It is the last full week before the April 2nd US tariff announcement, so expect lots of headlines on this. Indeed US equity futures are higher this morning on Friday's Bloomberg story that tariffs will be more targeted than the worst fears. Outside of trade, DB's Jim Reid notesthat inflation will take centre stage with the all-important US core PCE on Friday. Before that, UK and Australian inflation are out on Wednesday with flash French and Spanish CPI out on Friday, alongside Tokyo CPI.

In terms of other highlights, today’s global flash PMIs will be interesting. US and Europe bounced last month but since then the tariff rhetoric has aggressively stepped-up, but on the other hand Germany has reversed decades of fiscal conservatism. So, it’ll be interesting to see how the surveys respond to those developments.

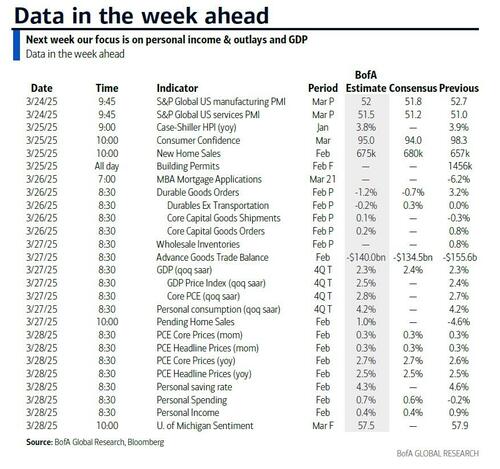

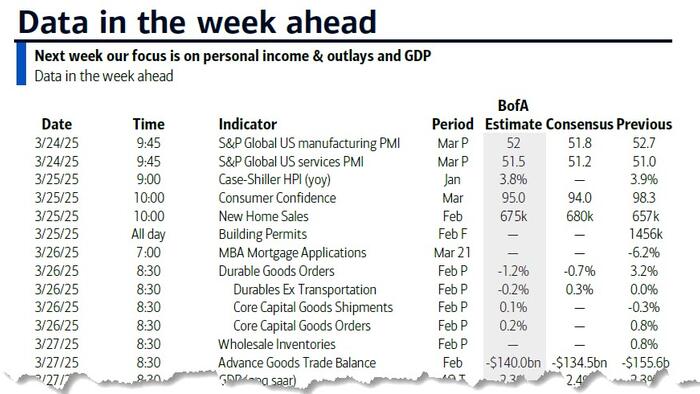

Other notable US economic indicators due include the Conference Board’s consumer confidence index tomorrow following a slide in the University of Michigan gauges last week (we have the final reading for this on Friday). Talking of confidence tomorrow sees the latest German IFO so we’ll get another chance to see if the fiscal package has changed the outlook or whether the threat of tariffs dominate. The IFO is only decimals off the recent lows which were only weaker at the height of the GFC and briefly at the start of Covid. Wednesday then sees US Durable Goods and the latest Spring statement from the UK with the fiscal finances precariously balanced given the self-imposed fiscal rules. See our economists’ preview here. Thursday will see the final Q4 US GDP print and latest trade data which will both impact Q1 GDP trackers. The trade data may see an import surge ahead of likely increases in tariffs. Also of note will be the latest Congressional Budget Office Federal debt and statutory limit report as well as the long-term budget outlook (all the way to 2055) on Wednesday and Thursday, respectively.

With regards to central banks, highlights include the summary of opinions from the March BoJ meeting on Thursday. In Europe, the ECB will publish its consumer expectations survey on Friday, the same day as Norway’s central bank will decide on rates. In China, highlights include the 1-yr MLF rate fixings tomorrow as well as industrial profits for February on Thursday. Focus will also be on the annual China Development Forum ending today in Beijing. Many CEOs of blue-chip American and European corporates are attending.

The full day-by-day week ahead is at the end as usual but let's preview the core US PCE on Friday. Personal income (+0.2% vs. +0.9%) and consumption (+0.3% vs. -0.2%) should normalize in opposite directions but the core PCE deflator (+0.37% vs. +0.28%) is likely to edge up and and that should push the YoY rate up a tenth to 2.8%. The recent stronger-than-expected inflation readings have caused DB's economists to mark up their 2025 inflation forecasts. They now see Q4/Q4 core CPI and core PCE inflation at 3.0% and 2.7%, respectively.

Elsewhere, over the weekend the news flow intensified in Türkiye with key opposition leader, and Istanbul mayor, Ekrem Imamoglu being jailed on corruption charges after being detained by police last week. The fact that he wasn't charged with terrorism means the news isn't as extreme as it could have been as such a move would have led to the appointment of a trustee to the Istanbul Municipality, risking more protests and unrest. The Bloomberg TRL equity index fell -17.59% last week and the central bank hiked overnight lending rates by 200bps to 46%. Last night the regulator broadened a short-selling equity ban and relaxed company share buy-back rules to try to help stabilize markets. So one to watch this morning.

Courtesy of DB, here is a day-by-day calendar of events

Monday March 24

Tuesday March 25

Wednesday March 26

Thursday March 27

Friday March 28

Finally, looking at just the US, the key economic data releases this week are core PCE inflation and the University of Michigan report on Friday. There are several speaking engagements by Fed officials this week, including an event with Governor Barr on Monday.

Monday, March 24

Tuesday, March 25

Wednesday, March 26

Thursday, March 27

Friday, March 28

Source: DB, Goldman