As DB's Jim Reid writes in his expansive Daily Reid note this morning, five years ago today, global markets first began to panic after a weekend that saw 11 Italian towns emerge from it in Covid lockdown. Five years later we had a mini panic on Friday as attention focused on a report earlier in the week about a new coronavirus discovery in bats, from the infamous Wuhan lab, with similar properties to Covid-19. And speaking of five years, will the German election be seen as a pivotal moment when we look back on it in 2030? For financial markets the make-up of the Bundestag was probably as important as the overall results and the one line summary is that the centre-right and centre-left should have sufficient seats to form a grand coalition but overall the centrist parties are short of a two-thirds majority. This latter means that any future reforms of the debt break will be challenging and may require compromise and horse trading.

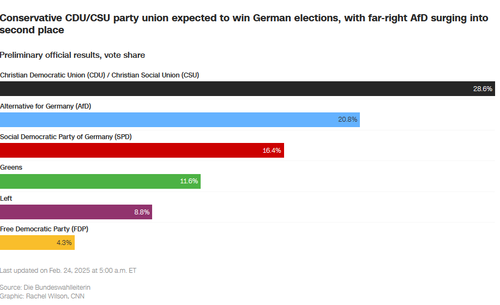

In terms of the details, the provisional results confirm a victory for the centre-right CDU/CSU (28.6%), followed by the far-right AfD (20.8%), centre-left SPD (16.4%) and Greens (11.6%). Of the smaller partis, the leftist Linke (8.8%) comfortably exceeded the 5% threshold, but the far-left BSW (4.97%) and liberal FDP (4.3%) fell short. BSW’s narrow failure to enter the Bundestag, which may take a few days to be definitively confirmed, has the important consequence of leaving the CDU/CSU and SPD combined with a projected 52% of the seats.

That leaves the grand coalition as the most likely outcome, being the only option to avoid the need for three-party coalition given that mainstream parties have ruled out partnering with the AfD. DB's Germany economists see the prospect of a two-party coalition led by a strong CDU/CSU as a positive for Germany's corporate sector, promising less policy gridlock and uncertainty than under the outgoing government. Earlier in the night, CDU leader Merz said he wanted to form a coalition within the next two months.

While the outcome may reduce the risks of particularly fractious coalition talks, it still confirms an ongoing anti-establishment trend that has been visible both in Germany and Europe as a whole. The result marks the lowest ever vote share for the two major parties, even as the turnout (82.5%) was the highest since at least 1990. And it leaves the centrist parties short of a 2/3rds constitutional majority, with the CDU/CSU, SPD and Greens jointly at just under 66% of seats. That means any debt brake reform, including for defense spending, would require support from one of the fringe parties. This may not be impossible, but it would require significant political compromises.

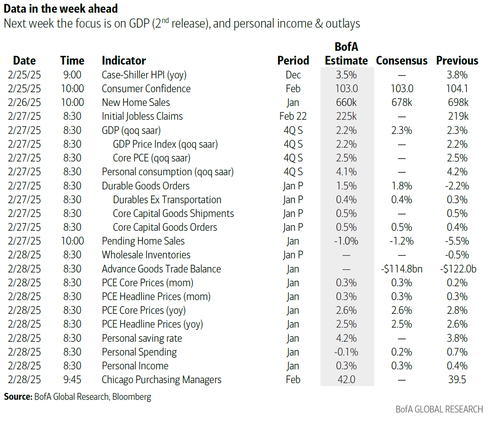

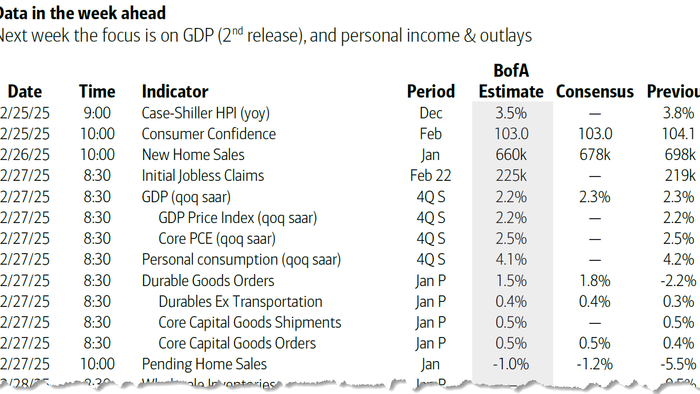

In terms of other events this week, Nvidia's earnings on Wednesday could be the biggest mover of markets. Interestingly of the 62 analysts who cover the stock on Bloomberg, 56 have a buy rating with only one sell. DB are currently one of only 5 with a hold rating. Outside of that, inflation takes centre stage with US core PCE, German, French and Italian flash CPI, as well as Tokyo CPI all out on Friday with Spain's equivalent coming out on Thursday. In terms of the rest of the main global releases, the German Ifo survey today will be less relevant given the election but later we have the Dallas and Chicago Fed manufacturing surveys. Tomorrow sees the US Conference Board consumer confidence release which will be interesting after Friday's weak UoM equivalent. Wednesday sees US new home sales and Australian inflation. Thursday sees US durable goods and the ECB account of their January meeting and Friday sees US personal income and spending data and the ECB consumer expectations survey. There are also lots of central bank speakers through the week, including at the G20 central bankers and finance minister meeting in Cape Town on Wednesday and Thursday. You can see the main ones detailed in the day-by-day calendar at the end as usual, along with key earnings releases and all the other data.

Digging into the main US data this week now. According to DB economists, Friday's personal income (+0.3% forecast vs +0.4% previously) and consumption (+0.2% vs. +0.7%) will likely be softer due to the LA wildfires and poor weather with the all-important core PCE deflator (+0.27% vs. +0.16%) higher but not as extreme as CPI due to softer subcomponents in the subsequent PPI. This would lower the YoY core PCE two tenths to 2.6%.

In the US consumer confidence tomorrow, the jobs-plentiful / jobs hard-to-get series is important as a good proxy for the unemployment rate. For claims on Thursday our economists are looking to the DC area in particular given press reports of substantial federal government layoffs. Around 20% of the ~2.3mn federal government employees live in Washington DC, Maryland and Virginia. The German bank estimates that there have been roughly 14k potential federal layoffs since the Trump Administration took office with another 12k pending the resolution of court cases. Clearly this is just within the first month.

Courtesy of DB, here is a day by day summary of the key events:

Monday February 24

Tuesday February 25

Wednesday February 26

Thursday February 27

Friday February 28

Finally, Goldman notes that the key event this week is this week is core PCE inflation on Friday. There are several speaking engagements by Fed officials this week.

Monday, February 24

Tuesday, February 25

Wednesday, February 26

Thursday, February 27

Friday, February 28

Source: DB, Goldman, BofA