As we start a new month, it is set to be a busier week after the lull of Thanksgiving, with a lot of focus on various important US employment data culminating in payrolls on Friday, a number that could influence the fairly tight December 18th Fed decision. As DB's Jim Reid notes, the US ISM indices (today and Wednesday), some global PMIs, and the University of Michigan's consumer survey (Friday) are also due with inflation expectations within the survey fascinating after last month saw the joint highest (3.2%) for the 5-10yr expectations series since 2011. From central banks, speakers include Fed Chair Powell and ECB President Lagarde (both Wednesday).

In terms of the US employment data, Deutsche Bank's forecast for Friday's payrolls is +215k (consensus +200k) with private payrolls at +185k (consensus +200k). Last month the data printed at +12k and -46k, respectively, with weather and strikes impacting the numbers. For private payrolls it was the first negative print since December 2020 during the winter Covid wave. The DB economist forecast assumes 75k of positive payback split equally between weather and returning strikers. DB and consensus expect the unemployment rate to hold at 4.1%. Prior to this we have JOLTS (tomorrow), ADP (Wednesday) and the employment components of today manufacturing ISM and Wednesday's services equivalent. JOLTS is always one month behind payrolls (e.g. October) so it will be influenced by the weather disruptions we had that month.

Over in Europe, a number of economic activity indicators are due for the main economies including factory orders (Thursday), industrial production and the trade balance for Germany (both Friday). Industrial production (Thursday) and the trade balance (Friday) are also due for France. Otherwise there will also be November CPI prints in Switzerland (Tuesday) and Sweden (Thursday).

In Asia, Japan's wages and consumption activity are out on Friday. In Australia, Q3 GDP will be released on Wednesday. Briefly rounding off with geopolitics, South Africa took over the G20 presidency from Italy yesterday and the OPEC and non-OPEC ministerial meeting (online) will be held on Thursday as supply remains in focus.

Also watch France today as the National Assembly starts to review social security within the budget bill. If Barnier uses article 49.3 to push through the bill without a vote, it is feasible a no-confidence motion could come as early as today if the premier doesn't take into account the demands of the far-left and far-right. Le Pen in particular has been very hawkish over the weekend, suggesting that her extra budget demands need to be met today.

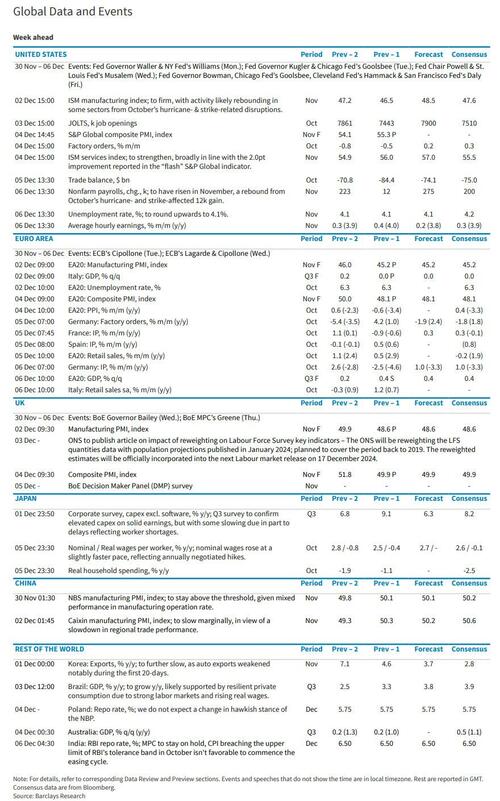

Courtesy of DB, here is a day-by-day calendar of events

Monday December 2

Tuesday December 3

Wednesday December 4

Thursday December 5

Friday December 6

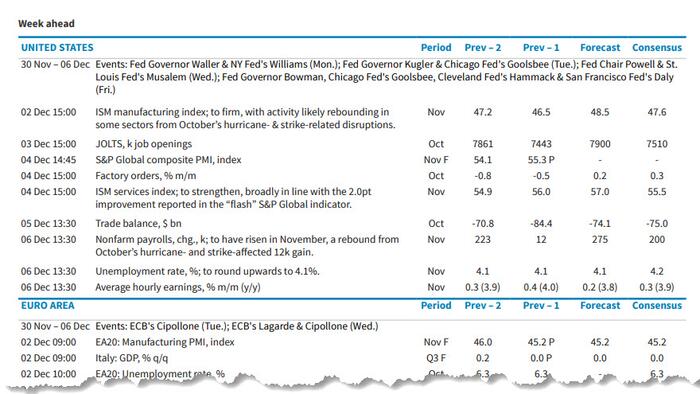

Focusing just on the US, Goldman writes that the key economic data releases this week are the ISM manufacturing index on Monday, the ISM services index on Wednesday, and the employment report on Friday. There are several speaking engagements from Fed officials this week, including a speech on the economic outlook by Governor Waller on Monday.

Monday, December 2

Tuesday, December 3

Wednesday, December 4

Thursday, December 5

Friday, December 6

Source: DB, Goldman