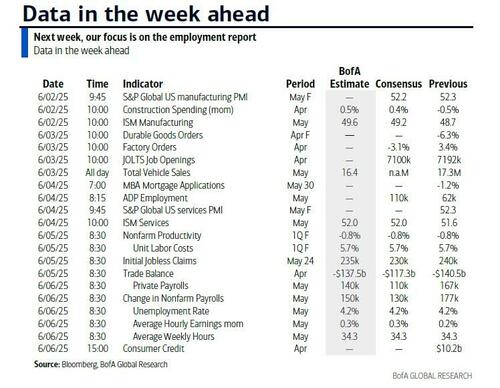

Following a relatively quiet, holiday-shortened week, newsflow starts to pick up again. In terms of data this week, we have US payrolls on Friday as the main event but the US manufacturing ISM today and the services equivalent on Wednesday will also be important. We will also get various global PMIs spread across this week. You can see the main ones in the day-by-day calendar at the end as usual.

The ECB rate decision on Thursday (25bps cut widely expected), and what the tone suggests going forward, will also be a big focus. The BoC meet on Wednesday (a 25bps cut also expected). May CPI prints are due in the Eurozone, Switzerland (tomorrow) and Sweden (Thursday). Broadcom, which sits just outside the Mag-7, sees their earnings on Thursday and this might give us some latest thoughts on current AI trends.

Given its payrolls week we also have JOLTS (Tuesday) and ADP (Wednesday), with jobless claims (Thursday) of added interest given we saw a small but notable increase last week. For payrolls economists expect the headline (+128k forecast vs. +177k previously) and private (+115k vs. +167k) gains to slow relative to their trailing three-month averages of 155k and 148k, respectively, with the unemployment rate staying at 4.2%. For the rest of the week ahead see the diary at the end.

DB's economists also flag that the Senate will return to Washington DC this week to begin marking up the “One Big Beautiful Bill Act”. They think it will be interesting to see if the GOP Senators are as eager to make deep cuts to clean energy tax credits and Medicaid as their House counterparts. At the same time, the latest legal developments on the trade front pose risks to tariff revenues.

Courtesy of DB, here is a day-by-day calendar of events

Monday June 2

Tuesday June 3

Wednesday June 4

Thursday June 5

Friday June 6

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the ISM manufacturing and services indices on Monday and Wednesday, respectively, and the employment report on Friday. There are several speaking engagements from Fed officials this week. Chair Powell will deliver opening remarks at a conference hosted by the Fed Board on Monday

Monday, June 2

Tuesday, June 3

Wednesday, June 4

Thursday, June 5

Friday, June 6

Source: DB, Goldman