By Peter Tchir of Academy Securities

Do we have to? Yes, I think we do.

U.S. stock markets had an incredible week, with the S&P 500 and Nasdaq both up around 5%, and the Russell 2000 ripping up almost 9%!

Interestingly, at least from my perspective as an election night bond bull, the 10-year Treasury yield finished 8 bps lower on the week and about 27 bps tighter than its widest levels on Wednesday morning.

Credit did well too, with CDX IG at 47 bps (the lowest in at least 3 years). But the Bloomberg Corporate Bond OAS stole the show, reaching 74 bps, the lowest level this century!

Crypto, as a source of funding for candidates and often an early indicator of market views on the election, saw Bitcoin finish the week at all-time highs.

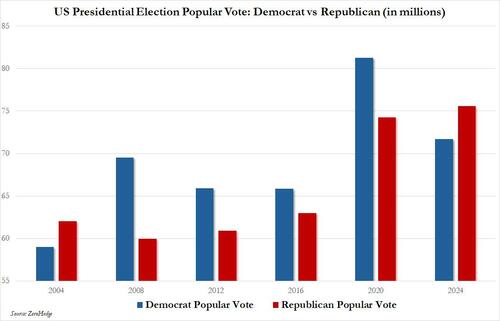

The Fed likely helped, but the market reaction was primarily due to the election results. As of Saturday morning, according to the Bloomberg Map, President-elect Trump (“Trump” going forward for simplicity), had 301 Electoral College votes compared to 226 for Vice President Harris (“Harris”). Arizona still hasn’t been decided and still only had 81% of votes counted. The popular vote stands at 75 million versus 71 million (though that margin will narrow, assuming California manages to count the 37% of votes not yet counted). I did triple check those “percentage counted” statistics, as it seems (at least for me) difficult to believe that it takes so long.

The Senate shows up as 53 to 46 for Republicans with Arizona not yet decided (a lot of votes yet to be counted). I see two listed as independents, so I assume they have been slotted into whatever side they will caucus with, but the Senate has gone Republican, though not filibuster proof.

The House, as of Saturday morning, shows up as 211 versus 200, with a bunch more seats to be decided (with Arizona and California leading the way in undecided races). I’m seeing one site say that the betting odds are at 97% for Republican control, but I cannot tell if that is truly up to date or not, and the link seems sketchy enough that I didn’t include it (but it sounds about right).

We are starting to see proposed cabinet positions and will get a better sense of what the Trump administration is likely to look like.

At the risk of annoying people, on both sides, I think there are two things that I can safely say:

Trying to figure this out is why we need to understand TrumpSpeak.

I checked the Babbel website and there are 13 languages that I can learn, but TrumpSpeak isn’t one of them.

If I was able to train an AI Large Language Model, I’d be trying to train it on TrumpSpeak. The database of things that he has said (and tweeted) has to be pretty large. Then I would try to train that AI to predict what is likely to come out of all of that TrumpSpeak.

One thing I can say with certainty is that taking TrumpSpeak at face value has rarely been effective. Worse yet is taking the worst parts of TrumpSpeak (and there are some worse parts) and extrapolating them, which might generate a lot of clicks, but it is unlikely to help anyone make good decisions. For those of you in markets and running businesses, making the best decisions possible is what it is all about.

We will do our best to try to figure out what is likely to occur, but I do think some more background is helpful.

I will never forget Donald Trump speaking at a Bankers Trust High Yield Conference (I think it was before Deutsche Bank, and given the topic, I could probably figure it out, but that’s not overly important to the story).

He was speaking to a large audience of bond investors, many of whom had recently lost money on one of his Atlantic City casinos (I think it was the Taj, but I could be wrong). The audience, while not hostile, was far from receptive to his discussion – which, of course, focused on raising debt for his new project in Atlantic City (the Taj II if memory serves correctly). Yet, by the end, there was a buzz in the audience, all wanting to get a good allocation when the new bonds came out. Even after his lawyer/accountant, came out and “corrected” some things and said some other things that might not have been 100% correct, there was still a buzz. So, from my perspective, don’t underestimate his ability to charm a room, and even if not everything said is accurate, that room can remain charmed. You can argue that this shouldn’t be the case, but I think if we are going to figure out TrumpSpeak together, this should always be at the back of our minds, if not the forefront.

On the other side (assuming that the above reminiscence is a positive about Trump), his business organization looks very different (in my opinion) compared to other large organizations. The various businesses are compartmentalized. Unless things have changed, there isn’t a Golf Course Corp that manages all the golf courses. Properties and businesses stand as individual entities or maybe in small groups. There is also no one who stands out as his “trusted lieutenant.” So many business leaders rely on often a handful of people for advice and help. We all know when “so and so” gets promoted or goes to another firm, who they are going to bring with them. Yet Trump never seemed to have that cadre of trusted people who have important and visible roles in his dealings (he likely has some people that are in his inner circle, but they don’t seem to be well known, which after 8 years in politics seems surprising). So, a concern I had was his ability to delegate, which I think hampered his first term, as turnover was high, and a lot of roles were left vacant. Quite frankly, during this campaign, many people plugged into the campaign told me that several people recommended that he tone down some of his rhetoric and choice of words. He didn’t listen. He still won.

