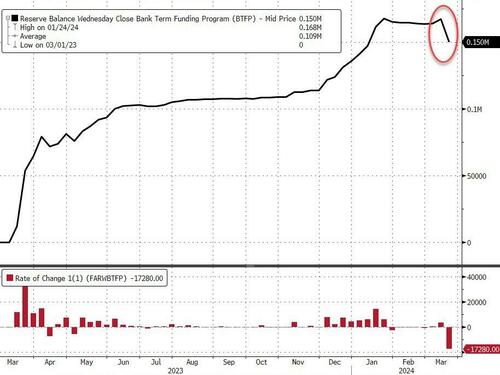

With The Fed's bank bailout facility now expired, the 12-month term loans are starting to mature and the fund dropped over $17.2BN last week...

Source: Bloomberg

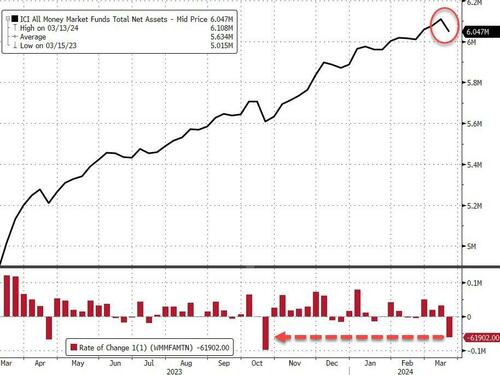

Money-market funds saw a big outflows of almost $62BN, which we wonder if related to tax-year liquidity issues, but it is a little early in the year...

Source: Bloomberg

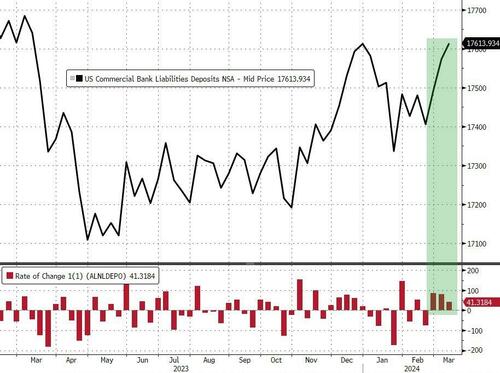

And as money-markets saw outflows, so banks saw deposit inflows... +$38.2BN (SA) and +$41.3BN (NSA) in total deposit increases...

Source: Bloomberg

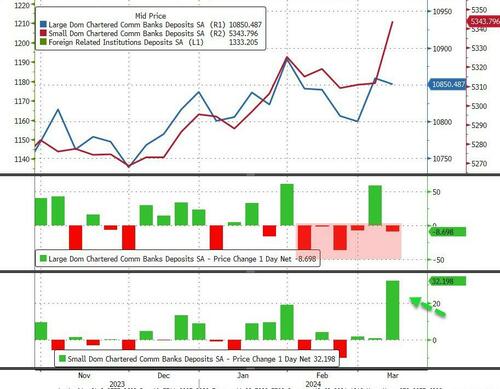

Excluding foreign deposits, domestic banks saw their second straight week of SA inflows +$23.5BN (Large Banks -$8.7BN, Small Banks +32BN), while NSA deposits saw a third straight week of inflows +50.1BN (Large banks +47.4BN, Small banks +2.7BN)

Source: Bloomberg

Large Domestic US banks have seen deposit outflows for 5 of the last 6 weeks (while Small banks saw a huge deposit boost)...

Source: Bloomberg

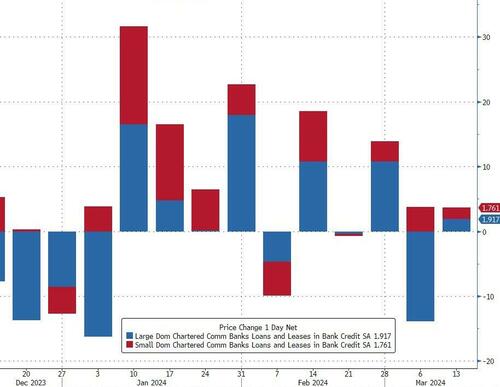

Overall loan volumes rose, but very modestly (Large banks +$1.9BN, Small banks +$1.8BN)

Source: Bloomberg

Interestingly, there was a large jump in small bank cash relative to total assets last week (and viuce versa for large banks) which happens to coincide with the end of the BTFP facility

Source: Bloomberg

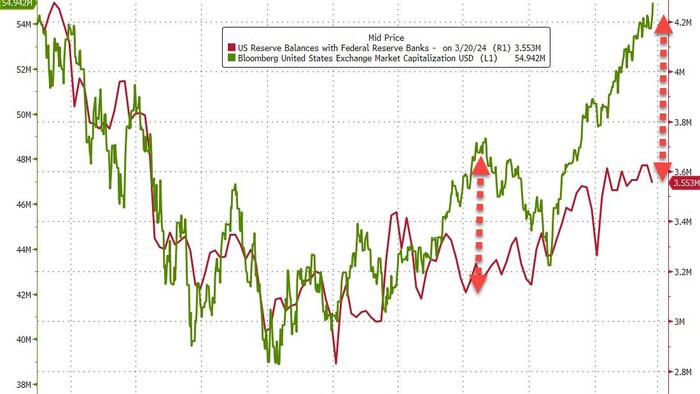

Finally, US bank reserves at The Fed shrank this week as US equity market cap soared to a new record high...

Source: Bloomberg

Quite a decoupling.