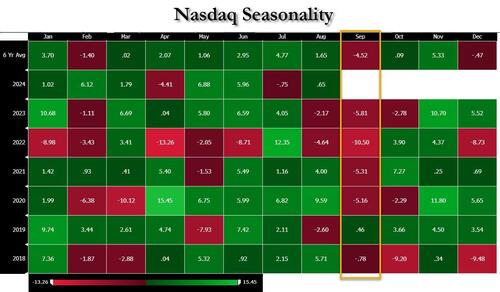

Welcome to September although as Jim Reid writes this morning, given the track record of recent years, perhaps we should say beware rather than welcome. For what it’s worth, the S&P 500 and the STOXX 600 have lost ground in each of the last 4 Septembers...

... while the Nasdaq is a veritable September horror show.

And for those hoping to find cover in fixed income, there hasn’t been any there either. In fact, Bloomberg’s global bond aggregate is down in each of the last 7 Septembers according to Reid. So if we do manage to get some positivity this month, that would fly in the face of a succession of negative performances.

That said, August was more than a solid month especially after the shocking plunge at the start, so even a red September will hardly be a shock after the staggering rebound achieved after August 5, in no small part thanks to the latest dovish pivot by the Fed.

And speaking of the Fed, all roads this week lead to the US jobs report on Friday, which is going to be pivotal in terms of how much they cut rates by at their next meeting. As it stands, futures still see a 25bp move as more likely, but a 50bp move is being priced with a 31% probability this morning, so it’s in the balance as far as markets are concerned. And as we found out last month, an underwhelming jobs report can quickly shift expectations.

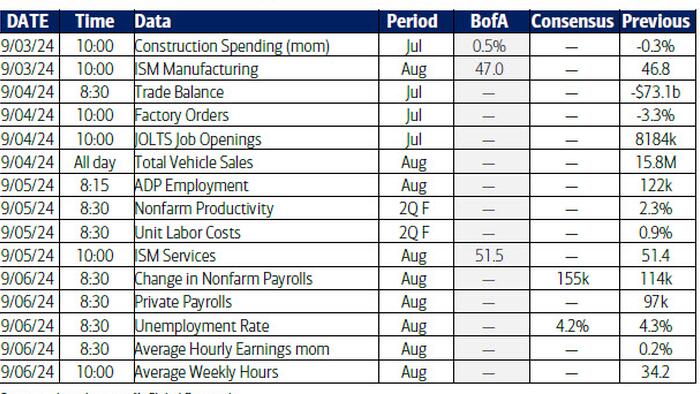

In terms of what to expect this time around, economists are forecasting that nonfarm payrolls will come in at +165k in August, a strong rebound from the shockingly bad 114K print in July. That assumes a rebound from potential weather-related disruptions in the July report, and they also see the unemployment rate ticking down a tenth to 4.2%. Of course, much of the focus will be on how Fed officials react, although they won’t have long to discuss the data, as the blackout period ahead of the September meeting begins the day after the jobs report. One final point: after the near record September negative payrolls revision, it wouldn't be surprising to see a surge in payrolls now that we have had a kitchen sink reset of the fake numbers and the BLS can resume fabricating data from square one.

Although last month’s jobs report was underwhelming, it’s also worth noting that much of the data since then has looked more positive. The weekly initial jobless claims have fallen from their levels in late-July, the latest retail sales print was very strong as well, and the revisions to Q2 GDP growth saw it adjusted up to an annualized pace of +3.0%, which isn’t consistent with a recession (but it is consistent with pre-election propaganda meant to put lipstick on the economy). Moreover, Friday saw the Atlanta Fed’s GDPNow estimate for Q3 move up to +2.5%, so again pointing away from a recession.

This week we should get some more details on the August picture, as we’ll get the ISM manufacturing and services prints, which are coming out on Tuesday and Thursday respectively. The JOLTS report on Wednesday will also be worth looking at, although that’s a bit more backward-looking as it’s the July reading.

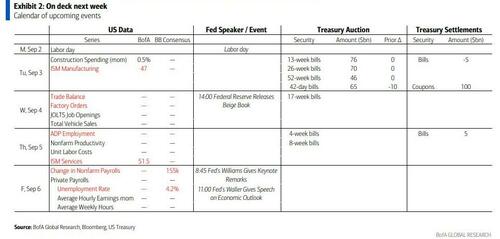

Aside from the US data, it’s a fairly subdued calendar this week, and US markets are closed today for the Labor Day holiday. One thing we will get though is the Bank of Canada’s latest policy decision on Wednesday, where they’re widely expected to cut rates by 25bps for a third consecutive meeting, which would take their policy rate down to 4.25%.

Courtesy of DB, here is a day-by-day calendar of events

Monday September 2

Tuesday September 3

Wednesday September 4

Thursday September 5

Friday September 6

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the ISM manufacturing index on Tuesday, the JOLTS job openings report on Wednesday, and the employment report on Friday. New York Fed President Williams and Fed Governor Waller will deliver speeches on Friday.

Monday, September 2

Tuesday, September 3

Wednesday, September 4

Thursday, September 5

Friday, September 6

Source: DB, Goldman