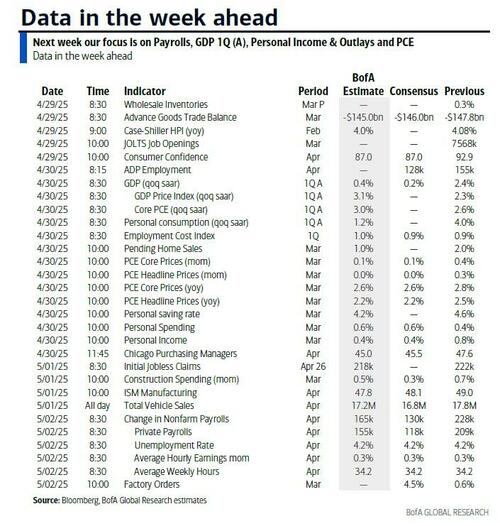

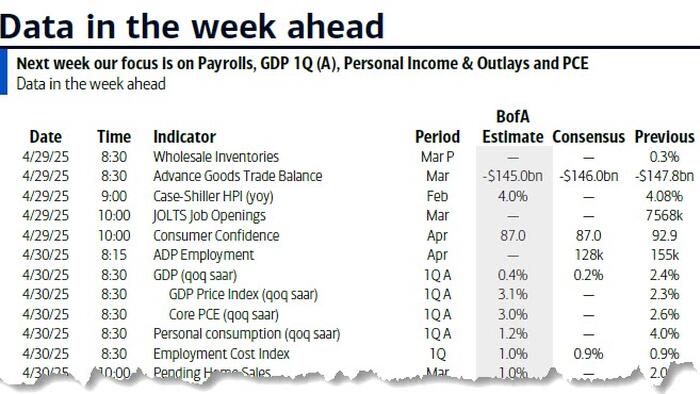

This week will be the first for a while where data and earnings will compete with tariff headlines as it’s a bumper week on this front. According to DB"s Jim Reid, in terms of data the main highlights in the US are payrolls (Friday), core PCE inflation and US GDP (Wednesday), ISM manufacturing (Thursday) and the latest JOLTS and consumer confidence tomorrow.

In Europe flash CPI numbers get released from Spain tomorrow, Germany, France and Italy on Wednesday, with the Eurozone aggregate on Friday (our economists’ preview is here). On Wednesday, Q1 GDP reports are due for Germany, France, Italy and the Eurozone. In Asia, the focus will be on the BoJ meeting (Thursday - our preview here) and April PMIs in China (Wednesday).

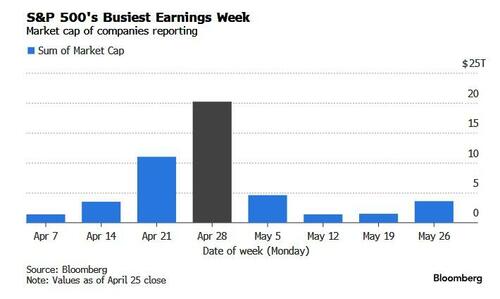

Besides the macro, we get an avalanche of micro as we face the busiest week of Q1 earnings season with corporate reporting centering around results from Microsoft and Meta on Wednesday and Apple and Amazon on Thursday. This will contribute to a whopping 40% of S&P 500 market cap reporting this week.

It's fair to say that Mag-7 earnings will go a long way to dictating the tone of the week, and perhaps quarter, now that the worst of tariffs appears to be behind us. As Jim Reid mentioned last week, remember that before Liberation Day the main theme bubbling in the background was the Mag-7 underperforming due to DeepSeek, worries about extreme levels of Capex needed to power AI forward, valuations and a disappointing Q4 reporting season around the end of January. Three months on we'll see what earnings look like.

Elsewhere we see the federal election in Canada today. Remember the ruling Liberal Party were frequently 25% behind in the polls in early-mid January even after Trudeau had announced his resignation as leader. However after the "51st state" rhetoric and aggressive tariffs, the rally round the flag movement has propelled the Liberals into a 3-4pp lead in current poll of polls which if replicated today would likely give them a small majority. So a remarkable turnaround.

Elsewhere in politics, Wednesday will mark President Trump’s first 100 days in office. So expect lots of reflections on this landmark. The UK holds local elections on Thursday with the main point of interest being how well the populist Reform Party does given they have recently edged ahead of the ruling Labour Party in national polls.

So its fair to say it will be a busy week.

Let's go into more detail on some of the main data points. Firstly, in terms of payrolls, DB economists forecast that headline (+125k forecast vs. +228k previously) and private (+125k vs. +209k) payrolls will mean revert after a strong March, particularly within the leisure/hospitality and retail sectors. The bank's econ team point out that March and April can get whipped around due to the timing of Easter and school spring breaks. Unemployment should remain steady at 4.2% though.

Wednesday's advance Q1 GDP will be interesting as the consensus suggests only +0.4% annualized growth in the quarter (+1.1% expected at DB vs. +2.4% in Q4) so that will raise some concerns if it materializes. At the same time DB sees March personal income (+0.5% DB vs. +0.4% last month) and spending (+0.6% DB vs. +0.4%) data. This will also contain the latest reading on the core PCE deflator (+0.1% vs. +0.4%) which is expected to be on the softer side this month. This will be welcome but remember this is all largely pre-tariffs.

The day by day week ahead is at the end as usual, including the highlights from a busy week for earnings on both sides of the Atlantic. One final thing to note is the US Treasury’s updated borrowing estimates (today) and the subsequent refunding announcement (Wednesday). This normally gets released without too much fuss but remember that in Summer 2023 (end July/early August) this quarterly announcement helped cause brief but great stress in markets due to higher than expected borrowing and more long-dated issuance. Since then the Treasury has managed the process with a view to minimising market fears but in an era of large borrowings these events are always worth keeping an eye out for.

Courtesy of DB, here is a day-by-day calendar of events

Monday April 28

Tuesday April 29

Wednesday April 30

Thursday May 1

Friday May 2

FInally, looking at just the US, Goldman writes that the key economic data releases this week are the Q1 advance GDP report and core PCE inflation on Wednesday and the employment report on Friday. Fed officials are not expected to comment on monetary policy this week, reflecting the blackout period ahead of the May FOMC meeting.

Monday, April 28

Tuesday, April 29

Wednesday, April 30

Thursday, May 1

Friday, May 2

Source: DB, Goldman