There’s a lot going on this week but the latest developments in the Israel-Iran conflict will clearly dominate, especially now the US is involved. Against this backdrop, the NATO summit will be held in The Hague tomorrow and Wednesday. It seems all members will agree to a 5% of GDP defense spending plan apart from Spain who will get an exemption. The latest draft appears to be - what else - a delay of the full spending spree until 2035 rather than the initial 2032 that Secretary General Rutte was aiming towards (and which sparked the rabid move higher in European stocks at the start of the year which has all but fizzled now). Note 3.5% would be core military spending, and 1.5% would be defense related areas such as infrastructure and cybersecurity.

Elsewhere Fed's Chair Powell's semi-annual testimonies to Congress on Tuesday and Wednesday are usually key events but note that this comes shortly after last week’s FOMC so maybe they’ll be less additive information this time. There is also lots of Fedspeak this week that will be in the day-by-day calendar but Waller speaking again today will be of note given his dovish speech on Friday where he all but confirmed that he was one of the two members who have three cuts this year in the dots. He didn’t rule out a July cut and markets are trying to handicap what it would mean if he became the next Fed chair. In a speech earlier today, Fed vice chair Michelle Bowman joined Waller in calling for a July rate cut, sending the dollar plunging.

Staying in the US, the Senate will continue its mark-up of the “One Big Beautiful Bill Act” (OBBBA) with potential for a vote by the end of the week. However, several substantial policy debates remain – namely, Medicaid, SALT cap reform and repeal of clean energy tax credits. Though many details remain in flux, from what our economists know at present, their expectations for 6.5 – 7.0% deficits as a share of GDP over the next three years has remained largely unchanged.

Outside of the big NATO meeting, China will hold its NPC Standing Committee meeting from tomorrow through to Friday. There will also be an EU-Canada summit today, with Canada's Prime Minister Carney attending. Finally, EU leaders will hold a summit in Brussels on Thursday/Friday.

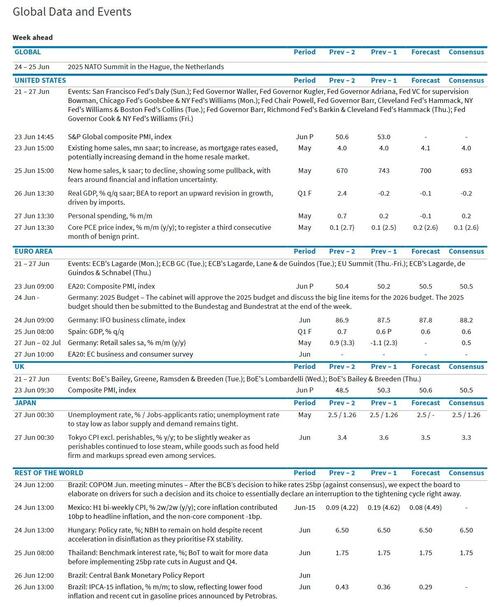

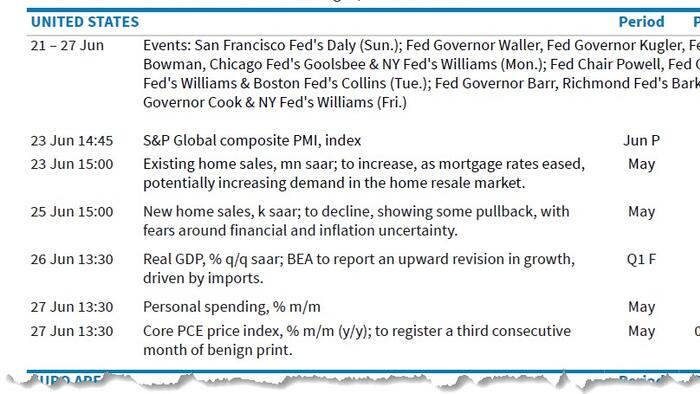

In terms of the other highlights we have preliminary June PMIs, US existing home sales and Lagarde speaking today; US consumer confidence, the German Ifo and Canadian CPI tomorrow; US new home sales, Japanese PPI, Australia CPI and a 5yr UST auction on Wednesday; final US Q1 GDP, US durable goods, the Chicago Fed, the US trade balance, jobless claims, and a 7 yr UST auction on Thursday; and core US PCE, US personal spending/income, Chinese Industrial profits, Tokyo CPI, and French and Spanish CPI. There are more in the calendar at the end but of these the core US PCE is the most interesting.

Courtesy of DB, here is a day-by-day calendar of events

Monday June 23

Tuesday June 24

Wednesday June 25

Thursday June 26

Friday June 27

Finally, turning to the US, Goldman writes that the key economic data releases this week are the durable goods and advance goods trade balance reports on Thursday and the core PCE inflation report on Friday. There are many speaking engagements by Fed officials this week, including Chair Powell's semiannual Congressional testimony on Tuesday and Wednesday.

Monday, June 23

Tuesday, June 24

Wednesday, June 25

Thursday, June 26

Friday, June 27

Source: DB, Goldman