Morgan Stanley analysts have released a report that drills into the "tariff math" for clients, outlining how President Trump's ongoing trade war with China could impact the discretionary retail sector—specifically Softlines (apparel and footwear) and Hardlines (general retail) companies within their stock coverage universe with the highest exposure to Chinese supply chains. The report also identifies which retailers are likely to raise prices the most.

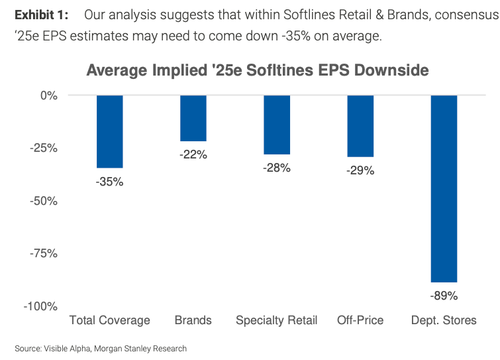

Analysts, including Alex Straton, first described which companies across their Softlines and Hardlines stock coverage universe face the greatest EPS downside in 2025 due to tariff-related pressures:

Softlines/Hardlines tariff analysis, we estimate the potential impact on EPS across our coverages. Within Softlines, we calculate ~35% avg. '25e EPS downside, with FL, KSS, & UAA appearing most at risk. For Hardlines, we estimate ~33% fully annualized negative revision risk to EPS, on average, with FIVE, ASO, & DLTR most at risk.

Here are the analysts' key findings on the impact of the 145% tariff on Chinese goods and the 10% tariff on imports from other countries (excluding USMCA members) on Softlines stocks within their coverage:

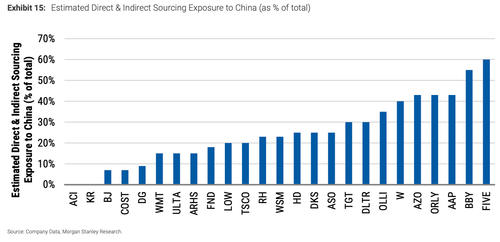

Key findings for hardline stocks under the analysts' coverage universe:

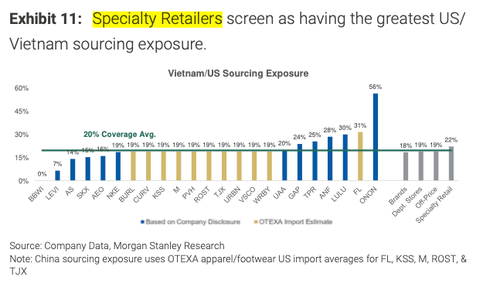

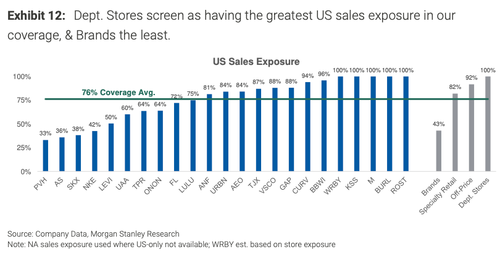

Given the expected EPS hit across a wide range of Softlines and Hardlines stocks, the analysts identified the companies that have the highest supply chain exposure to China—posing not only near-term EPS pressure but also the risk of higher prices on store shelves.

Department stores with the greatest China-US sourcing exposure, as per analysts' coverage, and brands with the least.

Specialty retailers with the greatest US-Vietnam sourcing exposure.

Department stores with the greatest US sales exposure.

Estimated direct and indirect supply chain sourcing exposure to China (as % of total).

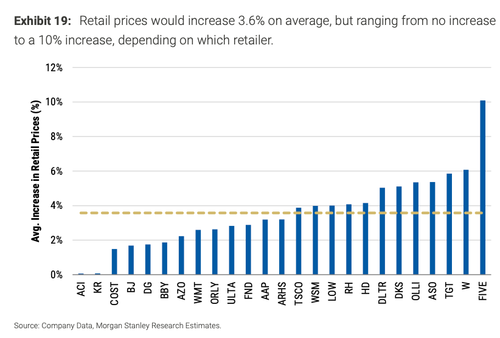

These are the retailers expected to roll out the highest price hikes on items.

The report builds on our earlier note, citing Goldman's warning at the start of the month about the apparel brands and retailers most vulnerable to price hikes (view: here). Together, these reports offer a guide for readers to avoid the tariff landmines at some retailers and reward the companies that listened to Trump in his first term to shift supply chains out of China.