So, as I try to think about TrumpSpeak, I think of someone who can surprise people by getting them to agree with him, but who might not like delegation and having others share in the success.

You are free to disagree with that, but in my building blocks of thinking about TrumpSpeak, I go back to these “first principles” consistently, and it served me quite well the first time he was president.

Let’s start with the topic of tariffs as it has garnered so much attention and seems less sensitive than immigration. I also think that if we start with tariffs, it might help us with TrumpSpeak.

I remember writing a lot about Trade Wars and Tariffs back in the day. I think it may have been before we regularly used our website as all I could find from 2018 was The Battle for IP & Unfair Trade and Time to Price In a Trade War Victory.

I do remember that I was one of only a few economists/strategists who supported tariffs. I argued that we had been in a trade war for decades, but only one side was firing the shots.

2018 was a long time ago, but I remember the back and forth with some economists/strategists who were adamantly against tariffs. In fact, some of the most outspoken people right now were part of that same group. Few, if any, bothered to complain that President Biden left them all in place, and then added some more. I’d be far more worried that the angst is valid, if it didn’t feel like history was repeating itself.

On Friday, I did get to bring up some thoughts on tariffs and protectionist countries in a segment that Bloomberg titled Tchir Says The Gloves Are Coming Off With China. I suspect this is a topic I will cover on Monday (Veteran’s Day) with Charles Payne on Fox Business.

Before worrying about 100% or 200% or whatever number is being bandied about, let’s just stop for one second on the complexity of tariffs and international trade.

Assembled in America (or USA Assembled). I assume that means something more than just being able to use it as a marketing slogan. That somehow “assembling” here has some impact on tariffs or tax or something. On the glasses, which I like a lot, the assembly is probably a little bit more difficult to do than assembling a Lego kit geared for 6-year-olds, but not by much (I have put the glasses back together after breaking them). I’d guess that the value of the components is about 90% of the value of the product and assembly is 10%. On the golf club, I can only imagine a carton of golf club heads and a carton of shafts being assembled in about 1.5 seconds! Total, not each . But seriously, it is probably more efficient to ship them that way, but why use the sticker “assembled in America?” On this particular product, I vaguely remember reading that it isn’t just for marketing, and it impacted the duty owed.

The above all seems a bit bizarre to me but should be a reminder that international trade is complex and lawyers (as they are apt to do) have built in so many loopholes that you can take very little at face value (who knew the 2018 tariffs would create a surge in Chinese facilities in Mexico?).

We still need to think about tariffs, but as we wade deeper into the discussion, let’s at least be cautious in thinking it is easy to implement tariffs holistically in a way that loopholes aren’t readily available.

I’m old enough to remember, back in 2018, when markets would move on trade negotiation headlines. It isn’t like we woke up one day and suddenly tariffs appeared.

While I completely believe Trump is willing to impose significantly large and new tariffs, I don’t think that will be the starting point. Having said that, if I didn’t think he would impose those tariffs, then it wouldn’t be much of a bargaining chip, so he has to convince me, you, and everyone else that the threat is real. Since he has done it before, the threat carries real weight.

So, I fully expect negotiations to begin in earnest once he takes office (and maybe even before). Trump “likes wins” (another thing I take into account in TrumpSpeak) and it is unclear that levying tariffs, especially if they don’t elicit some form of capitulation from China, constitutes a win.

On the other hand, threatening tariffs and getting China to give us some sort of a “deal” to avoid them can easily be spun as a win, and leaves the tariff threat good for another day. The “Art of the Deal” was a popular book (I think) back in the 1980’s. Trump likes to “win” and he likes “deals,” both of which point me to using the threat of tariffs to get some concessions from China.

I am scared of the tariffs – but not for the reason everyone else is.

I mostly fear that “we” will agree to a deal that seems like a “win” but really just gives Xi more time to get the Made By China strategy working well enough that China’s economy can get back to a path that is good for China and the CCP. 2025 was likely a bit ambitious for some of China’s targets, but they have been making a lot of progress towards their stated goals on many fronts, like manufacturing and technology. A deal that gives them more time to build out, with less pressure than they currently face, could prove very detrimental to our interests longer-term, while sounding good in the short-term.

So, I do not lie awake at night worrying about tariffs stoking inflation to unreasonable levels. I do worry that we won’t press our current advantages enough, giving China time to perfect its strategy.

I do agree with those who argue that tariffs alone won’t do much to boost domestic production. Yes, in theory, it will make foreign (Chinese goods) more expensive here, but will the cost be high enough to ramp up domestic production, or will the costs just shift along the existing supply and consumer chain, rather than create a revised, domestic-focused supply chain?

Carefully executed tariffs, that can shift the cost structure enough that domestic production wins out, would be really interesting to see, but might be very difficult to achieve, at least without some sort of additional support.

