With the mid-summer sun rising, things turn much quieter across markets although there are still enough events to keep traders on their toes and within Wifi coverage at their favorite vacation spot. As DB's Peter Sidorov writes, in terms of events this week, we will get several soundbites on the strength of the US economic cycle, especially on the consumer front, with retail sales (Tuesday) industrial production (Wednesday) and a number of key retailers reporting results. In addition, the Fed will release the minutes of the July FOMC meeting (Wednesday).

In Europe, the key data will be in the UK, with the July labour market (Tuesday), inflation (Wednesday) and retail sales (Friday). It will also be a busy week in Asia with the July activity data and the 1-year MLF rate decision in China (Tuesday) and with preliminary Q2 GDP (Tuesday) and national CPI (Friday) in Japan.

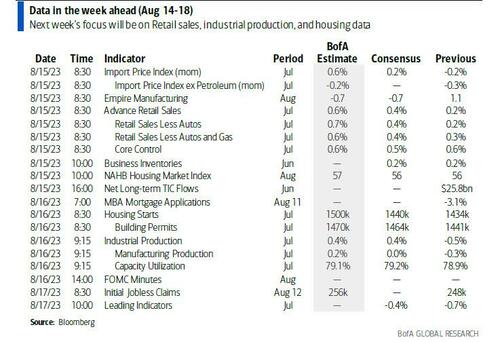

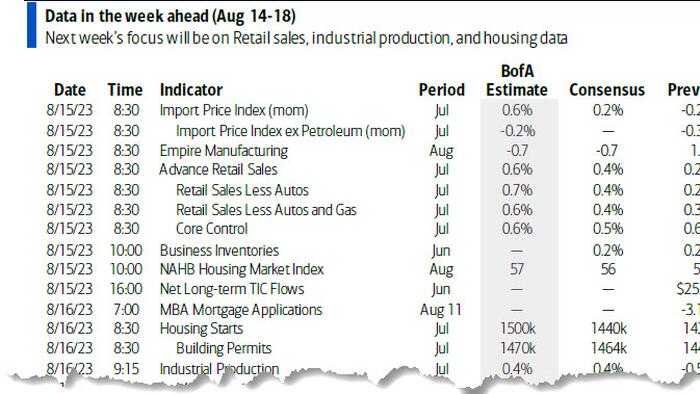

In more detail, DB economists expect monthly retail sales to rise +0.3% in July (vs +0.4% consensus and +0.2% prev.) with a slightly slower rise in retail control (+0.2% vs +0.5% consensus). We will also get July industrial production (est. +0.3%), housing starts, the NAHB housing market survey and business surveys from the New York and Philly Feds. The health of the consumer will be crucial to whether the US can avoid a recession. US households will face more headwinds in H2 – slowing employment growth, pass through of policy tightening as well as the resumption of student loan repayments and deferred taxes coming due – though these are more likely to become visible in the autumn. As a reminder, our US economists continue to see a baseline of a mild recession from late 2023, but consumer resilience has made it a closer call.

Consumer activity will also be in focus at the tail end of the earnings season with reports this week from Home Depot (Tuesday), Target (Wednesday) and Walmart (Thursday). Other notable corporate earnings include Cisco and Applied Materials in the US and Tencent and JD.com in China.

From a central bank perspective, the minutes of the July FOMC meeting will give hints about the Fed’s reaction function ahead of the September meeting, where the Fed is expected to keep rates on hold. With the data-dependent tone from Fed speakers, any discussion on the expected path of inflation will be particularly interesting.

Over in Europe, the UK inflation print for July will be the highlight. A strong downside surprise last month drove the second strongest daily rally in 2yr gilts (-18bp) since March. DB's UK economist Sanjay Raja sees headline inflation at 6.8% in line with consensus, with core at 6.9% (consensus 6.8%). This would mark the lowest headline inflation since February 2022, but still the highest among the G7.

In Asia, China will dominate the headlines on Tuesday with the July activity data including retail sales and industrial production (we also get the 1yr MLF rate fixing the same day). After weaker trade and bank credit numbers last week, investors will watch for further evidence on the trajectory of China’s economy. The same day we will get the Q2 GDP print in Japan (DBe: +0.9% qoq vs +0.7% qoq consensus). Meanwhile, Japan’s CPI print on Thursday is expected to show CPI ex fresh food and energy moving back to its May peak (+4.3% DBe and consensus vs +4.2% prev.).

Courtesy of DB, here is a day-by-day calendar of global events

Monday August 14

Tuesday August 15

Wednesday August 16

Thursday August 17

Friday August 18

Finally, turning to just the US, Goldman writes that the key economic data releases this week are the retail sales report on Tuesday and the Philadelphia Fed manufacturing index on Thursday. The minutes from the July FOMC meeting will be released on Wednesday, and Minneapolis Fed President Kashkari has a speaking engagement on Tuesday.

Monday, August 14

Tuesday, August 15

Wednesday, August 16

Thursday, August 17

Friday, August 18

Source: DB, Goldman, BofA