In this week's relative data vacuum, as earnings season grinds to a close and US payrolls not due until next Friday, all eyes will be on the flash February European CPI releases (France Tues, Germany Weds, Italy and EA Thurs) and labor market data released throughout the week. The CPI numbers follow Friday's upward revisions for the January report in the Euro Area, where core inflation was revised up a tenth to a new record of +5.3%. We also have the global PMIs and US ISMs with manufacturing on the first day of the month (Wednesday) and services (Friday).

ECB speakers will have plenty of opportunity to reflect on the data with at least 8 appearances already scheduled for next week. For a more backward-looking assessment, markets will also have the ECB's account of the February meeting due Thursday to read through. DB's European economists upgraded their ECB call last week and now see two +50bps hikes in March/May followed by a final +25bps hike in June, which would imply a terminal of 3.75%, up from 3.25% previously. Fed speakers are also prevalent as you'll see in the day-by-day week ahead breakdown below courtesy of DB's Jim Reid. There are six FOMC voters and there is a lot for them to chew over at the moment, especially after Friday's PCE data.

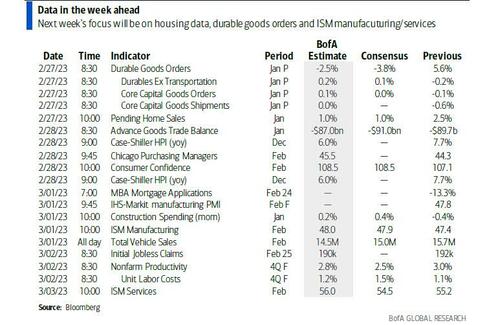

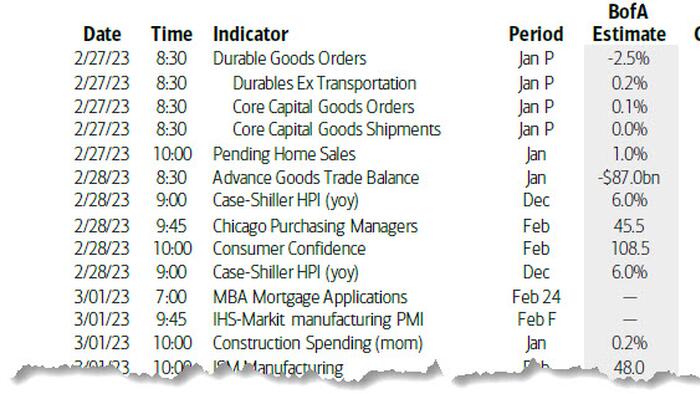

Outside of the ISMs, US data will revolve around consumer and manufacturing activity. That will include the Conference Board's consumer confidence index tomorrow, Chicago PMI (also tomorrow) and a host of regional central bank indices. Other notable indicators due include durable goods orders today and the advance goods trade balance tomorrow.

Earnings season comes to a close, but there are still several prominent companies reporting earnings including OXY, ZOOM, Rivian, Costco, Best Buy, Nio, Target, AMC, Lowe's, Splunk, Macy's and a handful other names.

Courtesy of DB, here is a day-by-day calendar of events

Monday February 27

Tuesday February 28

Wednesday March 1

Thursday March 2

Friday March 3

Finally, looking at the US, Goldman notes that the key economic data release this week is the durable goods report on the Monday and the ISM manufacturing report on Wednesday. There are several speaking engagements from Fed officials this week, including remarks by Governor Jefferson on Monday, by Chicago Fed President Goolsbee on Tuesday, and by Governor Waller on Thursday.

Monday, February 27

Tuesday, February 28

Wednesday, March 1

Thursday, March 2

Friday, March 3

Source: Deutsche Bank ,BofA, Goldman