The key data release this week is be the global flash PMIs for April on Wednesday. In addition, in its preview of the week's main events DB flags the Spring Meetings of the World Bank and the IMF will be held on April 21-26. In corporate earnings, highlights include Alphabet, Tesla and SAP.

Taking a closer look: the highlight in economic data be the April flash PMIs for the key economies due Wednesday. The impact of US tariffs will be the main focus, especially for European manufacturing gauges, which have been recovering in recent months. Among G7 countries, the manufacturing index was slightly above 50 (50.2) only in the US.

Other notable economic indicators out next week include March durable goods orders and housing market data in the US. DB economists see durable goods orders (Thursday) growth at +0.5% MoM (+1.0% in February). The Fed will also release its Beige Book on Wednesday.

In Europe, several other sentiment gauges are due, including the Ifo survey in Germany (Thursday) as well as consumer confidence indicators in the UK (Friday), the Eurozone (Tuesday) and France (Thursday).

In Asia, the focus in Japan will be on the Tokyo CPI for April out on Friday. 1-yr and 5-yr loan rates fixings are due in China on Monday.

Apart from economic data, notable events next week include the 2025 Spring Meetings of the World Bank and the IMF on April 21-26, in Washington, D.C. The IMF will release its full World Economic Outlook and Global Financial Stability reports on Tuesday.

Rounding out with corporate earnings, the spotlight next week will be on Alphabet (Thursday) and Tesla (Tuesday). Other tech reports due include Intel, IBM and ServiceNow. The focus will also be on consumer firms such as P&G, PepsiCo and Chipotle. Key US defence firms RTX, Lockheed Martin and Northrop Grumman will release earnings on Tuesday. In Europe, names to watch include SAP and Dassault Systemes.

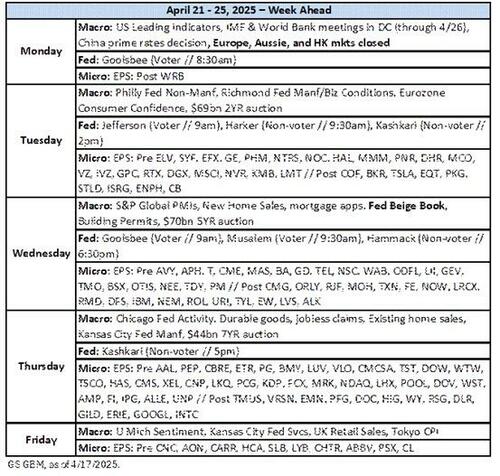

Courtesy of DB, here is a day by day calendar of events

Monday April 21

Tuesday April 22

Wednesday April 23

Thursday April 24

Friday April 25

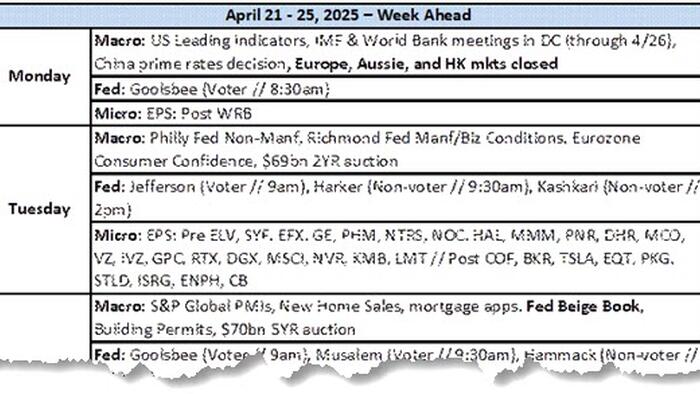

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the durable goods report on Thursday and the University of Michigan report on Friday. There are several speaking engagements by Fed officials this week.

Monday, April 21

Tuesday, April 22

Wednesday, April 23

Thursday, April 24

Friday, April 25

Source: DB, Goldman