So far we’ve had a fairly light calendar over the summer, but as DB's Jim Reid notes, this week that should change with the Fed’s Jackson Hole Economic Symposium. The overall title this year is “Structural Shifts in the Global Economy”, and Chair Powell’s speech on Friday at 10am is simply given the heading “Economic Outlook”. Unlike last year's fire and brimstone last-minute-revised speech, most economists don’t expect Powell to send strong signals about the near-term policy path. However, it is true that recent years have seen Powell deliver some important longer-term policy messages. In particular, last year saw him deliver a fairly short and direct message on the importance of price stability, which left little doubt as to the Fed’s resolve to return inflation to target.

As Reid observes, this year’s conference comes at an interesting moment. On the one hand, nominal and real yields have risen substantially. But some other measures of overall financial conditions are still not particularly tight, and Bloomberg’s index of US financial conditions right now is more accommodative than its historical average. Moreover, the supposedly resilient economic data out of the US over recent weeks has helped to bolster the soft-landing case. However, the risk is that with the data coming in so strong, real yields keep pressing higher, which raises the chance that something ends up breaking, as has usually occurred during previous Fed hiking cycles through history.

Apart from Jackson Hole, another important focus this week will be China’s economy. On Sunday, the People’s Bank of China encouraged banks to boost lending to support growth. And this morning, banks have cut the one-year loan prime rate by 10bps to 3.45%. However, Chinese equities have still fallen this morning, since that was smaller than the 15bps cut expected. Furthermore, the 5-year loan prime rate was left unchanged, contrary to the 15bps cut that was expected there too.

Looking forward to the week ahead, there are several other events to look out for. On the data side, the flash PMIs for August are coming out on Wednesday, which will offer an initial indication as to how the major economies have been faring this month. Separately, another important release that day in the US will be the Q1 Quarterly Census of Employment and Wages (QCEW). That provides a benchmark for employment data, so it means we’ll also get some revisions to nonfarm payrolls over previous months. Our US economists have some more details on the release here.

When it comes to earnings, the bulk of this season is over now, so there’s not much left to come out. That said, one remaining highlight will be Nvidia on Wednesday. Readers might recall that their outlook back in late-May was far above expectations thanks to demand for AI processers, and it helped kick off a significant equity rally that continued into June and July. So that’s definitely one to watch out for.

On the rates side, this week’s US Treasury auctions include 20yr Treasuries (Tuesday) and 30yr inflation-protected Treasuries (Wednesday), which will be interesting with yields having risen to multi-year highs. Otherwise from central banks, there are plenty of speakers apart from Fed Chair Powell, including ECB President Lagarde on Friday.

Lastly in the political sphere, there’ll be some more action on the 2024 US Presidential race over the week ahead. In particular, the first Republican primary debate is taking place on Wednesday. But yesterday, former President Trump confirmed that he wouldn’t be doing the debates. President Trump remains the polling frontrunner for the Republican nomination by a substantial margin, and FiveThirtyEight’s average gives him 54.3%, which is well ahead of the next-placed candidate, Florida Governor Ron DeSantis on 14.8%. No other candidate is in double-digits.

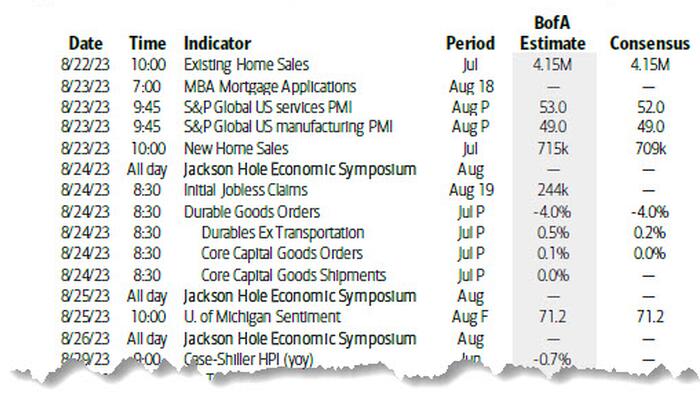

Courtesy of DB, here is a day-by-day calendar of events

Monday August 21

Tuesday August 22

Wednesday August 23

Thursday August 24

Friday August 25

Finally, looking at just the US, Goldman writes that the key economic data release this week is the durable goods report on Thursday. There are a few scheduled speaking engagements from Fed officials this week, including a speech by Fed Chair Jerome Powell on Friday at the Jackson Hole Economic Policy Symposium.

Monday, August 21

Tuesday, August 22

Wednesday, August 23

Thursday, August 24

Friday, August 25

Sourece: DB, Goldman, BofA