Ahead of today's jobs report, Goldman shared the following market matrix on how to interpret the data: "The best case scenario for stocks is a small headline miss...call it 175k – 200k range. Stocks don’t want a surprising print in either direction (big beat investors will stress over inflation and continued rate hikes / big miss investors will stress the hard landing)." To be sure, now that the BLS has finally stopped defending the "strong labor market" myth, the risk was to the downside, with Newedge warning that “based on a linear regression of jobless claims, ISM employment, NFIB hiring, ADP, JOLTs, conference board, and Indeed/ZipRecruiter surveys that predict a negative 49K.”

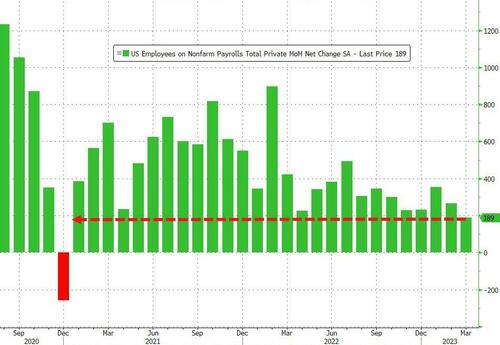

In the end, however, the BLS decided not to ruffle any feathers on a day when markets are closed and the March payrolls print came at 236K, just above the 230K expected, and below last month's upward revised 326K (up from 311K). Despite the aggressive recent revisions, this was the lowest monthly increase in 27 months: the last time we had a lower monthly print was December 2020 when they tumbled 268K.

The change in total nonfarm payroll employment for January was revised down by 32,000, from +504,000 to +472,000, and the change for February was revised up by 15,000, from +311,000 to +326,000. With these revisions, employment in January and February combined is 17,000 lower than previously reported.

While total payrolls came in just stronger than expected, this was thanks to 47K government jobs, private payrolls were only 189K, missing the consensus print of 218K and below February's 266K.

For those expecting the long-overdue mea culpa from the BLS on its payrolls fabrication, especially after the dismal JOLTS and claims prints, well they will have to wait some more because today's jobs report was the 11th monthly beat in a row.

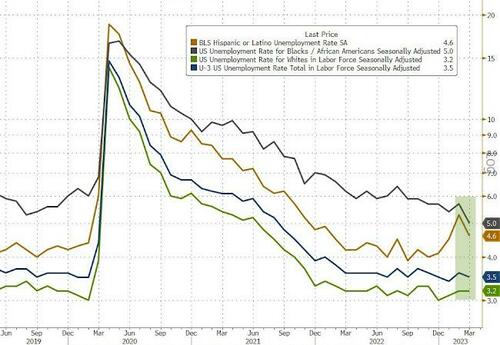

The unemployment rate unexpectedly dipped after rising last month, and dropped from 3.6% to 3.5%, below the 3.6% consensus; the number of unemployed persons, at 5.8 million, was little changed in March. Among the major worker groups, the unemployment rate for Hispanics decreased to 4.6% in March, essentially offsetting an increase in the prior month. The unemployment rates for adult men (3.4 percent), adult women (3.1 percent), teenagers (9.8 percent), Whites (3.2 percent), Blacks (5.0 percent), and Asians (2.8 percent) showed little or no change over the month. Of note, this was the lowest unemployment rate for blacks on record.

It wasn't just the unemployment rate that improved, the participation rate did as well, rising from 62.5% to 62.6%. The employment-population ratio edged up over the month to 60.4 percent. These measures remain below their pre-pandemic February 2020 levels...

... but the prime-age participation rate is now back to pre-Covid levels.

Perhaps the biggest surprise in today's report, however, was the continued drop in hourly earnings, which in April came in at 4.2% Y/Y, down from 4.6% in February and below the 4.3% expected. On a monthly basis, earnings rose 0.3%, as expected, and up modestly from 0.2% last month. That, however, may be due to another modest drop in the average hours worked, which dipped from 34.5 to 34.4, below the 35.5 expected.

Some more details:

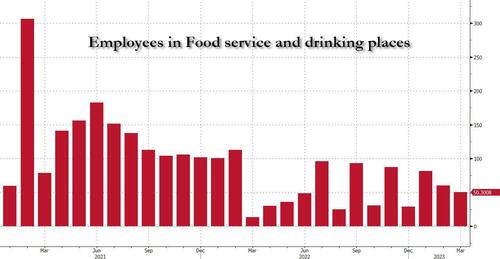

A breakdown of the various jobs shows the following:

Hilariously, in a month when we saw the biggest banking crisis since Lehman, the BLS "calculated" that 1,000 financial activity jobs were lost.

In his kneejerk reaction to the jobs report, Academy Securities strategist Peter Tchir writes that "NFP didn’t completely confirm the weakness in ADP, nor the bump up in jobless claims" and while he headline number of 236k, with -17lk of revisions was right in line with expectations (though maybe a touch above the “whisper” number), somewhat disappointing was private payrolls were only 189k, much lower than expectations, so government hiring picked up the slack.

On the Household side, there were 577k jobs added! That is impressive and reduces the longstanding gap between the establishment and household portions of the survey. It is also why the unemployment rate inched lower to 3.5% while the participation rate actually increased (which is good in my view).

Wage growth remained steady at 0.3% on the month (up from 0.2% last month). Hours worked were a touch light.

This allows/forces the Fed to remain on the “hawkish” side of things:

As Tchir concludes, "you could probably craft a “Goldilocks” scenario around this data for markets, but equally compelling, especially around current positioning, you could craft a scenario that isn’t great for markets."

Finally as it pertains to stocks, Tchir writes that he expects the data, on balance, to reinforce the recession is near narrative in the coming weeks "so that is why I cannot buy into any “goldilocks” theories on today’s numbers."