By Russell Clark, founder of Capital Flows and Asset Markets,

The last 10 years or so have seen the lowest interest rates and bond yields on record. No doubt interest rates have been low due to central bank activism, from forward guidance to massive bond buying. In an historical and economical context it is very hard to understand why policy makers have have set interest rates so extremely low.

The BOE provides a history of the Bank Rate going back to the 1600s, and last ten years has seen the Bank Rate set at levels below even those seen during the Great Depression

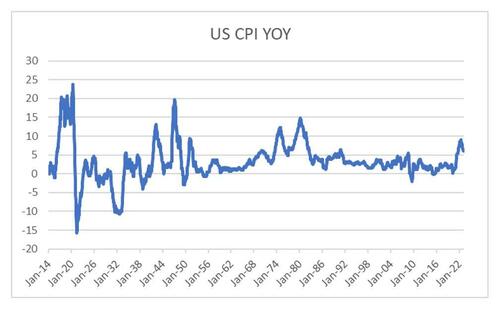

Due to World War I and II which had a more an impact on inflation in the UK, I look at US inflation rates to see what trends were like during the Great Depression. Even though inflation has been surprising low since 1980 until recently, it never went negative like it did during the 1930s.

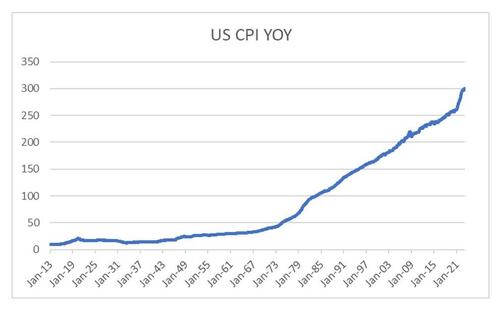

If we transform the inflation data from year on year trend to an index level (forgive the typo in heading), the change inflation trends during the 1930s and 1970s are much more clear. It also makes it harder to understand why interest rates have been so low or even negative in recent years, when there has been no outright deflation as we saw in 1930s. Central bankers would argue that without their intervention inflation would have been negative, but in a period when Chinese GDP more than doubled, I feel like this is hard to believe.

So what would a Marxian analysis of the world say? You have to remember that Marx died well before any of his dreams of a Communist nation was realised. The world that Marx lived in was one of very limited government, limited enfranchisement, and the chaotic boom bust nature of Industrial Revolution economics. His analysis, which proved so prescient during the Great Depression was that the capitalist need to push costs down would eventually lead to weak demand, and destruction of capitalism itself.

It was the failure of capitalist economies, and the relative success of command economies that set the scene for large government sectors, and government policy focused on full employment and rising wages. The world we live in today, of government sectors taking up a large part of the economy, setting tax policy, free trade agreements and regulation, was not a world that Marx would have seen.

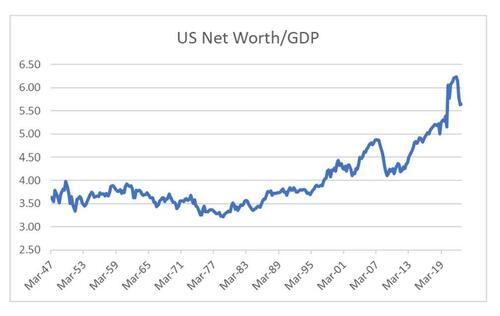

Why I think this is significant, is that the 1980s saw a turn to pro-capital policy, while it recalls the globalization period we saw before World War I, the reality is that we have never seen a pro-capital era AND a large government era before. In the pre World War I period, with the notable exceptions of organizations such as the East-India Company, business and government were largely separate. It was only in reaction to the Great Depression did government policy and industry begin to work together. The pro-capital turn in policy in the US in 1980s, was not a return to neo-classical economics that existed pre 1930. It was taking the infrastructure that was pro-labor, and turning it to make it pro-capital. Any policy that promoted growth in the value of capital, and the growth of wealth was smiled upon. Free trade agreements, the opening up of capital markets, deregulation, lower tax rates, anti-union policies, immigration, lower tariffs. Privatisation of various assets with natural monopoly tendencies have also favored capital over labor. The continual extension of patent life fit into this pattern.

This trend has had two effects. Labor and wages have seen little real growth (as this would have had a negative effect on profits), and policy making has focused on raising the value of capital. Using Federal Reserve data on net worth, and comparing to GDP, we can see that net worth in the US relative to GDP has risen from 320% in the late 1970s to a peak of over 600%

So the answer to why interest rates were so low is that it was part of a bigger policy shift that voters endorsed from the 1980s onwards. And politicians bent institutions under their control to give voters what they want. Central banks have just been a continuation of these policies.

So where to from here then? The rise of populism for me reflects voters rejection of these pro-capital policies. Tariffs, industrial policy, closed capital accounts, reduced immigration, any policy that boosts wages are now vote winners. Personally, I don’t see any change to this trend in the foreseeable future. In a very Marxian analysis, I see politics trumping economics. From a financial and political perspective, bonds remain a short.