This week kicks off with a partial US holiday (Columbus Day) today where bond markets will be closed but with equity markets remaining open. The main news over the weekend has been from China where the highly anticipated Ministry of Finance press conference on Saturday was a dud, light on specifics of immediate stimulus measures, even as it yet another "strong forward commitment" and the announcement of a large-scale local government debt swap, suggesting it could mark a multi-year turning point in China's fiscal policy framework. DB, like Goldman, raised their 2024 GDP forecast to 4.9% (from 4.7%), based on already announced measures and are expecting more concrete measures to now appear at the upcoming NPCSC in late October.

Also over the weekend, data revealed that China’s September CPI rose by +0.4% year-on-year, the slowest in three months, compared to a +0.6% rise in August and below market expectations of a +0.6% increase. PPI fell by -2.8% year-on-year, the fastest decline in six months, compared to a -1.8% drop in the previous month and below the expected -2.6% decline. So weaker prices than expected all round, but with the subsequent stimulus announcement markets should be comfortable excusing recent data for now.

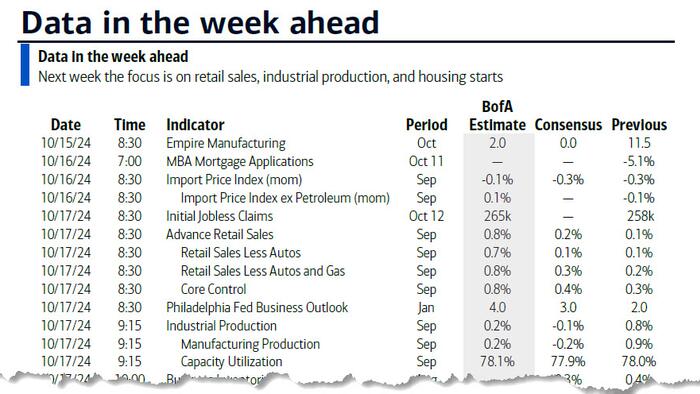

In terms of this week, the key events will likely be on Thursday with US retail sales and jobless claims, alongside the latest ECB meeting. Outside of this, US earnings season starts to accelerate after last Friday's unofficial start and there are plenty of central bank speakers to digest as well. Before we dig into these, the other main global highlights this week are the NY Fed 1yr inflation expectations (today), UK employment, German/European ZEW survey, ECB bank lending survey, Eurozone IP and Canadian CPI (tomorrow), UK inflation (Wednesday), US IP and NAHB housing index (Thursday) and US housing starts/building permits, China's monthly data dump (including Q3 GDP, retail sales, IP, and property data), alongside Japanese CPI to round out the week on Friday.

Digging a bit more into that week ahead now, of all the Fedspeak, Waller today may be the most interesting given he's traditionally a hawk and is a voter. In his last outing, Waller suggested that another 50bp reduction in an upcoming meeting was a possibility if the labor market weakened further or if inflation continued to come in softer than expected. Since then the opposite has seemingly occurred so will he revert back to more hawkish form?

Skipping to Thursday, September US retail sales will be a swing factor in putting together final Q3 GDP forecasts but jobless claims could spike a significant amount higher (DB forecast 270k vs. 258k last week) and to 3-year highs due to the latest storm. We were surprised that the market zoned in on the spike last week as much as it did as you have to assume for now that most, if not all, of the increase was storm related. The impact of the storm will also feed into this month's payroll data so there will be a lot of difficulty in assessing employment trends in the next several weeks. Even retail sales might spike up a little this week as storm preparation in Florida may have boosted sales at the end of September.

The highlight of the week in Europe will be the ECB decision on Thursday. DB economists expect a 25bps rate cut following recent lower-than-expected inflation prints as well as weaker growth. The central bank will also release its bank lending survey on Tuesday and the survey of professional forecasters on Friday. The lending survey is a good guage to see whether we're past the peak impact of the monetary transmission mechanism. In recent quarterly surveys, lending has improved with future expectations improving too so things have been looking up. Elsewhere in Europe keep an eye for the budget in Italy tomorrow, ahead of the EU deadline. Fitch and S&P are likely to opine on Italy's rating after the close on Friday. The former could influence the latter to some degree. Indeed, late on Friday Fitch placed France on negative outlook after its budget announcement last week saying that "Fiscal policy risks have increased since our last review." Over in Asia, the focus outside of China will be on the Japanese national CPI due on Friday.

In terms of earnings, we'll start to see some momentum with the highlights including key semiconductor firms TSMC (Thursday) and ASML (Wednesday). Otherwise, US bank results will continue to come in with Bank of America, Citigroup and Goldman Sachs (all tomorrow) the highlights, alongside large cap healthcare names including UnitedHealth, Johnson & Johnson (both tomorrow) and Abbott (Wednesday). Other notable names include Netflix and Blackstone on Thursday and Procter & Gamble on Friday.

Here is a day-by-day calendar of events

Monday October 14

Tuesday October 15

Wednesday October 16

Thursday October 17

Friday October 18

Finally turning to the US, Goldman writes that the key economic data release this week is the retail sales report on Thursday. There are several speaking engagements by Fed officials this week, including events with Governors Waller on Monday and Friday and Governor Kugler on Tuesday.

Monday, October 14

There are no major economic data releases scheduled.

Tuesday, October 15

Wednesday, October 16

Thursday, October 17

Friday, October 18

d