This week one of the main highlights will take markets through what DB's Jim Reid calls "a full on Back to the Future and Quantum Leap (his favorite show as a teenager) moment" as the-every-5-years US GDP revisions take place on Thursday alongside the final Q2 2023 revisions (unch at 2.4% expected). GDP will be revised (lower) from Q1 2005 through Q1 2023, although revisions prior to the first quarter of 2013 will be offsetting across industries within each period. Gross domestic income (GDI) and select income components will be revised from Q1 1979 through Q1 2023. As Reid showed in a recent Chart of the Day, the current big gap between US GDI and GDP could be explained by erroneous recent data showing that net interest payments have been going down in the US as rates and yields have been soaring in the last 2 years.

While it's possible that revisions could make GDI look more healthy (interest payments add income to parts of the economy) but also make interest costs in the economy look more realistic and hurt fundamental models of interest cover for those indebted. Anyway, the revisions are potentially an important event and could make us think differently about the US economy in the recent past and therefore the future.

Outside of the downward GDP revision, the core PCE deflator on Friday is as important. DB economists point out that the data from the August CPI and PPI releases point to a slightly softer reading (+0.20% vs. +0.22% last month), which would have the effect of lowering the year-over-year growth rate by a little over 30bps (to 3.9%). As they highlight, the Fed's latest SEP forecast for Q4/Q4 core PCE inflation last week was 3.7%, which implies a modest re-acceleration in the monthly prints. This is one reason why they - and many others - believe that the bar is relatively high for the Fed to hike again before year-end.

Staying with inflation, over in Europe, the flash September CPIs kick off with prints from Germany on Thursday. The numbers for the Eurozone, France and Italy will be out on Friday. Friday also sees Tokyo CPI which is an important economy wide lead indicator as the BoJ considers more radical changes to its monetary policy soon.

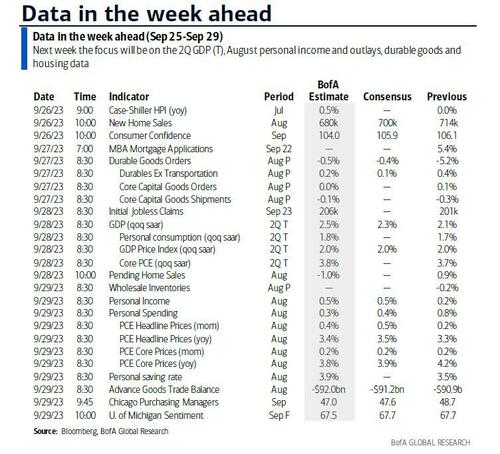

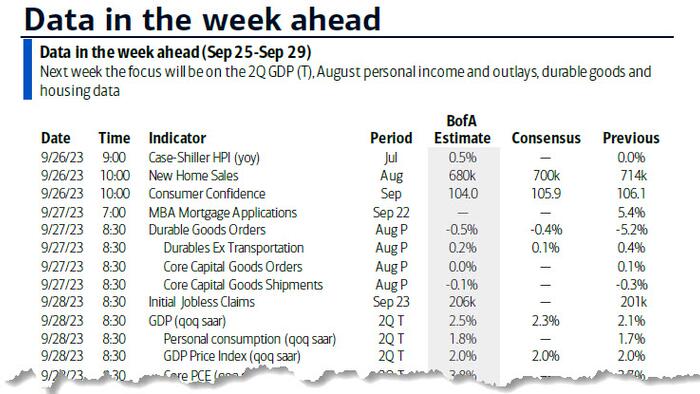

Elsewhere in the US we have new home sales and consumer confidence tomorrow, durable goods on Thursday with trade numbers and personal income and consumption numbers on Friday.

In Europe, Germany sees the Ifo survey today, consumer confidence on Wednesday and labour market data on Friday. In France, consumer confidence will be out on Wednesday and consumer spending data is due Friday. Sentiment gauges will also be out in Italy and the Eurozone on Thursday.

Here is a day by day summary of key events this week courtesy of DB:

Monday September 25

Tuesday September 26

Wednesday September 27

Thursday September 28

Friday September 29

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the durable goods report on Wednesday and the core PCE report on Friday. There are several speaking engagements from Fed officials this week, including chair Powell, governors Bowman and Cook, and presidents Kashkari, Goolsbee, Barkin, and Williams.

Monday, September 25

Tuesday, September 26

Wednesday, September 27

Thursday, September 28

Friday, September 29

Source: DB, Goldman, BofA,