By Benjamin Picton, senior market strategist at Rabobank

There is an old joke in economics that if you put your feet in the oven and your head in the freezer you are, on average, at a pleasant temperature. More and more we see this dynamic in financial markets where – like deer in the headlights – wildly binary outcomes are dealt with by taking probability weighted averages of potential future states of the world. This produces prices that represent the least likely of all scenarios: a pleasant middle ground between polar extremes.

We see this effect everywhere. Changes in trade, geopolitics, capital markets, climate and demographics mean that inflation might be very high in the future – or very low. So let’s take the average and assume that inflation averages 2%. Likewise, policy rates may need to be very low to finance new investment in energy, AI, semiconductor manufacturing, military hardware, housing and infrastructure – or very high to keep inflation in check. Or maybe inflation targeting as a concept is past its sell-by date, and everything we know about how monetary policy is supposed to work is about to change as politically-favoured sectors get low rates while others get high?

Of course, the reality is that ‘low-for-some-high-for-others’ interest rates are already happening, both outside the West and in, but perhaps what we have seen so far is just a prelude of things to come as the manifold challenges faced by society raises the temptation of price discrimination and central planning?

A suggestion of this arrived last week with the publication of the Fed’s updated dot plot. The median dot suggests two more cuts to the Fed Funds rate this year, and one next year. However, an outlier dot (belonging to Stephen Miran) says 100bps worth of cuts remaining in 2025. That’s a material departure from the consensus, with attendant implications for asset prices and maybe even for the broader question of how production is organized inside the USA.

With prices of assets highly dependent on the state of the world, the theory goes that our efficient financial markets construct complete menus of Arrow securities that payout in every potential state. Prices of those securities adjust to reflect judged probabilities of scenarios occurring. The time-boundedness of events is reflected through changes in the time value of money, which is interest rates.

The theory is elegant, but does it line up with what we are seeing in reality? Perhaps it does if you are looking at gold prices making new all-time-highs and relate that to central banks de-emphasising inflation dynamics, or focusing too-intently on a narrow conception of consumer inflation that excludes the most costly thing that people want to consume: houses. Perhaps it does if you look at farmland trading at prices implying negative carry and relate that back to rising geopolitical tensions or ideas of commodity prices permanently rebasing at higher levels. Perhaps it does if you look at the Crump & Moench term premium graph and relate that back to deteriorating national fiscal positions, pressure on the Dollar and questions about its status as a global reserve currency.

But there are confounding signs, too. Why does the VIX index think it’s 1996? And why are lawyers and consultants paid more than plumbers, or welders, or carpenters? And is the probability of a state of the world where AI makes those practical skills more valuable than white-collar skills rising? NVIDIA CEO Jensen Huang seems to think so, but to the extent that labor force planning occurs in the West it still emphasizes university education.

To state the obvious, the polarization trend is evident in political circles as well. Britain, Canada and Australia have today recognized a Palestinian state at the United Nations, upsetting traditional allies Israel and the United States with the former vowing reprisals in due course and Republican politicians in the latter arguing in favor of the same. Britain, Canada and Australia all currently have centre-left governments, and all have centre-right opposition parties who are critical of the decision – characterizing it as rewarding the use of violence as a means of achieving political objectives. Is there a middle ground between these viewpoints? Is an assumption of social cohesion ‘in the price’? Will the USA allow its allies to have their cake and eat it too? If not, how might that look?

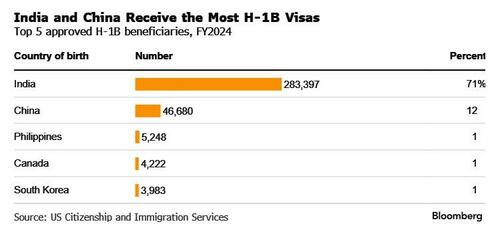

The Trump administration amped-up its nationalistic labor market approach by imposing a $100k annual fee on companies applying for new H-1B visas to bring skilled workers into the country. The FT says the cost to US employers could be $14bn. The move also sets up further potential misgivings between the USA and India, which is the country of origin for more than 70% of H-1B visa holders.

In a similar vein, UK Reform party leader Nigel Farage says that a Reform government would be prepared to deport up to 600,000 migrants over the course of five years. Reform is currently leading in UK polls, so would have to be an odds-on chance to form government. Are UK gilt yields high enough yet? Does it make sense that Cable is up 7.6% YTD?

Needless to say, these are not business as usual moves. How to account for the rising probability of these events – or even more extreme events – occurring? Imagination is required to conceive of how the world might look in the future, because if the last 15 years have taught us anything its that the past is a foreign country. The assumption of mean reversion is not a favored strategy.