As we move into the second half of August, this week’s center of attention for investors will be the Jackson Hole Economic Symposium that runs from Thursday evening through Saturday. The good news, as DB's Peter Sidorov writes, is that markets are approaching this in a much better mood than looked likely two weeks ago as the extreme volatility seen at the start of August seems almost a distant memory. Meanwhile, the S&P 500 is on its best 7-day run since October 2022 (+6.82%) and has moved to within 2% of its all-time high, while the VIX ended last week at 14.80, down to below 15 for the first time in over three weeks. This comes as a 50bp Fed rate cut in September is now just over 30% priced, down from being fully priced on August 5 and 55% a week ago.

The overall title at Jackson Hole this year is “Reassessing the Effectiveness and Transmission of Monetary Policy” and central bankers will surely feel more satisfied with their policy levers than the last two times they met at the Wyoming retreat. The 2022 symposium came as inflation neared double digits across many developed economies with rates markets undergoing a sharp hawkish repricing, while a higher-for-longer focus saw Treasury yields reach post-GFC highs in the run-up to the 2023 gathering, with the 10yr yield then touching 5% last October. By contrast, this year’s event comes with US PCE inflation down to 2.5%, the unemployment rate up by 0.6pp since the start of 2024 and the Fed keeping rates on hold for the past 12 months. 10yr Treasuries are back below 4% as markets are pricing 95bps of Fed rate cuts across the remaining three meetings this year and 200bps of easing by next October.

In this context, investors will be keenly watching for signals on the timing and pace of rate cuts, especially from Fed Chair Powell’s speech at 10am EST on Friday. DB's economists don’t expect him to pre-commit to any particular rate cut trajectory but to signal that the Fed has gained sufficient confidence that it will soon be appropriate to begin easing policy, with rate cuts justified by both sides of the Fed’s dual mandate. They see rate cuts as likely to be framed as dialing back restraint, leaving the exact path data dependent. With r-star uncertain and policy risks evident following the election, rate cuts beyond the first 75-125bps are more uncertain. For more, including the arguments for starting the easing cycle with 25bps vs 50bps cuts, see our economists’ full preview here.

Other scheduled Jackson Hole speakers include BoE Governor Bailey late on Friday and ECB Chief Economist Lane on Saturday. Ahead of this, we will also get the latest Fed and ECB meeting minutes on Wednesday and Thursday, respectively, which may offer some colour on the strength of the conditional September rate cut signals that both central banks sent at their July meetings. Elsewhere, tomorrow Sweden’s Riksbank is expected to deliver a second 25bps cut of its easing cycle, with markets pricing a c. 20% likelihood of a larger 50bps cut.

On the data front, this week’s main event will come with the flash August PMIs out in the US, euro area, UK and Japan on Thursday. Last month’s slippage of the US manufacturing PMI to below 50 (at 49.6) contributed to a rise in US recession fears that has since ebbed, while in the euro area activity surveys have consistently disappointed over the past two months. Another notable release will be Wednesday’s Q1 Quarterly Census of Employment and Wages (QCEW) in the US, which will provide preliminary benchmark revisions to the payrolls data.

Turning to politics, today will see the start of the US Democratic National Convention in Chicago, where masses of antifa NPCs are expected to crash the event, literally. Politics will also be in the headlines in Japan as on August 20 the LDP is due to finalize the schedule for its September leadership election.

Day-by-day calendar of events

Monday August 19

Tuesday August 20

Data: US August Philadelphia Fed non-manufacturing activity, China 1-yr and 5-yr loan prime rates, Germany July PPI, Italy June current account balance, ECB June current account, Eurozone June construction output, Canada July CPI, Denmark Q2 GDP

Wednesday August 21

Thursday August 22

Friday August 23

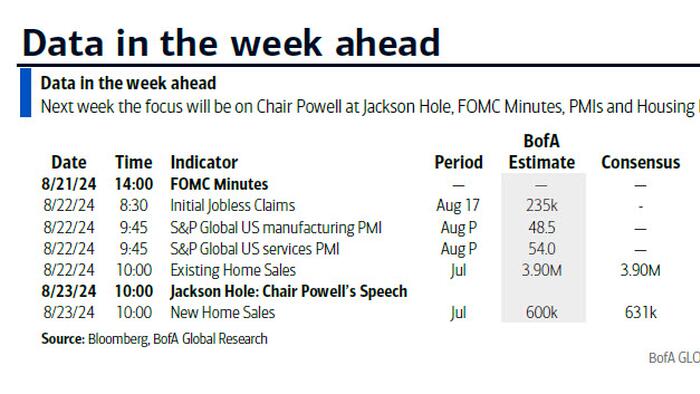

Finally, focusing on just the US, Goldman writes that the key economic data releases this week are the jobless claims and existing home sales reports on Thursday. The minutes from the July FOMC meeting will be released on Wednesday. There are several speaking engagements from Fed officials this week, including Governor Waller, President Bostic, and Chair Powell, who will deliver the keynote address on Friday at the Jackson Hole Economic Policy Symposium.

Monday, August 19

Tuesday, August 20

Wednesday, August 21

Thursday, August 22

Friday, August 23

Source: DB, Goldman