As DB's Jim Reid writes (on his "day off"), the week starts off with the financial world assessing what the failed assassination attempt on Donald Trump means for the Presidential race and for markets. PredictIt has the probability of a Trump victory increasing from around 55% on Friday to around 65%.

On a state basis, the shooting took place in Pennsylvania, one of the three most important battleground states and one Biden needs to win to be President given where current polling is. Before the weekend Trump was around 3.5% ahead in the state in the latest poll of polls. When Biden performed poorly in the debate 2 and a half weeks ago, Treasuries sold off 20bps in a couple of sessions as markets looked to price in a more fiscally loose Trump clean sweep. And with the Republican National Convention starting today, there will be plenty of politics all week.

Outside of the Presidential race, the most consequential event of the week could come today as Fed Chair Powell is interviewed at the Economic Club of Washington DC at 5pm London time. Will his tone take a notably dovish shift given the soft CPI print last week? DB's economists new Fed forecasts would suggest he might as they now expect three cuts in the remainder of 2024 (Sep, Nov, Dec) as a mid-cycle adjustment before three more from September 2025. Eight other FOMC voters will also be on the radar this week (see them detailed in the diary at the end) so we'll have a good idea of whether the Fed are moving direction by the end of the week. Interestingly, DB economists point out that back in December 2023 and March 2024 the Fed median forecasts from the SEP expected 75bps of cuts this year with unemployment at 4.0-4.1% and core PCE inflation 2.4-2.6% by year-end. Recent data suggest that reasonable year-end forecasts are now 4.0-4.2% for unemployment and 2.5-2.6% for core PCE.

Staying with central bankers, the ECB meets on Thursday with the council expected to vote to stay on hold for now. Also watch for the quarterly ECB bank lending survey tomorrow. This has tentitatively turned more positive in the last couple of quarters, especially in the expectations component.

In terms of the other main non-data highlights, earnings season in the US starts to build, China's Third Plenum starts today through to Thursday with all eyes on potential policies and reforms targeted at key economic issues including the property sector (the market, understandably, expects very little from Beijing). On the same days the Republican National Convention will take place with the main event being the unveiling of the Vice President nomination and the reaction to the assassination attempt. Staying with politics, Wednesday sees the UK State Opening of Parliament and the King's Speech which contains the new government's legislative program for the year. The following day sees a European Parliament vote on whether European Commission President Von der Leyen gets a second term.

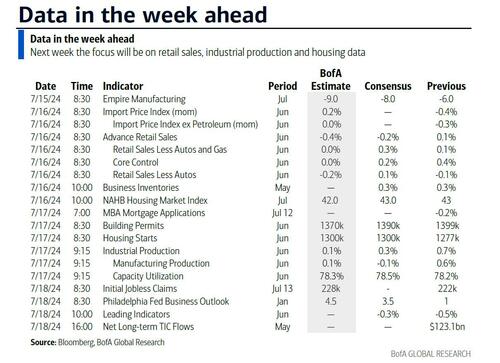

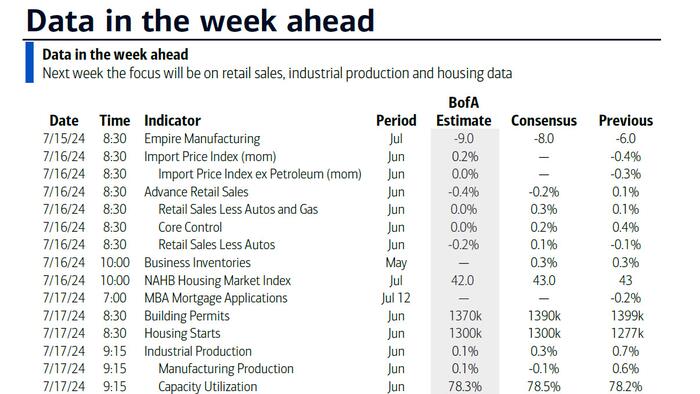

In terms of data and earnings, on a day by day basis the highlights are as follows: Today sees US Empire manufacturing, Eurozone IP with Blackrock and Goldman reporting. Tomorrow sees the very important US retail sales, the NAHB US housing index, German/EuroZone ZEW survey, Canadian CPI with BoA and Morgan Stanley reporting. Wednesday sees US IP, capacity ulitisation, building permits, housing starts, the Fed Beige Book, UK CPI, a 20yr UST auction with Johnson and Johnson and ASML the earnings highlights. Thursday sees the US Phili Fed index, jobless claims as ever, UK employment data, and with TSMC and Netflix reporting. Friday sees Japanese CPI, UK retail sales and public finance data, German PPI with Amex the earnings highlight.

Also of note will be the stock market after a fascinating week last week where the Mag-7 underperformed the index with the highlight being Thursday's largest performance gap between the S&P 500 and the equal weighted equivalent since November 2020, just after the Pfizer vaccine announcement. Reid did what he thought was a very good CoTD on Friday reminding readers of what happened to other sectors when the tech bubble burst in March 2000. The three "dullest" sectors (Consumer Staples, Healthcare and Utilities) had performed badly in the last few months of the bubble but rallied +25-35% in the final 9 months of the year as tech slumped. It wasn't until 2001 and 2002 that the wider market really slumped. So if tech does see a correction, the market will likely go down given their size, but several sectors could rally notably.

Finally, on the earnings front we have Goldman and Blackrock today, Bank of America tomorrow, ASML, JNJ and United Wednesday, Netflix Thursday and American Express reporting on Friday.

Day-by-day calendar of events

Monday July 15

Tuesday July 16

Wednesday July 17

Thursday July 18

Friday July 19

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the retail sales report on Tuesday and the Philly Fed manufacturing index on Thursday. There are several speaking engagements from Fed officials this week, including remarks from Chair Powell on Monday.

Monday, July 15

Tuesday, July 16

Wednesday, July 17

Thursday, July 18

Friday, July 19

Source: DB, Goldman