the headline which will surely be revised to a sub-100K print in the next month or two.