Shares of Lockheed Martin fell the most in months on Tuesday, pressuring industry peers, after the defense giant reported second-quarter earnings that missed the Bloomberg consensus. The company also slashed its full-year outlook after taking charges on a classified program tied to its aeronautics business segment and international helicopter programs at its Sikorsky business unit.

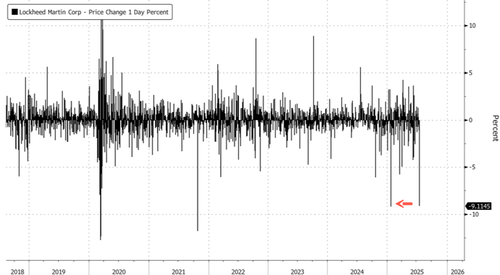

Lockheed reported a major miss, with operating profit plunging 65% to $748 million (vs. an estimated $2.15 billion) and revenue falling short at $18.16 billion. Shares slumped 9% by midday - the since the start of the year.

Not a good trendline to break.

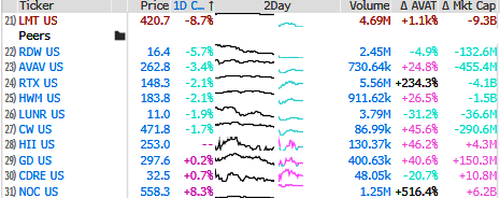

Industry peers were also pressured lower...

Everything you need to know about Lockheed's Q2 earnings:

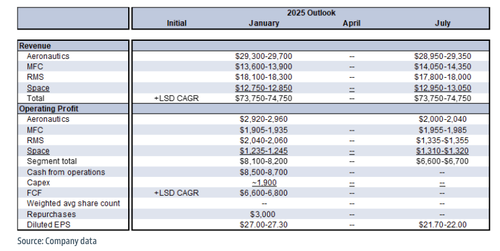

Lockheed lowered its full-year earnings per share of $21.70 to $22, down from a previous level of as much as $27.30.

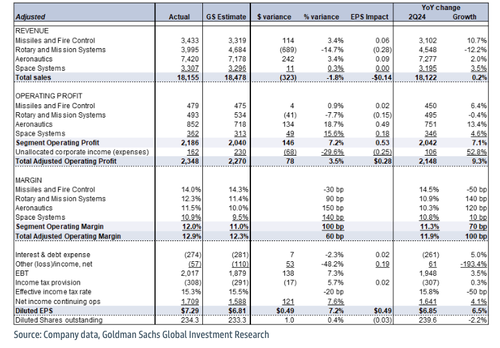

Goldman analysts led by Noah Poponak provided a first take for clients, noting that earnings were mixed for the quarter and weighed down by $1.6 billion in charges.

Here's more from Poponak:

Bottom Line:

LMT reported mixed 2Q25 results, with revenue and FCF below consensus, but adjusted margins, EBIT, and EPS ahead. The revenue variance was largely due to weaker than expected sales in RMS, while the adjusted operating profit beat was primarily driven by margin strength at Aeronautics and Space Systems. LMT recorded $(1.6)bn in pre-tax losses on programs in Aeronautics and RMS in the quarter, an EPS impact of $(5.83). The company reiterated its 2025 revenue and FCF guidance, but lowered guidance for EPS and segment operating profit.

Details:

2Q25 adjusted EPS of $7.29 compares to FactSet consensus at $6.52 and our $6.81. Revenue is 2% below consensus driven by a miss in RMS. Adjusted segment EBIT is 10% above consensus and 7% above our model, driven mostly by Aeronautics and Space Systems. However, LMT took a $(950)mn charge in its Aeronautics segment for updated cost and schedule estimates on a classified program and a $(665)mn charge in RMS for revised costs at two helicopter programs, which put reported total earnings well below consensus. Reported book to bill in the quarter is 0.65X (LTM 1.1X), while total backlog is down 4% qoq and up 5% yoy. Free cash flow is $(150)mn, relative to consensus at $1.2bn; LMT repurchased $500mn worth of shares in the quarter. LMT updated its 2025 guidance, including revenue of $73.75-74.75bn (reiterated; vs. consensus of $74.3bn), EPS of $21.70-22.00 ($27.00-27.30 prior; vs. consensus of $27.36), and FCF of $6.6-6.8bn (reiterated; vs. consensus at $6.7bn).

LMT variance table vs. GS estimates ($mn, except EPS)

LMT 2025 guidance ($mn)

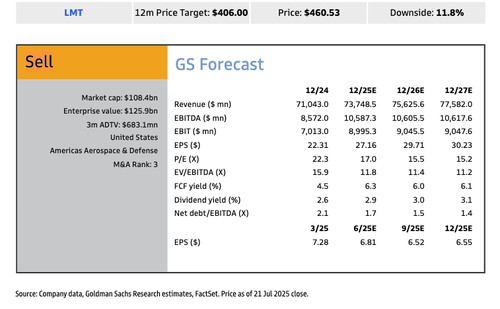

Poponak maintained a 12-month price target of $406 with a "Sell" rating.

"On one level you could argue this clears it all up, but on the other you could argue that it may be a roach motel, with more yet to emerge from under the bed, given the previous year's charges," Nick Cunningham, the managing partner at Agency Partners in London, wrote in a note to clients.

Cunningham emphasized, "This is typical of a defence contracting environment where growth is marginal, so there is no leeway to absorb problems, and a business of this size always has something bad going on."