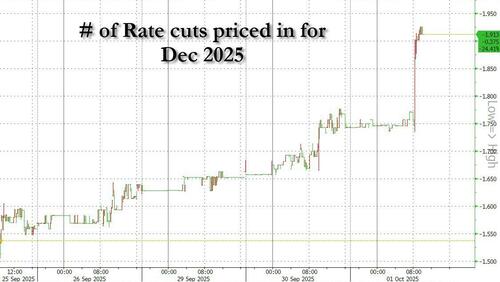

After this morning's shockingly bad ADP print, which printed negative for the 3rd time in the past 4 months, was a six-sigma miss to estimates, and which sent market-implied rate cuts odds for December to nearly 2 from 1.75 earlier in the day...

... the subsequent two economic reports today were much more muted.

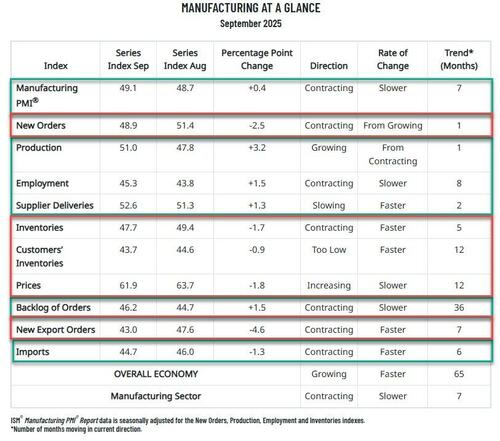

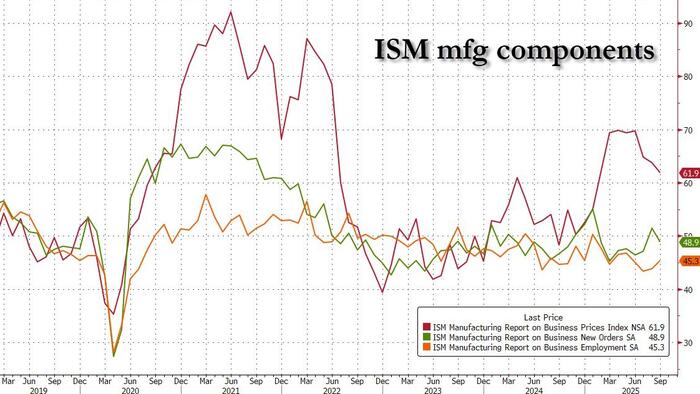

Under the hood, we saw a continuation of recent trends, as priced paid fell again, this time dropping to 61.9, from 63.7 and below the 62.7 est. This was the lowest print since February (i.e., before Liberation day). Meanwhile, New Orders also declined, sliding into contraction territory (from 51.4 to 48.9), although the improvement in the Employment indicator was probably the most important metric, because coming after the atrocious ADP print, the rise from 43.8 to 45.3, and above the 44.3 estimate, will probably help set some traders at ease that the labor market isn't completely collapsing.

The full breakdown is below:

The five manufacturing industries reporting growth in September are: Petroleum & Coal Products; Primary Metals; Textile Mills; Fabricated Metal Products; and Miscellaneous Manufacturing. The 11 industries reporting contraction in September — in the following order — are: Wood Products; Apparel, Leather & Allied Products; Plastics & Rubber Products; Paper Products; Furniture & Related Products; Chemical Products; Electrical Equipment, Appliances & Components; Transportation Equipment; Nonmetallic Mineral Products; Machinery; and Computer & Electronic Products.

"The overall economy continued in expansion for the 65th month after one month of contraction in April 2020" said Susan Spence, Chair of the Institute for Supply Management. “In September, U.S. manufacturing activity contracted at a slightly slower rate, with production growth the biggest factor in the 0.4-percentage point gain of the Manufacturing PMI. However, the combined drops in the New Orders and Inventories indexes (4.2 percentage points) exceeded the increase in the Production Index (3.2), rendering the Manufacturing PMI improvement negligible. Last month’s increase in new orders (an index gain of 4.3 percentage points from July to August) seems to have flowed through to production but does not appear to be sustainable given the subsequent drop in new orders in September.

“One of the four demand indicators improved, with the Backlog of Orders Index showing a gain of 1.5 percentage points (which could be due to August’s increase in new orders, cited above), while the New Orders, New Export Orders and Customers’ Inventories indexes contracted at faster rates. A ‘too low’ status for the Customers’ Inventories Index is usually considered positive for future production.

“Regarding output, the Production and Employment indexes improved, though 64 percent of panelists’ comments still indicated that managing head count is still the norm at their companies, as opposed to hiring.

“Finally, inputs (defined as supplier deliveries, inventories, prices and imports), on net, moved further into contraction territory. The Supplier Deliveries Index indicated slower deliveries, the Inventories Index worsened, and the Prices Index continued to increase, but at a slower rate. The Imports Index moved further into contraction.

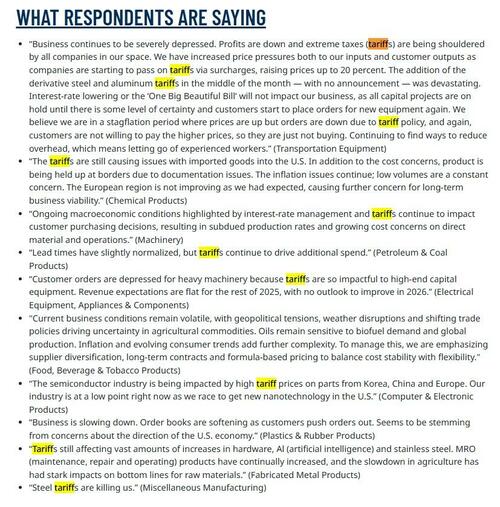

Respondents were, as has been the case lately, largely despondent and still blaming tariffs for their woes (because that's easier than adjusting any weakness in their business of course):

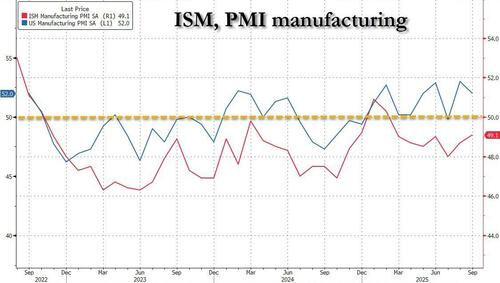

Overall, while the ISM report indicated continued contraction (as opposed to the PMI report which saw another month of expansion), there was some improvement on both sides, with Employment most notable and an indication that the real labor market situation is not nearly as bad as indicated by ADP.