Let’s start with this article from Politico (which leans left according to an AllSides Media Bias Chart). It states that for the CHIPS Act, only one deal, totaling $123 million, out of a total of $33 billion announced, has been finalized!

I am fully in favor of developing a domestic foundry business (along with more extraction and processing of rare earths and critical minerals). It seems critical to national and corporate security to have a reliable supply chain of domestically manufactured chips, right up to the most state-of-the-art chips being made.

Not only do I fully support the idea of building out foundries, but I also think that with or without tariffs, we will need to create incentives and subsidies to speed up the re-shoring of crucial industries.

So why isn’t the CHIPS Act working well? On the bright side, availability of credit from traditional sources is high and inexpensive, so companies don’t need as much. But we’ve discussed that the Act itself tried to incorporate too many “features.” It didn’t just “help establish foundries,” it “helped establish foundries that meet a lot of additional, often complex, and sometimes very difficult to achieve metrics.” They don’t even sound like the same thing because they aren’t.

From the Politico article:

“The Biden administration is trying to balance business-world speed with a web of political and policy priorities, seemingly leaving none of the participants happy.”

There is a push now to close as many deals as possible while the current administration remains in power. I think that makes sense, as not only do I view chip production as a key element of national security, but I also think the jobs that come with it will allow us to truly re-establish a middle to upper income class of workers. I do hope they finalize some deals as I think this is an area that deserves investment, and so far, TrumpSpeak hasn’t focused on this area, at least not as positively as I’d like it to.

The chip industry, the logistics of supporting it (including water, rare earths/critical minerals, and energy) are all at the top of my investment list for stocks and bonds (while valuations in some sectors seem very stretched, there are immense opportunities here).

If we are going to do a CHIPS Act, it would be more effective if we simply focused on the stated goal of developing foundries in the U.S. rather than trying to wedge a lot of other policies into the CHIPS Act. Making a competitive domestic chip manufacturing industry is difficult enough without attaching a lot of bells and whistles. Bells and whistles we may want (and even need), but should be handled in their own right, not haphazardly attached to other projects (if they weren’t haphazardly attached, I suspect we’d have more than one deal finalized).

As a whole, the nation, over time, has established a lot of “dos and don’ts.” We have made commitments to not do things, for a variety of reasons. Often environmental.

Those decisions were made when we had no real competition globally.

I am not arguing that we should abandon all the protections we put in place, but I do think we need to re-evaluate many of them as the world has changed and we may no longer have the luxury to do everything we said we would or wouldn’t do.

The Keystone pipeline comes to mind (only because it seemed so close to getting done).

But more importantly, chips, rare earths, critical minerals, refineries, etc., are all likely to be crucial to our success and we may need to figure out why they aren’t getting done or built, and if there is something we can do about that. In case I’m sounding like I’m preaching from a soapbox and have some moral high ground, I’m perfectly capable of being hypocritical and fighting a cell phone tower my town plans to build – hypothetically that is .

Seriously, there are no easy answers, but we made a lot of decisions over the past few decades, where the competitive landscape has changed, and we should at least think about re-evaluating some things in the new world we face.

Wow, I’ve gone on so long already, and despite having more to say, we will end this by examining the TrumpSpeak of ending the war in Ukraine.

I think there is a very good opportunity to end the war.

My take on TrumpSpeak related to this subject, once again, varies from much of what I see or hear in the media. There is a lot of concern that since the Republicans and Trump have not been supportive of weapons, they will somehow cut off the supply and demand peace. That is possible, but I don’t think it fits with TrumpSpeak very well. I see it playing out more like this:

So, I see it more as stopping a playground fight (though I don’t mean to diminish the deaths and brutality) by telling both sides what they already know to be true and using a mix of rewards and threats.

I don’t see why that cannot be done and I don’t think it is at all contradictory to the TrumpSpeak we’ve heard.

I am not sure I’m fully on board with the idea that the markets are moving a lot higher because of significantly improved growth prospects. It is possible, and I think there are a lot of potential positives, but that might be the market getting ahead of itself.

What I can argue vehemently for is that the risk of a meaningful economic slowdown in the next year or two has been dramatically reduced:

I think bigger projects might come to fruition, but the first 100 days is likely to be less overwhelming than the market seems to expect (the bond market has regained some of its sense in that respect). The new administration will want to get some big things done while they control everything, but that will likely take time.

I’m also in the camp, that while a mandate was given to the Republicans, many will be cautious on how to use it, as Trump will not be standing for re-election (unless you believe some of the more aggressive conspiracy theories).

In the meantime, we will all figure this out, and please take time to remember and thank veterans on Veterans Day. I’m very proud to work with the team at Academy and have learned a lot about what it takes to be a veteran and to have served! I have not served but I can thank my teammates and hope that we can continue to flourish and do our part to hire and train more veterans.

I can also point you to In Flanders Fields, which I think is a poignant and inspirational poem and appropriate for the day!

My apologies if I offended anyone, but I’m trying to explain how I think about this, and in any case, figuring out how to think about a lot of issues, and getting that analysis correct, will be a key component of success for you, your companies, and your investments.