As discussed earlier, this week is pretty quiet in terms of planned economic and macro events... although as Jim Reid notes, this year has been as busy as he can remember outside of a crisis in terms of unplanned events so the first part of this sentence will likely be proved to be meaningless.

In terms of the known highlights, we have the global flash PMIs on Thursday alongside what is universally accepted to be an ECB on hold meeting. With the Fed on their blackout ahead of next week's FOMC, the only noise will come from how hard Trump wants to continue to push on with criticizing Powell (on a daily basis). Powell does open a regulatory conference tomorrow but won't discuss monetary policy given the blackout.

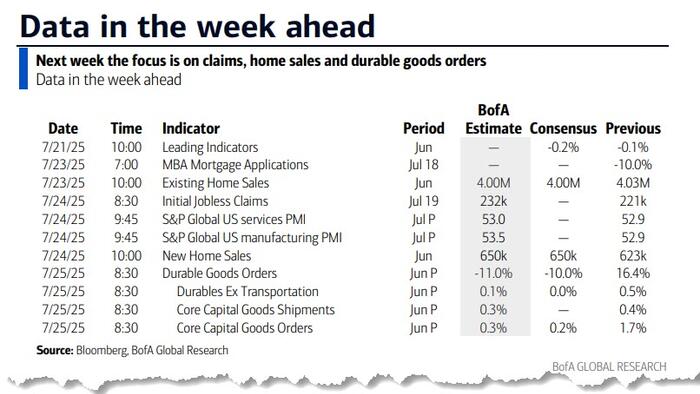

The key US data are some regional manufacturing surveys tomorrow, existing home sales on Wednesday, new home sales, jobless claims and the Chicago Fed survey on Thursday, and then durable goods on Friday.

In Europe, the key to the ECB meeting this Thursday is how long they're expected to pause. The central bank will also release its bank lending survey tomorrow.

In terms of economic data, other sentiment indicators out in the region will include consumer confidence in Germany (Thursday), the UK, France and Italy (Friday). The German Ifo survey is out on Friday.

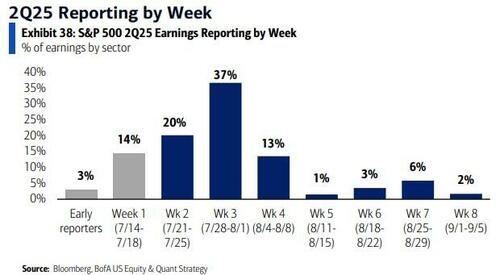

It's certainly busier on the earnings side as we start to see Q2 earnings get fleshed out a little more this week with 135 S&P 500 and 189 Stoxx 600 companies reporting. Two of the Magnificent 7, Alphabet and Tesla, will report on Wednesday. Other tech firms releasing results this week include IBM, ServiceNow and Intel. Defence firms including RTX, Lockheed Martin and Northrop Grumman also report.

In Europe, earnings will be due from the region's largest company, SAP tomorrow. Three others from the top 10 by market cap - LVMH, Roche and Nestle - also report, along with several European banks. See the full day-by-day calendar of events as usual at the end

Courtesy of DB, here is a day-by-day calendar of events

Monday July 21

Tuesday July 22

Wednesday July 23

Thursday July 24

Friday July 25

Looking at just the US, the major economic data release this week is the durable goods report on Friday. Fed officials are not expected to comment on monetary policy this week, reflecting the blackout period ahead of the July FOMC meeting.

Monday, July 21

Tuesday, July 22

Wednesday, July 23

Thursday, July 24

Friday, July 25

Source: DB, Goldman