In his preview of the next few days, DB's Jim Reid has some good news for those who feel like it's already Friday: "It doesn't feel like its going to be the most exciting week ahead of us" although with earnings season now in full throttle and with a seemingly extremely tight US election just two weeks tomorrow there is undoubtedly plenty to think about and react to.

Having said the election is tight, Reid notes that over the last two weeks the probability markets have been shifting back towards Trump. At the start of October a Republicans sweep was a 28% probability on Polymarket.com but that's now shifted to a 42% chance. A Democrats sweep has fallen from 21% to 14%.

Outside of the tax and spending implications, Trump last week said that "the most beautiful word in the dictionary is tariff". So that should have reminded markets that he is serious on this matter if he gets elected. In terms of fiscal, Deutsche Bank economists believe that the deficit will be between around 7 to 9% from 2026-2028 whatever political configuration we have in the White House.

Staying on debt we do have the IMF and World Bank annual meetings in Washington from today and across the rest of the week. There is expected to be a focus on the unsustainability of global debt in these meetings but that is probably more of a medium-term concern rather than anything markets will latch on to this week. There are plenty of central bankers speaking at the various Washington events but in particular watch out for ECB President Lagarde and BoE's Governor Bailey (both tomorrow). Ahead of that, today sees quite a bit of Fedspeak. There is also the BRICS summit held in Kazan, Russia from tomorrow to Thursday hosted by Putin. China's President Xi and India's Prime Minister Modi are expected to attend.

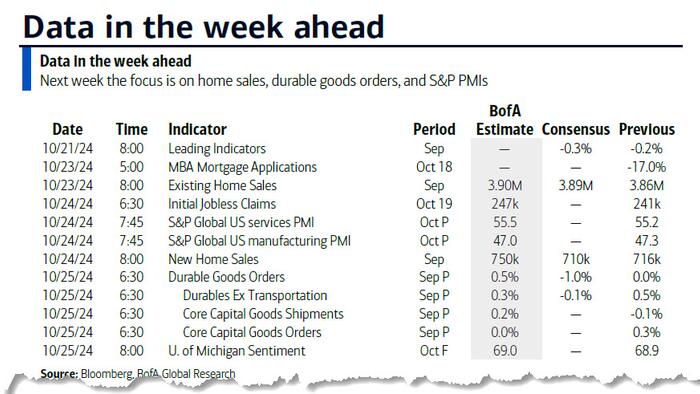

In terms of data, the main highlight is probably the round of global flash PMIs (Thursday). Walking through the data day-by-day, the other highlights are German PPI, French retail sales and the US leading index today, the US Phili Fed tomorrow, US existing home sales, the Beige book, Eurozone consumer confidence and the Bank of Canada meeting on Wednesday, US initial jobless claims on Thursday, and US durable goods, Tokyo CPI, and the German Ifo on Friday. Recent strikes and storms will likely distort US claims and durable goods so it will be tough to get a clean data read at the moment. The Beige book may give us a bit more insight into current economic momentum.

In corporate earnings, the main highlights are SAP (today), Texas Instruments, GE, and GM (tomorrow), and Tesla, IBM, and Boeing (Wednesday). We list others in the day-by-day calendar at the end.

Courtesy of DB, here is a Day-by-day calendar of events

Monday October 21

Tuesday October 22

Wednesday October 23

Thursday October 24

Friday October 25

Finally, turning to the US, Goldman writes that the key economic data release this week is the durable goods report on Friday. There are several speaking engagements from Fed officials this week.

Monday, October 21

Tuesday, October 22

Wednesday, October 23

Thursday, October 24

Friday, October 25

Source: DB, Goldman