Shares of Kohl's Corp. crashed during the early morning cash session following a dismal earnings report. Or better yet, let's call it what it is: a 'Kohllapse'...

Kohl's slashed guidance for the full year after reporting first-quarter results that missed about every metric.

Comparable sales, which measure the performance of stores open for more than one year, dropped 4.4% in the quarter ended May 4 — the ninth consecutive decline. Analysts tracked by Bloomberg were expecting a 1.74% decline.

Here's a snapshot of the first quarter (courtesy of Bloomberg):

The midmarket department store chain also slashed its full-year forecast to $1.25 to $1.85 a share, well below the Bloomberg consensus estimate of $2.39 a share.

Here's a snapshot of the full-year forecast (courtesy of Bloomberg):

"Regular price sales increased year-over-year, with early success in underpenetrated categories, positive trends in our Women's business, and continued strong growth in Sephora. However, lower clearance sales versus last year represented a more than 600 basis point drag on comparable sales," CEO Tom Kingsbury wrote in a statement.

Kingsbury continued, "We are approaching our financial outlook for the year more conservatively given the first quarter underperformance and the ongoing uncertainty in the consumer environment."

Here's how Wall Street analysts responded to the earnings report:

Vital Knowledge

Citi (neutral)

Bloomberg Intelligence

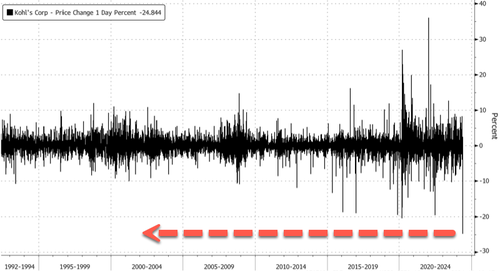

If Kohl's intraday plunge of 25% holds until close, it would mark the largest single-day crash in the company's history.

Shares are crashing to Covid lows.

Elsewhere, Foot Locker Inc. soared as much as 27%, the highest in years, after better-than-expected comparable sales provided insight into CEO Mary Dillon's turnaround plan, which showed some signs of working.

Still, Dillon warned about consumers: "There's still pressure on the consumer for us—exposure to inflation, interest rates and reduced savings," adding, "But it's discretionary for a reason. They decide where to spend it."

More headlines this AM from retailers (courtesy of Bloomberg):

The overall theme about the working poor, recently laid out by Goldman analysts, has been an ominous one:

This week's news from retailers continues to reinforce Goldman's theme about deteriorating working poor consumers.