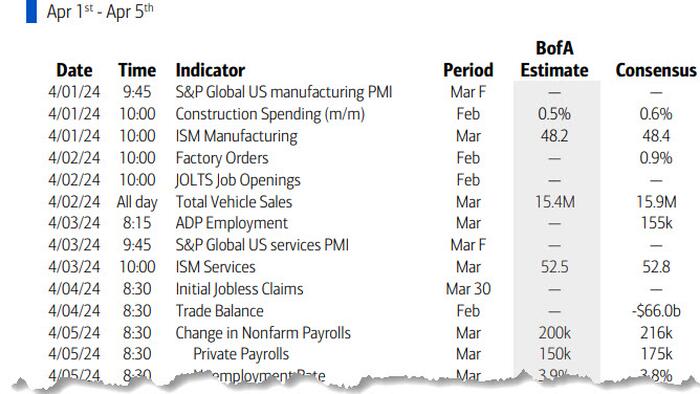

With the first quarter officially in the books, and just days until we start getting Q1 earnings (it sure does feel like we now live in one extra long earnings season), we have quite a few events this busy week starting with today's March manufacturing ISM print - which as noted earlier printed at 50.3, up from 47.8, above the 48.3 consensus and the first print above the 50 threshold reading since September 2022 (sparking a selloff in Treasuries and pushing the USD lower). Beyond today we get lots of Fed Speak (at least 8 speakers on deck including Jerome Powell), Friday's Payrolls, Euro Zone CPI and OPEC+ EURA.

The flood of scheduled Fed speakers will likely set the tone for the new quarter and month, including appearances from Chair Jerome Powell (who also spoke on Friday reiterating his previous non-committal comments) and the incoming St. Louis Fed President Alberto Musalem. The US jobs report due on Friday needs no introduction while the ISM surveys are also worth watching for an update on the health of the US economy.

The March jobs report (Apr 5) will be the main focus in the coming week. Consensus expects nonfarm payrolls to increase by 200k (vs. 275k in February). One of the reasons BofA is calling for a slowdown in job growth is that payrolls in the month of March have shown a tendency to be weak relative to February in recent years. For a similar reason, the bank is expecting private payrolls to slow from +223k in February to a below-consensus +150k in March. Average hourly earnings (AHE), meanwhile, are likely to rise by 0.3% m/m or 4.1% y/y. The quits rate and posted wage growth from Indeed point to a moderation in y/y rates for AHE. Average weekly hours should increase by a tenth to 34.4.

On the household (HH) survey side, BofA expects the unemployment rate (u-rate) to remain at 3.9%. But the HH employment data have been much weaker than NFP in recent months. This means we could see some payback – e.g. stronger HH employment growth than NFP and a lower u-rate. But if the divergence continues, there is risk of a higher u-rate. Also, expect the labor force participation rate to recover by a tenth to 62.6%. This is because BofA expects a rebound in the 16-24 years category, which declined by 0.4ppt in February

In Europe, consumer price data from the euro area should help shape interest-rate cut expectations with traders close to fully pricing in a 25 basis point European Central Bank reduction in June. Swiss inflation will also garner some interest after the surprise rate cut by the Swiss National Bank last week.

The OPEC+ joint ministerial monitoring committee will meet on Wednesday although delegates see no need to recommend any changes to oil supply policy.

Here is a day by day analysis of key global events, courtesy of Bloomberg:

Monday, April 1

Tuesday, April 2

Wednesday, April 3

Thursday, April 4

Friday, April 5

Focusing just on the US, Goldman writes that the key economic data releases this week are the ISM manufacturing report on Monday, the JOLTS job openings report on Tuesday, the ISM services report on Wednesday, and the employment situation report on Friday. There are many speaking engagements from Fed officials this week, including a speech by Chair Powell on Wednesday.

Monday, April 1

Tuesday, April 2

Wednesday, April 3

Thursday, April 4

Friday, April 5

Source: BBG, Goldman