After a burst of activity in the last week of August, and the summer, we start the first unofficial week of Fall with a slew of traders coming back from the Hamptons and a relatively muted calendar, which includes US factory orders (tomorrow) and more interestingly the ISM services and trade balance on Wednesday (economists expect the ISM gauge to drop to 52.5 from 52.7 in July). Consumer credit data on Friday will round out the week, and will be notable to watch after last month's unexpected plunge in revolving credit, which turned negative for the first time since covid.

As DB's Jim Reid notes, this week will be an interesting one for central banks. The RBA are expected to stay on hold tomorrow following recent softer data (Lowe's final meeting) and then the BoC will now more likely stay on hold on Wednesday following a surprising -0.2% fall in Q2 GDP on Friday against expectations of +1.2%. Later on Wednesday the Fed's Beige Book will show whether the strong start to Q3 US data is corroborated. Over in Europe, highlights include ECB's consumer expectations survey and inflation expectations tomorrow. In addition, we will see the BoE's Decision Maker Panel survey on Thursday as well as a long list of ECB speakers throughout the week, as there are with the Fed ahead of the coming quiet period. In Asia, two appearances from BoJ officials will also be of interest. That said, economists expects markets to be surprised if either emphasizes the need for policy normalization soon.

Back to economic data. Important releases for Germany include the trade balance on Monday and factory orders on Wednesday, followed by industrial production on Thursday. In France, similar indicators will be released, including the trade balance on Thursday and industrial production on Friday. Zooming out to the Eurozone-level data, the July PPI report tomorrow and retail sales on Wednesday will be among the highlights.

Trade data will be among the highlights in China this week, with the release due on Thursday. The Caixin services PMI release tomorrow will round out other PMI reports released last week that showed an improvement in manufacturing but a miss in the official non-manufacturing gauge.

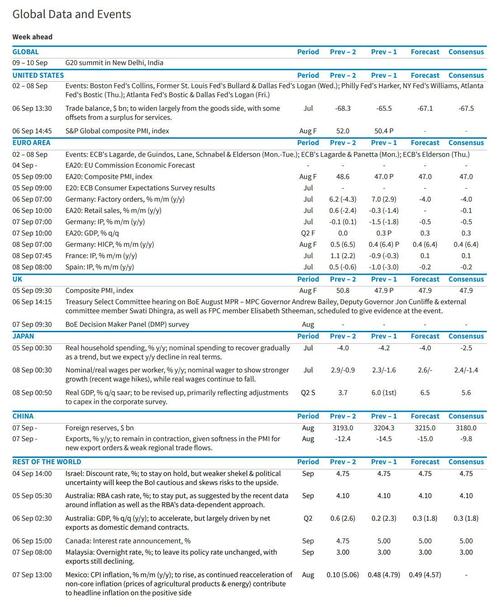

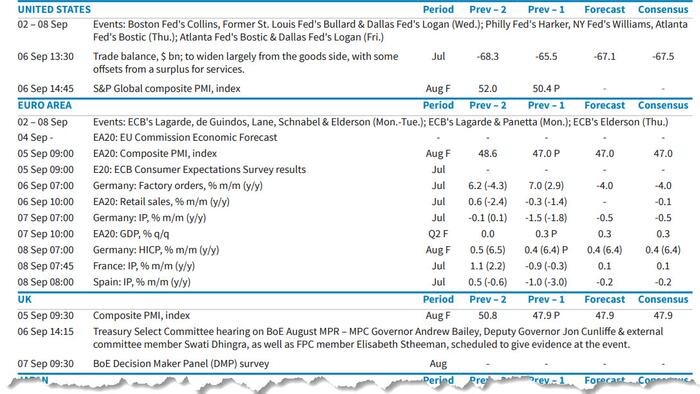

Below is a day-by-day calendar of events

Monday September 4

Tuesday September 5

Wednesday September 6

Thursday September 7

Friday September 8

Looking at just the US, Goldman writes that the key economic data release this week is the ISM services report on Wednesday. There are many speaking engagements from Fed officials this week, including governors Bowman and Barr, and presidents Williams, Collins, Logan, Harker, Goolsbee, and Bostic.

Monday, September 4

Tuesday, September 5

Wednesday, September 6

Thursday, September 7

Friday, September 8

Source: DB, Goldman, Barclays