As Jim Reid notes in his EMR note, "we had two US payrolls and two inflation releases to get through before the next FOMC in September and although the first of these on Friday was a mixed affair, it did trigger a big rally across the US rate curve with 2yr and 10yrs -11.7bps and -14.1bps tighter, respectively, on the day even if yields were still higher at the long-end on the week."

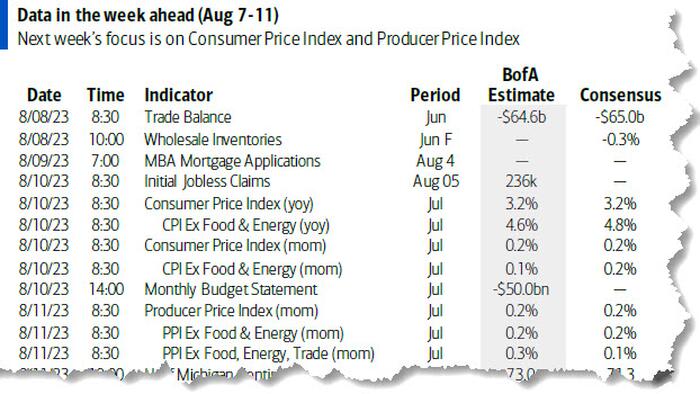

So with jobs out the way we now move on to the next big one, namely US CPI on Thursday. PPI follows fast behind on Friday alongside the University of Michigan consumer survey which contains the all-important inflation expectations series.

One thing to bear in mind for inflation over the next few months is the +15.8% surge in oil prices last month while gasoline prices are rising fast too. According to Reid, it's "too early perhaps to make much inroads yet but a complication if prices stay elevated." In fact, for now, with seasonally adjusted gas prices down a bit from June, DB economists expect a slightly weaker headline (+0.17% forecast vs. +0.18% previously) reading relative to core (+0.21% vs. +0.16%). This would equate to 4.8% YoY for core (though it is very close to rounding down to 4.7%), however, shorter-term trends should show significant improvement. The three-month annualized rate should fall by about 80bps to 3.3%, while the six-month annualised rate should fall by 40bps to 4.2%, both the lowest in over two years.

With regards to the ever-important core services excluding rent and medical services sector, last month's data showed significant progress. This category posted the second-lowest monthly print in the last 21 months (unch.), though much of this weakness was due to a sharp -8.1% drop in airfares. DB's economists explain that this decline brings airfares back to pre-pandemic levels, so is that normality returning or was last month an anomaly. We will see.

Staying with inflation, China CPI and PPI numbers on Wednesday are interesting as the country sits on the brink of consumer price deflation with the latest readings printing 0.0% for the CPI and -5.4% for the PPI YoY. Current median estimates on Bloomberg point to a -0.5% YoY CPI and -4.0% YoY PPI reading.

Meanwhile, after last week's juggernaut, corporate earnings wind down quite sharply with 33 S&P 500 and 55 Stoxx 600 companies reporting this week. Here are the most notable reporters:

Here is a day-by-day calendar of events

Monday August 7

Tuesday August 8

Wednesday August 9

Thursday August 10

Friday August 11

Finally, turning to just the US, Goldman notes that the key economic data release this week is the CPI report on Thursday. There are several speaking engagements from Fed officials this week.

Monday, August 7

Tuesday, August 8

Wednesday, August 9

Thursday, August 10

Friday, August 11

Source: DB, Goldman, BofA