After what was arguably the busiest macro week of the summer, with all major central banks revealing their latest monetary stance, DB's Jim Reid writes that it's not easy to find the main highlight this week with a number of events that could be meaningful but could also pass without incident. Powell's semi-annual testimony to the House and the Senate on Wednesday and Thursday, respectively, should be the key event but coming so soon after the FOMC it's hard to know what he can say that will be particularly new. Around this there is plenty of Fed and ECB speak where various officials will give their nuances to the policy meetings last week (see day-by-day calendar at the end).

Given an increasing global focus on rising UK rates of late, then UK CPI (Wednesday) and the expected 25bps hike on Thursday, and associated commentary, could have a big impact on Gilts and with it global bonds. There was lots in the weekend papers about the upcoming mortgage refi wave over the next couple of years if rates stay close to current levels. So this is becoming a big topic.

Staying with rates and yields, given how much US yields rallied for a period last week after jobless claims stayed surprisingly high, this Thursday's release could be one of the data highlights of the week. The recent rise has an element of the fraudulent filings the market discovered a few weeks back, but it’s got slightly more broad-based since so this could be the first area where we see any genuine cracks in the labor markets. So all eyes on this.

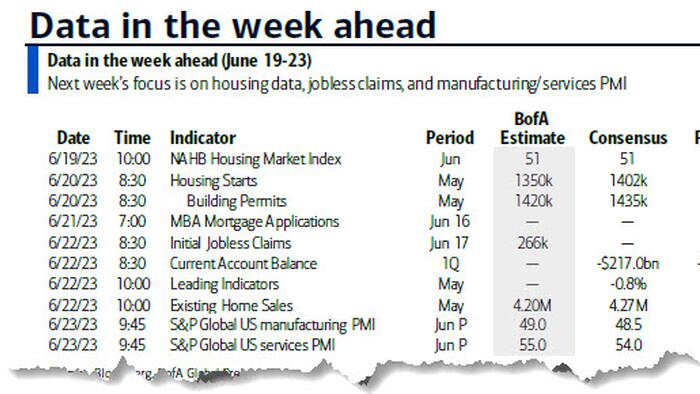

Elsewhere, Global flash PMIs on Friday are always a big focus. Back in the US we have a slew of housing data including the NAHB housing market index today, housing starts and building permits tomorrow and existing home sales on Thursday. Housing is still very weak but many are seeing green shoots starting to emerge. The other key highlights are Japanese inflation on Friday and UK retail sales the same day and PPI in Germany tomorrow. In China, markets will focus on domestic banks' loan prime rates fixings tomorrow following last week's PBoC reverse repo and MLF rate cuts as well as a round of disappointing economic data amid the broader talk about the need for stimulus to support the waning recovery. The rest of the day-by-day week ahead is at the end as usual.

Asian equity markets are largely struggling at the start of the week, tracking Friday’s fall in US stocks. As I check my screens, the Hang Seng (-1.57%) is the biggest underperformer across the region with the CSI (-0.84%), the Shanghai Composite (-0.54%) and the KOSPI (-0.86%) also trading in the red. The Nikkei (-1.11%) is also down after 10 straight weeks of gains. Elsewhere, the S&P/ASX 200 (+0.66%) is bucking the wider sell off in the region.

On a positive note, US Secretary of State Antony Blinken met China's president Xi Jinping on Monday to stabilise strained ties between the world’s biggest economies, although the outcome of the meeting was lackluster at best.

A quick look at markets, S&P 500 rally finally ran out of steam on Friday, down -0.37% after 6 consecutive days of gains. This still marked a +2.58% rise on the week to the highest weekly close since April 2022. At the sector level, the S&P reversal was led by the tech sector (-0.83%) as semiconductor manufacturer Micron Technology announced about half of its China customer revenue was at risk. This followed on from China’s bar on purchases of Micron chip products in late May amid elevated geopolitical tensions. Tech underperformance was reflected in the decline of NASDAQ (-0.68%) and the FANG+ (-1.27%) indices on Friday, though they were still up by +3.25% and +4.03%, respectively, on a weekly basis. The FANG+ Index is now 3% from its all-time highs in November 2021. With the US equities sell-off coming in the latter half of the day, in Europe the STOXX 600 climbed +0.53% on Friday before the US dip (and +1.48% week-on-week).

Lastly, in commodities, oil finished up the week strong off the back of optimism over China demand. This followed a Bloomberg report that the Chinese State Council was considering a sweep of stimulus proposals to boost consumption, as well as support for sectors including property. WTI crude gained +2.29% week-on-week bringing it to $71.78/bbl (+1.64% on Friday), and Brent crude gained +2.43% to $76.61/bbl (+1.24% on Friday). The news from China also lifted copper, which climbed +2.64% in weekly terms (but down a modest -0.31% on Friday), reaching its highest level for over a month.

Here is a day-by-day calendar of events, courtesy of Deutsche:

Monday June 19

Tuesday June 20

Wednesday June 21

Thursday June 22

Friday June 23

Finally, focusing on the US, Goldman writes that there are no key economic data releases this week, but there are several speaking engagements from Fed officials, including Chair Powell’s semi-annual congressional testimony on Wednesday and Thursday. Governors Barr, Waller, and Bowman and presidents Bullard, Williams, Goolsbee, Mester, and Barkin are also scheduled to speak.

Monday, June 19

Tuesday, June 20

Wednesday, June 21

Thursday, June 22

Friday, June 23

Sunday, June 25

Source: DB, Goldman, BofA