It's a quiet start to the week thanks to the President's Day holiday in the US, and it's also a relatively quiet week on the data front, however as DB's Jim Reid writes in his weekly preview, "it's a reflection of the world we live in that the most important event of the week may be Nvidia's earnings on Wednesday."

Indeed, NVDA is now the 4th largest company in the world and the best performer in the S&P 500 so far this year (+46.6% YTD), so this will be very important for sentiment. China's return from holidays will also add some interest after its recent equity market volatility and weak growth/inflation numbers (as noted earlier, it was the unexpected arrival of the plunge protection team that helped send Chinese stocks to session highs at the close). Here are the rest of the week's earnings:

Needless to say, all of the focus will be on NVDA earnings - Wednesday 2/21 (numbers hit at 420pm, conf call at 5pm).

While we will do a more detailed preview shortly, here are the highlights: according to Goldman, options are pricing in a ~11% move on earnings next week – notable given the last two quarters, NVDA hasn’t budged T+1 (‘consolidation’ events), despite beating EPS by 20-30% on both prints, with Goldman top TMT trader Peter Callahan writing that there is "plenty of tactical debate whether this print will be a local top or a ‘break-out’ moment for the stock and for the A.I. trade (.. from my seat, feels like consensus is learning more towards the former..)."

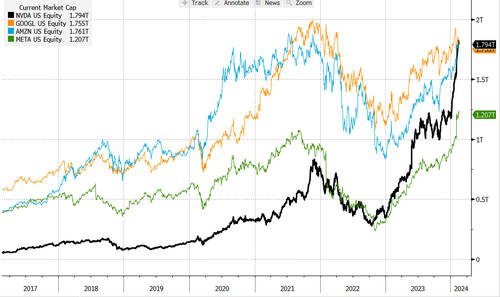

NVDA is now up more than 50% since last quarter’s earnings, surpassing both GOOGL & AMZN in market cap in the interim. Investors are looking for Nvidia to once again deliver a clear beat-and-raise print -- for context, Nvidia has beat revenue by ~$2bn the last couple of quarters (vs cons modeling ~$20bn in Jan qtr revenues), which will likely serve as a measuring stick alongside commentary on the April quarter (recall, Nvidia had guided Jan qtr +10% q/q) and the 2025+ roadmap (both visibility + product cadence). Next catalyst = NVIDIA GTC 2024 | March 18–21.

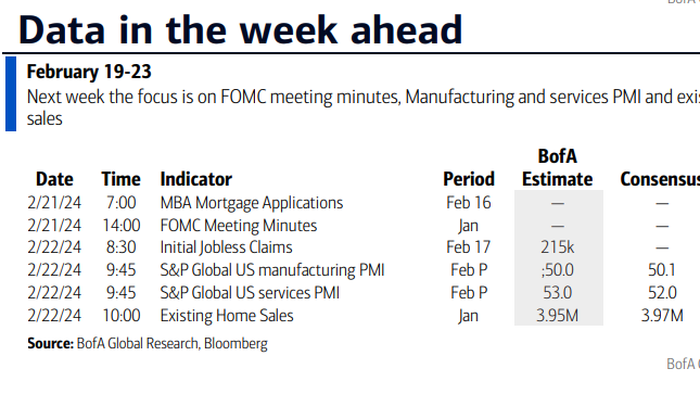

Elsewhere, we have the FOMC January minutes on Wednesday but a lot of data has flowed under the bridge since then and market pricing has moved closer to the Fed's dots and tone since then so its hard to see how much we'll learn from their thoughts three weeks earlier. The account of the January ECB meeting on Thursday will also be of note.

In terms of data, the global flash PMIs come out on Thursday and in the US this week's claims on the same day correspond to survey week for payrolls. Winter storms may make data challenging to interpret in the next few weeks though. Tomorrow's leading indicators and Thursday's existing home sales are the other US highlights.

Over in China, after leaving the 1-yr MLF rate unchanged yesterday (as expected), tomorrow sees them decide on the 1-yr and 5-yr loan prime rates. The market is expecting the latter to be cut 10bps to 4.1%.

The full list of events in the week ahead, including earnings and central bank speakers, is below. Thursday is a big day for Fed speak including Vice Chair Jefferson who we haven’t heard from since the FOMC, so his views at the center of the committee will hold some weight.

Courtesy of DB, here is a day-by-day calendar of events

Monday February 19

Tuesday February 20

Wednesday February 21

Thursday February 22

Friday February 23

Turning to just the US, Goldman notes that the key economic data releases this week are the jobless claims report on Thursday and the existing home sales report on Friday, while the minutes from the January FOMC meeting will be released on Wednesday. There are several speaking engagements by Fed officials this week, including Fed Vice Chair Jefferson, Fed Governors Bowman, Cook and Waller, and Presidents Bostic, Harker, and Kashkari.

Monday, February 19

Tuesday, February 20

Wednesday, February 21

Thursday, February 22

Friday, February 23

Source: DB, Goldman, BofA