Welcome to the last day of the month ahead of what is another very busy week ahead bookended with a Powell speech today and payrolls on Friday. Also key will be the flash CPIs from Germany and Italy (today), and the Eurozone (tomorrow), especially after weak numbers from France and Spain on Friday. This could tip the balance for an October ECB cut. Elsewhere the global reaction to the China stimulus blitz last week will stay ever present even if their golden week holiday starts tomorrow and we won't see domestic markets open over the period. And, as one can see in the ridiculous chart below, investors are in a full-blown panic to put on China risk this morning ahead of the holiday.

Let's now go into closer detail on the main events ahead before summarizing the rest of the week's highlights.

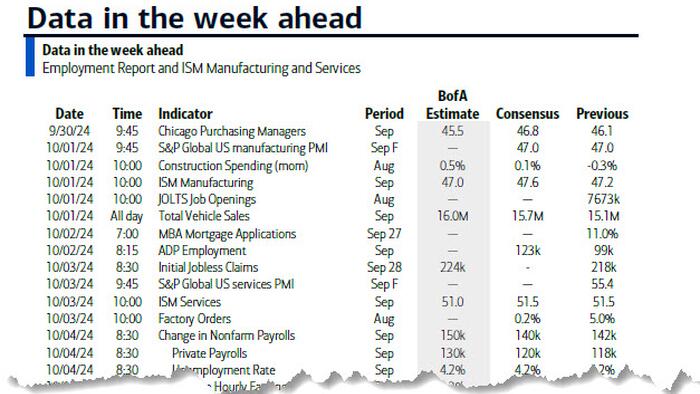

For payrolls, economists expect headline (146k forecast vs. 142k previously) and private (125k vs. 118k) payrolls to be slightly ahead of the 3-month averages of 116k and 96k, respectively. Consensus also expects the unemployment rate to be unchanged at 4.2% even with a slight pick-up in participation (to 62.72%). There are plenty of other employment signals this week with the ISM surveys, ADP, claims and JOLTS tomorrow. The JOLTS report has historically had one of the most reliable longer-term correlations to the prevailing employment trends but is always lagging by a month. Last month the private sector hiring rate continued near 2014 lows (outside the pandemic) but lay-offs were also lower than any period prior to the pandemic. The private sector quits rate (2.3%), is also back close to 2018 levels and more consistent with an unemployment rate of 4.5% using historical correlations as your guide. In short, according to DB's Jim Reid, the US labor market can be characterised by currently having relatively low hirings and very low firings. So this is why there is no current drama but why it's wise to be on high alert. One small shock could move things very quickly. Equally a recovery in hiring could increase the gap between the two quite sharply. Interestingly the following month's payrolls figures could be influenced by the Boeing strike in mid-September (that probably won't influence Friday's figures), and a potential dockworkers' strike starting tomorrow.

The risk of lay-offs increasing and tipping the balance in the current labor market is why the FOMC recently opened up their account with a 50bps cut. Powell's speech today (just after 1pm ET) will likely stick to his FOMC script but it's fair to say that Fedspeak since the meeting has been more amenable to additional 50bps cuts than we'd thought they would be. We have another round of Fedspeak this week as you'll see in the day-by-day calendar at the end so plenty of opportunity for that debate to move along even if the payrolls at the end of the week could have a bigger impact.

In Europe, today's German and Italian CPI will take on added significance given how weak Friday's French (1.5% YoY vs. 1.9% expected) and Spanish (1.7% YoY vs. 1.9% expected) numbers were. The Eurozone numbers come tomorrow. If these misses are repeated it probably forces the ECB to either lean towards 25bps next month or 50bps in December instead of 25bps. So important releases.

In terms of the rest of the week across the globe, the main highlights outside those already discussed are the Chicago PMI and Lagarde speech today, various global manufacturing PMIs and US ISM alongside the US Vice President debate and the Japanese tankan survey tomorrow, US ADP and Eurozone unemployment on Wednesday, and various global services PMIs and ISM and Eurozone PPI on Thursday. Outside of data a policy speech by French PM Barnier tomorrow will give clues to how the budget will materialize.

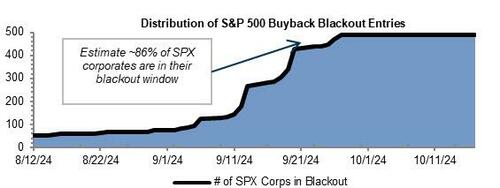

As a reminder, ahead of the start of earnings season in October, most companies are now in a buyback blackout period.

Courtesy of DB, here is a day-by-day calendar of events:

Monday September 30

Tuesday October 1

Wednesday October 2

Thursday October 3

Friday October 4

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the JOLTS job openings report and ISM manufacturing index on Tuesday, and the employment report on Friday. There are several speaking engagements from Fed officials this week including Chair Powell on Monday. The U.S. vice presidential debate is scheduled to take place at 9pm on Tuesday.

Monday, September 30

Tuesday, October 1

Wednesday, October 2

Thursday, October 3

Friday, October 4

Source: DB, Goldman